full report and disclosures - Berenberg Bank

full report and disclosures - Berenberg Bank

full report and disclosures - Berenberg Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Berenberg</strong> Macro Views<br />

Economics<br />

Euro crisis update: the bare essentials<br />

“Sleepwalking into the abyss”. The British media have missed no<br />

opportunities in the last six months to predict imminent disaster for the<br />

Eurozone. Instead, the crisis has faded as fast as optimists like us had<br />

hoped. How come?<br />

Simple mistake: In analysing the euro crisis, many observers make a<br />

simple mistake: they confuse their dreams for a perfect world with reality.<br />

The world does not have to be perfect to work: Reality never lives up<br />

to textbook ideals, <strong>and</strong> it does not have to. For example, an immediate<br />

<strong>full</strong>-scale banking union would be most useful to defuse the credit crunch<br />

for small <strong>and</strong> medium-sized enterprises in the euro periphery. But it is not<br />

essential for the euro crisis to fade. Credit constraints slow the pace of<br />

recovery. But they do not prevent recovery.<br />

Stripping it to the bare essentials, the Eurozone needs four<br />

ingredients for its crisis to fade. All four are in place.<br />

1. A reliable mechanism to contain contagion: The problems of<br />

small countries must not endanger the region as a whole. The ECB’s<br />

OMT safety net sees to that.<br />

2. The right incentives so that small countries like Greece fix their big<br />

underlying problems. Berlin’s tough-love approach of conditional<br />

credits for compliant countries provides exactly these incentives.<br />

3. The political will to stick to the gr<strong>and</strong> bargain: The strong help<br />

the weak while the weak accept the strings attached. Germany is<br />

solidly pro-euro <strong>and</strong> all peripheral countries are striving to meet the<br />

conditions.<br />

4. Some growth in key export markets: Good news from Germany,<br />

the US, UK, China <strong>and</strong> Switzerl<strong>and</strong> is more than offsetting the<br />

