Uniform Bank Performance Report - Anderson School of Management

Uniform Bank Performance Report - Anderson School of Management

Uniform Bank Performance Report - Anderson School of Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

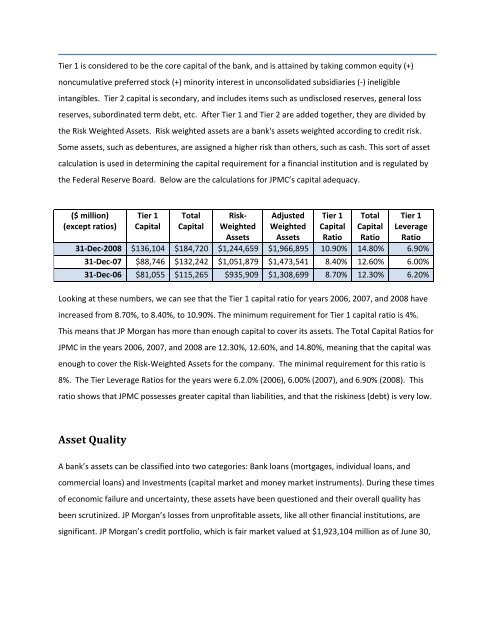

Tier 1 is considered to be the core capital <strong>of</strong> the bank, and is attained by taking common equity (+)<br />

noncumulative preferred stock (+) minority interest in unconsolidated subsidiaries (‐) ineligible<br />

intangibles. Tier 2 capital is secondary, and includes items such as undisclosed reserves, general loss<br />

reserves, subordinated term debt, etc. After Tier 1 and Tier 2 are added together, they are divided by<br />

the Risk Weighted Assets. Risk weighted assets are a bank's assets weighted according to credit risk.<br />

Some assets, such as debentures, are assigned a higher risk than others, such as cash. This sort <strong>of</strong> asset<br />

calculation is used in determining the capital requirement for a financial institution and is regulated by<br />

the Federal Reserve Board. Below are the calculations for JPMC’s capital adequacy.<br />

($ million)<br />

(except ratios)<br />

Tier 1<br />

Capital<br />

Total<br />

Capital<br />

Risk‐<br />

Weighted<br />

Assets<br />

Adjusted<br />

Weighted<br />

Assets<br />

Tier 1<br />

Capital<br />

Ratio<br />

Total<br />

Capital<br />

Ratio<br />

Tier 1<br />

Leverage<br />

Ratio<br />

31‐Dec‐2008 $136,104 $184,720 $1,244,659 $1,966,895 10.90% 14.80% 6.90%<br />

31‐Dec‐07 $88,746 $132,242 $1,051,879 $1,473,541 8.40% 12.60% 6.00%<br />

31‐Dec‐06 $81,055 $115,265 $935,909 $1,308,699 8.70% 12.30% 6.20%<br />

Looking at these numbers, we can see that the Tier 1 capital ratio for years 2006, 2007, and 2008 have<br />

increased from 8.70%, to 8.40%, to 10.90%. The minimum requirement for Tier 1 capital ratio is 4%.<br />

This means that JP Morgan has more than enough capital to cover its assets. The Total Capital Ratios for<br />

JPMC in the years 2006, 2007, and 2008 are 12.30%, 12.60%, and 14.80%, meaning that the capital was<br />

enough to cover the Risk‐Weighted Assets for the company. The minimal requirement for this ratio is<br />

8%. The Tier Leverage Ratios for the years were 6.2.0% (2006), 6.00% (2007), and 6.90% (2008). This<br />

ratio shows that JPMC possesses greater capital than liabilities, and that the riskiness (debt) is very low.<br />

Asset Quality<br />

A bank’s assets can be classified into two categories: <strong>Bank</strong> loans (mortgages, individual loans, and<br />

commercial loans) and Investments (capital market and money market instruments). During these times<br />

<strong>of</strong> economic failure and uncertainty, these assets have been questioned and their overall quality has<br />

been scrutinized. JP Morgan’s losses from unpr<strong>of</strong>itable assets, like all other financial institutions, are<br />

significant. JP Morgan’s credit portfolio, which is fair market valued at $1,923,104 million as <strong>of</strong> June 30,