Uniform Bank Performance Report - Anderson School of Management

Uniform Bank Performance Report - Anderson School of Management

Uniform Bank Performance Report - Anderson School of Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A very useful ratio when measuring bank pr<strong>of</strong>itability is the return on equity (ROE). In this ratio, the net<br />

income is divided by the average total equity. This shows the amount <strong>of</strong> income a bank has earned for<br />

every dollar <strong>of</strong> equity outstanding. It is a leading factor in investment decisions as it allows investors to<br />

measure how well the banks are using money invested in equity. The more a bank is able to earn per<br />

dollar <strong>of</strong> equity, the higher its ROE will be. ROE is also an indication <strong>of</strong> a bank’s solvency. If the bank has<br />

a negative ROE, it means that it has lost money on shareholders’ investments, and may not be able to<br />

repay interest and debt upon maturity.<br />

JP Morgan as well as its competitors showed a decline in their ROEs from 2007 to 2008. During this year,<br />

factors such as rising mortgage default rates began to hurt banks’ performances. These factors, as well<br />

as the full‐blown credit crisis in late 2008, stunted the ability <strong>of</strong> banks to generate income, thus causing<br />

ROE to fall. During this period, JPMC showed a small decrease in ROE from 10.9% to 8.8%, faring better<br />

than B <strong>of</strong> A, and slightly better than Wells Fargo. From 2008 to 2 nd quarter 2009, JPMC’s ROE fell more<br />

sharply and was inferior to that <strong>of</strong> Wells Fargo yet still slightly better than B <strong>of</strong> A.<br />

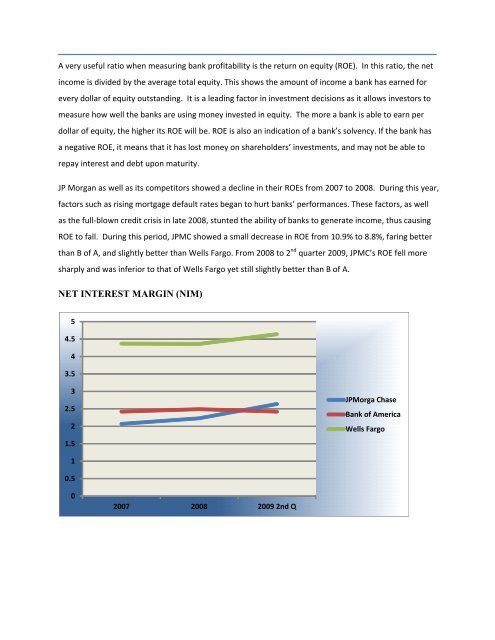

NET INTEREST MARGIN (NIM)<br />

5<br />

4.5<br />

4<br />

3.5<br />

3<br />

2.5<br />

2<br />

1.5<br />

JPMorga Chase<br />

<strong>Bank</strong> <strong>of</strong> America<br />

Wells Fargo<br />

1<br />

0.5<br />

0<br />

2007 2008 2009 2nd Q