wobbles in some emerging markets for euro periphery exports.<br />

The tail risks have receded. But they still exist. Our top two risks:<br />

Italian politics: If Berlusconi’s legal troubles were to bring down the<br />

Letta government, new elections could trigger a bout of uncertainty.<br />

But the real danger, the Grillo challenge, has receded.<br />

German court: If the court weakens the ECB’s OMT safety net too<br />

much, investors might panic again. Unlikely but not impossible. If the<br />

risk materialised, the ECB could resort to massive quantitative easing.<br />

On balance, we maintain our cautious optimism: The Eurozone is<br />

on the right track. The path will not always be smooth. That’s life.<br />

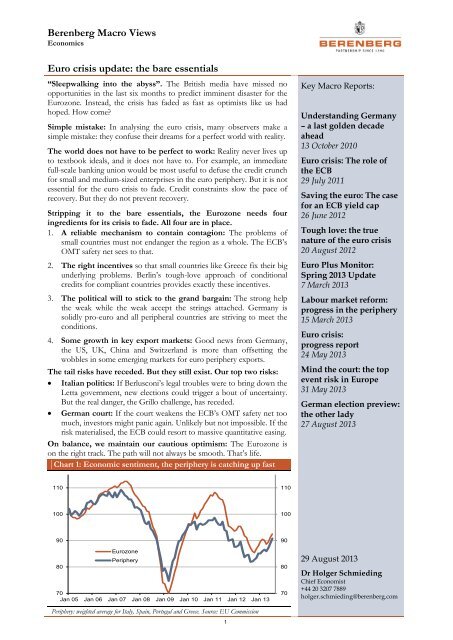

Chart 1: Economic sentiment, the periphery is catching up fast<br />

Key Macro Reports:<br />

Underst<strong>and</strong>ing Germany<br />

– a last golden decade<br />

ahead<br />

13 October 2010<br />

Euro crisis: The role of<br />

the ECB<br />

29 July 2011<br />

Saving the euro: The case<br />

for an ECB yield cap<br />

26 June 2012<br />

Tough love: the true<br />

nature of the euro crisis<br />

20 August 2012<br />

Euro Plus Monitor:<br />

Spring 2013 Update<br />

7 March 2013<br />

Labour market reform:<br />

progress in the periphery<br />

15 March 2013<br />

Euro crisis:<br />

progress <strong>report</strong><br />

24 May 2013<br />

Mind the court: the top<br />

event risk in Europe<br />

31 May 2013<br />

German election preview:<br />

the other lady<br />

27 August 2013<br />

110<br />

110<br />

100<br />

100<br />

90<br />

Eurozone<br />

Periphery<br />

80<br />

70<br />

Jan 05 Jan 06 Jan 07 Jan 08 Jan 09 Jan 10 Jan 11 Jan 12 Jan 13<br />

Periphery: weighted average for Italy, Spain, Portugal <strong>and</strong> Greece. Source: EU Commission<br />

1<br />

90<br />

80<br />

70<br />

29 August 2013<br />

Dr Holger Schmieding<br />

Chief Economist<br />

+44 20 3207 7889<br />

holger.schmieding@berenberg.com

<strong>Berenberg</strong> Macro Views<br />

Economics<br />

Confusing dreams <strong>and</strong> reality<br />

“Sleepwalking into the abyss” or “the euro crisis is back”. For the last six months,<br />

British media including The Economist have missed no opportunity to predict<br />

imminent disaster for the Eurozone. So far, however, the crisis monster has failed to<br />

rear its head again. With a gradual fading of market tensions, the Eurozone economy<br />

has started to recover. How come?<br />

In analysing the euro crisis, many observers make a simple mistake: they conflate<br />

their dreams for a perfect world with reality.<br />

The world does not have to be perfect in order to work. For example, Germany<br />

would arguably be much better off if it had a simple flat tax <strong>and</strong> a deregulated labour<br />

market. But in real life, a ridiculously complex tax system <strong>and</strong> an overregulated labour<br />

market have not prevented Germany from turning itself into the economic<br />

powerhouse of Europe. In the same vein, most Britons would live a more<br />

comfortable life if the country had a properly functioning housing market. But in real<br />

life, Britain’s absurd restrictions on the supply of new houses are not preventing the<br />

country from enjoying a credit-fuelled economic upturn.<br />

The same logic holds for the euro crisis. Many observers believe that the region<br />

needs <strong>full</strong> political union, <strong>full</strong> fiscal union, an immediate banking union <strong>and</strong> a <strong>full</strong><br />

German/ECB guarantee for sovereign debt or the realisation of some other<br />

pipedream to get out of its crisis. Some of the arguments such observers make are<br />

not wrong. Yes, some kinds of financial tensions could be contained more reliably by<br />

a <strong>full</strong>-scale mutualisation of public debt or other variants of fiscal or even political<br />

union. And yes, an immediate banking union or any other way to end the credit<br />

crunch for small <strong>and</strong> medium-sized enterprises in parts of the euro periphery in one<br />

fell swoop might be quite helpful. But discussing what may or may not be desirable is<br />

very different from analysing what is strictly necessary for the euro crisis to fade.<br />

Sleepwalking into the<br />

abyss? Not really<br />

You don’t have to be<br />

perfect to get some growth<br />

Desirable does not equal<br />

essential<br />

The bare essentials<br />

Stripping it down to the bare essentials, the Eurozone needs four ingredients<br />

for its crisis to fade. All four are in place.<br />

1. A reliable mechanism to contain contagion: The problems of small countries<br />

must not endanger the region as a whole. Since Draghi’s announcement on 26<br />

July 2012 that the second most powerful economic institution in the world, the<br />

European Central <strong>Bank</strong>, would not commit suicide but would instead do all it<br />

takes to preserve the euro <strong>and</strong> its own existence, this ingredient is present.<br />

2. The right incentives so that countries like Greece fix their underlying<br />

problems. With the tough-love approach pursued by Germany <strong>and</strong> the ECB, this<br />

ingredient is there as well: Europe helps nations such as Greece or Irel<strong>and</strong> with<br />

serious amounts of money if the recipients submit to harsh reform conditions. 1<br />

Despite occasional hiccups, the reform process is well entrenched <strong>and</strong> well<br />

advanced. 2<br />

Contagion control in place<br />

Crisis countries are<br />

adjusting<br />

1 We explain this approach in detail in Tough Love: the true nature of the euro crisis, <strong>Berenberg</strong>, 20 August<br />

2012.<br />

2 See for example our Euro Plus Monitor, Spring 2013 Update, <strong>Berenberg</strong> <strong>and</strong> Lisbon Council, 7 March 2013.<br />

2

<strong>Berenberg</strong> Macro Views<br />

Economics<br />

3. The political will to stick to the gr<strong>and</strong> bargain: The strong help the weak<br />

while the weak accept the strings attached. All German mainstream political<br />

parties back Chancellor Merkel’s euro policies. No realistic result of the German<br />

election on 22 September 2013 could lead to Germany turning its back on its<br />

European partners. 3 At the periphery, the will to do what it takes to stay part of<br />

the euro family has survived numerous challenges including elections <strong>and</strong><br />

changes in government in Greece, Irel<strong>and</strong>, Portugal, Italy <strong>and</strong> Spain.<br />

4. Some growth in key export markets: To export their way out of their<br />

domestic adjustment recessions, the euro peripheral countries need some<br />

increase in global dem<strong>and</strong> <strong>and</strong> in core European domestic dem<strong>and</strong>. So far,<br />

external dem<strong>and</strong> has proved suitably resilient. For the euro periphery, good news<br />

from Germany, the US, UK, China <strong>and</strong> Switzerl<strong>and</strong> is more than offsetting the<br />

wobbles in a number of emerging markets.<br />

Of course, past performance provides no guarantees for the future. But it does hold<br />

lessons. Eurosceptics <strong>and</strong> the readers of those British media who know very little<br />

about what is really happening on the continent underestimate at their own peril the<br />

capacity of the Eurozone to contain <strong>and</strong> overcome its crisis.<br />

The political will has<br />

survived various elections<br />

Key export markets are<br />

growing<br />

Risks are receding as economies turn the corner<br />

Serious risks remain, including the risks that (i) the German Constitutional Court<br />

could constrain the ECB’s OMT safety in a way that renders it ineffective or that (ii)<br />

potential new elections in Italy or Greece could sweep irresponsible mavericks like<br />

Beppe Grillo or Alexis Tsipras into power. But with the peripheral economies<br />

starting to stabilise <strong>and</strong> the rise in unemployment starting to fizzle out, the<br />

vulnerability of the Eurozone to contagion hazards <strong>and</strong> the political challenges in<br />

peripheral economies are now less serious than they used to be.<br />

It could still go wrong. But it would now take a bigger shock to trigger massive new<br />

tensions. Also, the probability that such a shock will occur has receded. In the next<br />

two sections, we take a closer look at the two major risks – the German<br />

Constitutional Court <strong>and</strong> Italian politics.<br />

Of course. Life is <strong>full</strong> of<br />

risks<br />

It would no take a bigger<br />

shock to trigger a new<br />

wave of crisis<br />

Risk 1: Italian politics<br />

In early 2013, Italian politics topped our list of what could still go wrong in the<br />

Eurozone. The risk receded when Italy’s President Napolitano (our favourite excommunist)<br />

forced Italy’s centre-left <strong>and</strong> centre-right into an uneasy coalition in early<br />

April after the inconclusive election of late February. The risk could flare up again if<br />

the centre-left votes to strip the centre-right leader, the convicted tax fraudster<br />

Berlusconi, of his Senate seat <strong>and</strong> the centre-right then withdraws from government.<br />

The Senate is scheduled to vote on 9 September, although the vote might still be<br />

delayed.<br />

New Italian elections would create new uncertainty. That would be awkward. But as<br />

we argued in March, the later such new elections come, the less disruptive they would<br />

Thank you, Mr President<br />

Less concerned than<br />

3 See our German election preview: the other lady, <strong>Berenberg</strong>, 27 August 2013.<br />

3

<strong>Berenberg</strong> Macro Views<br />

Economics<br />

probably be. We are less concerned about political instability in Italy than we were in<br />

early 2013.<br />

before<br />

<br />

<br />

Logic suggests that Berlusconi, while playing hardball to get as much out of his<br />

centre-left coalition partner as possible, does not have an incentive to go for new<br />

elections. If he lost such elections, as he probably would, his chances of getting<br />

any kind of leniency or even pardon from a new Italian government <strong>and</strong>/or the<br />

Italian president would probably be zero. His best chance to stay out of jail, or at<br />

least avoid lengthy house arrest, would be to stay on speaking terms with<br />

President Napolitano <strong>and</strong> the centre-left rather than throwing the country into<br />

new turmoil in a rash response to losing his Senate seat.<br />

President Napolitano has shown a steely resolve to keep Italy out of trouble. If<br />

he feared that the uncertainty created by new elections could disrupt Italy’s<br />

economic healing process, he might just ask Prime Minister Letta to stay on as<br />

interim prime minister for an extended period until it were safe to call new<br />

elections or until a post-Berlusconi centre-right sorted itself out <strong>and</strong> joined the<br />

government again. In the meantime, a centre-left interim government would have<br />

a majority in Italy’s House of Representatives but not in the Senate. In such<br />

circumstances, Italy might not get much done. But neither would it provoke a<br />

disaster. After all, US President Obama <strong>and</strong> Germany’s Chancellor Merkel are in<br />

the same position: both lack a majority in their upper houses <strong>and</strong> cannot get<br />

major laws passed unless they strike specific deals with the opposition.<br />

Berlusconi: how best to<br />

stay out of jail?<br />

A caretaker government if<br />

need be?<br />

<br />

New elections in Italy in late 2013 or early 2014 would be much less of a risk<br />

than they would have been in May or June. Memories of the savage Monti tax<br />

hikes of 2012 are now less raw. Italian consumer confidence <strong>and</strong> other leading<br />

economic indicators have recovered. Beppo Grillo has shown himself to be a<br />

dictatorial leader of his “Five Star” movement, alienating some erstwhile<br />

supporters. Opinion polls (Chart 2) suggest that new elections would now be a<br />

straight race between the centre-left <strong>and</strong> centre-right with both sides, on balance,<br />

likely to pursue fairly sensible <strong>and</strong> pro-euro policies if they won.<br />

Chart 2: Centre-left up, Grillo down: Italian opinion polls<br />

40%<br />

New elections in Italy<br />

would be awkward but<br />

less dangerous than before<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

Berlusconi coalition<br />

Centre-left coalition<br />

Monti<br />

Grillo<br />

Other<br />

Grillo is trailing far<br />

behind the mainstream<br />

0%<br />

Feb 2013 Mrz 2013 Apr 2013 Mai 2013 Jun 2013 Jul 2013 Aug 2013<br />

Average of the five most recent opinion polls each week. Source: Ipsos, Coesis, IPR, EMG, Peipoli, LORIEN,<br />

Euromedia, SWG, Tecne<br />

4

<strong>Berenberg</strong> Macro Views<br />

Economics<br />

Risk 2: German court<br />

Some time after the German elections on 22 September 2013, the German<br />

Constitutional Court will probably give its verdict on the ECB’s OMT programme.<br />

Judging by the tone of the court hearings on 12 <strong>and</strong> 13 June 2013, the judges are no<br />

fans of the ECB promise to buy sovereign bonds of peripheral countries in the event<br />

of renewed market turmoil, to put it mildly. But Berlin sees the ECB’s safety net as<br />

essential to contain the euro crisis. The court has no tradition of contradicting Berlin<br />

on key issues of Germany foreign policy. And whatever their misgivings about the<br />

OMT, the judges probably have no desire to trigger grave financial turmoil.<br />

We thus expect the judges to say that the OMT is legal under the German<br />

constitution <strong>and</strong> the German interpretation of the Maastricht treaty if the OMT<br />

respects some constraints which the judges will outline.<br />

The genuine risk we see is that the judges, in trying to constrain the OMT, may do so<br />

in a way that renders it ineffective. In markets, perceptions matter even more than<br />

substance. And the judges are not financial experts. If markets conclude after the<br />

verdict that a constrained OMT is no longer a reliable shield against contagion risks,<br />

contagion might again spread like wildfire in the Eurozone, sending financial markets<br />

<strong>and</strong> leading economic indicators into a tailspin.<br />

We consider this unlikely. But we cannot rule it out. If the risk were to materialise,<br />

the ECB would need to find other ways to make good on its vow to do all it takes to<br />

preserve the euro. As a first reaction, the ECB would probably cut rates by 25bp <strong>and</strong><br />

remind markets that the bank has other powerful instruments including outright<br />

quantitative easing at its disposal. If that were not enough, the ECB would probably<br />

start a major programme of quantitative easing with outright purchases of sovereign<br />

bonds of all member countries above a certain ratings threshold. The threshold<br />

would likely be set to include Italian <strong>and</strong> Spanish bonds but not those of Greece or<br />

Portugal. Massive quantitative easing would probably calm markets again. The risk of<br />

renewed recession in the wake of escalating market turmoil would give the ECB the<br />

justification to act so decisively.<br />

It would be one of the ironies of history. If the German Constitutional Court rules<br />

against the ECB promise to buy sovereign bonds of some countries that meet certain<br />

conditions, the result could be massive <strong>and</strong> unconditional purchases of sovereign<br />

bonds of almost all Eurozone countries. That would be unfortunate. But it would not<br />

spell disaster.<br />

The judges have no<br />

tradition of upsetting<br />

Berlin on key issues of<br />

foreign policy<br />

Expect the judges to<br />

constrain the OMT<br />

But what if these<br />

constraints render the<br />

OMT ineffective?<br />

If worst came to worst, the<br />

ECB would not shy away<br />

from quantitative easing<br />

to end a market panic<br />

An irony of history?<br />

The end of the crisis? Not yet, but maybe soon<br />

At the start of 2013, we had a clear idea of what we wanted to do at the end of the<br />

year: we wanted to write a big <strong>report</strong> declaring the end of the euro crisis. As we<br />

discussed in March, the biggest risk to our plan remains that we may have missed the<br />

boat. Judging by the level of market tensions, the euro crisis was largely over by<br />

February 2013. But we first need to actually see the economic rebound in the euro<br />

periphery which leading indicators are now flagging, <strong>and</strong> we need to get beyond the<br />

German court verdict, before we can judge whether or not the crisis is over for good.<br />

Until then, we still face the risk that a new but probably less vicious wave of crisis<br />

could hit the Eurozone before we can sound the all-clear.<br />

A merry Christmas?<br />

5

<strong>Berenberg</strong> Macro Views<br />

Economics<br />

Disclaimer<br />

This document was compiled by the above mentioned authors of the economics department of Joh.<br />

<strong>Berenberg</strong>, Gossler & Co. KG (hereinafter referred to as “the <strong>Bank</strong>”),. The <strong>Bank</strong> has made any effort to<br />

care<strong>full</strong>y research <strong>and</strong> process all information. The information has been obtained from sources which we<br />

believe to be reliable such as, for example, Thomson Reuters, Bloomberg <strong>and</strong> the relevant specialised press.<br />

However, we do not assume liability for the correctness <strong>and</strong> completeness of all information given. The<br />

provided information has not been checked by a third party, especially an independent auditing firm. We<br />

explicitly point to the stated date of preparation. The information given can become incorrect due to passage<br />

of time <strong>and</strong>/or as a result of legal, political, economic or other changes. We do not assume responsibility to<br />

indicate such changes <strong>and</strong>/or to publish an updated document. The forecasts contained in this document or<br />

other statements on rates of return, capital gains or other accession are the personal opinion of the author<br />

<strong>and</strong> we do not assume liability for the realisation of these.<br />

This document is only for information purposes. It does not constitute a financial analysis within the meaning<br />

of § 34b or § 31 Subs. 2 of the German Securities Trading Act (Wertpapierh<strong>and</strong>elsgesetz), no investment<br />

advice or recommendation to buy financial instruments. It does not replace consulting regarding legal, tax or<br />

financial matters.<br />

Remarks regarding foreign investors<br />

The preparation of this document is subject to regulation by German law. The distribution of this document<br />

in other jurisdictions may be restricted by law, <strong>and</strong> persons, into whose possession this document comes,<br />

should inform themselves about, <strong>and</strong> observe, any such restrictions.<br />

United Kingdom<br />

This document is meant exclusively for institutional investors <strong>and</strong> market professionals, but not for private<br />

customers. It is not for distribution to or the use of private investors or private customers.<br />

United States of America<br />

This document has been prepared exclusively by Joh. <strong>Berenberg</strong>, Gossler & Co. KG. Although <strong>Berenberg</strong><br />

Capital Markets LLC, an affiliate of the <strong>Bank</strong> <strong>and</strong> registered US broker-dealer, distributes this document to<br />

certain customers, <strong>Berenberg</strong> Capital Markets LLC does not provide input into its contents, nor does this<br />

document constitute research of <strong>Berenberg</strong> Capital Markets LLC. In addition, this document is meant<br />

exclusively for institutional investors <strong>and</strong> market professionals, but not for private customers. It is not for<br />

distribution to or the use of private investors or private customers.<br />

This document is classified as objective for the purposes of FINRA rules. Please contact <strong>Berenberg</strong> Capital<br />

Markets LLC (+1 617.292.8200), if you require additional information.<br />

Copyright<br />

The <strong>Bank</strong> reserves all the rights in this document. No part of the document or its content may be rewritten,<br />

copied, photocopied or duplicated in any form by any means or redistributed without the <strong>Bank</strong>’s prior written<br />

consent.<br />

© August 2013 Joh. <strong>Berenberg</strong>, Gossler & Co. KG<br />

6

<strong>Berenberg</strong> Macro Views<br />

Economics<br />

Contacts: Investment <strong>Bank</strong>ing<br />

Equity Research<br />

E-mail: firstname.lastname@berenberg.com; Internet www.berenberg.com<br />

AUTOMOTIVES DIVERSIFIED FINANCIALS MID-CAP GENERAL<br />

Adam Hull +44 (0) 20 3465 2749 Pras Jeyan<strong>and</strong>han +44 (0) 20 3207 7899 Gunnar Cohrs +44 (0) 20 3207 7894<br />

Roman Mathyssek +44 (0) 20 3207 7841 Bjoern Lippe +44 (0) 20 3207 7845<br />

ECONOMICS Anna Patrice +44 (0) 20 3207 7863<br />

BANKS Dr. Holger Schmieding +44 (0) 20 3207 7889 Stanislaus von Thurn und Taxis +44 (0) 20 3465 2631<br />

Nick Anderson +44 (0) 20 3207 7838 Dr. Christian Schulz +44 (0) 20 3207 7878<br />

James Chappell +44 (0) 20 3207 7844 Robert Wood +44 (0) 20 3207 7822 OIL & GAS<br />

Andrew Lowe +44 (0) 20 3465 2743 Asad Farid +44 (0) 20 3207 7932<br />

Eoin Mullany +44 (0) 20 3207 7854 FOOD MANUFACTURING Jaideep P<strong>and</strong>ya +44 (0) 20 3207 7890<br />

Eleni Papoula +44 (0) 20 3465 2741 Fintan Ryan +44 (0) 20 3465 2748<br />

Michelle Wilson +44 (0) 20 3465 2663 Andrew Steele +44 (0) 20 3207 7926 REAL ESTATE<br />

James Targett +44 (0) 20 3207 7873 Kai Klose +44 (0) 20 3207 7888<br />

BEVERAGES Estelle Weingrod +44 (0) 20 3207 7931<br />

Philip Morrisey +44 (0) 20 3207 7892 GENERAL RETAIL & LUXURY GOODS<br />

Josh Puddle +44 (0) 20 3207 7881 Bassel Choughari +44 (0) 20 3465 2675 TECHNOLOGY<br />

John Guy +44 (0) 20 3465 2674 Adnaan Ahmad +44 (0) 20 3207 7851<br />

BUSINESS SERVICES Sebastian Grabert +44 (0) 20 3207 7834<br />

William Foggon +44 (0) 20 3207 7882 HEALTHCARE Daud Khan +44 (0) 20 3465 2638<br />

Simon Mezzanotte +44 (0) 20 3207 7917 Scott Bardo +44 (0) 20 3207 7869 Ali Khwaja +44 (0) 20 3207 7852<br />

Arash Roshan Zamir +44 (0) 20 3465 2636 Alistair Campbell +44 (0) 20 3207 7876 Tammy Qiu +44 (0) 20 3465 2673<br />

Konrad Zomer +44 (0) 20 3207 7920 Charles Cooper +44 (0) 20 3465 2637<br />

Graham Doyle +44 (0) 20 3465 2634 TELECOMMUNICATIONS<br />

CAPITAL GOODS Louise Hinds +44 (0) 20 3465 2747 Wassil El Hebil +44 (0) 20 3207 7862<br />

Frederik Bitter +44 (0) 20 3207 7916 Tom Jones +44 (0) 20 3207 7877 Usman Ghazi +44 (0) 20 3207 7824<br />

Benjamin Glaeser +44 (0) 20 3207 7918 Stuart Gordon +44 (0) 20 3207 7858<br />

William Mackie +44 (0) 20 3207 7837 HOUSEHOLD & PERSONAL CARE Laura Janssens +44 (0) 20 3465 2639<br />

Margaret Paxton +44 (0) 20 3207 7934 Jade Barkett +44 (0) 20 3207 7895 Paul Marsch +44 (0) 20 3207 7857<br />

Alex<strong>and</strong>er Virgo +44 (0) 20 3207 7856 Seth Peterson +44 (0) 20 3207 7891 Barry Zeitoune +44 (0) 20 3207 7859<br />

Felix Wienen +44 (0) 20 3207 7915<br />

INSURANCE<br />

TOBACCO<br />

CHEMICALS Tom Carstairs +44 (0) 20 3207 7823 Erik Bloomquist +44 (0) 20 3207 7870<br />

John Philipp Klein +44 (0) 20 3207 7930 Peter Eliot +44 (0) 20 3207 7880 Kate Kalashnikova +44 (0) 20 3465 2665<br />

Evgenia Molotova +44 (0) 20 3465 2664 Kai Mueller +44 (0) 20 3465 2681<br />

Jaideep P<strong>and</strong>ya +44 (0) 20 3207 7890 Matthew Preston +44 (0) 20 3207 7913 UTILITIES<br />

Sami Taipalus +44 (0) 20 3207 7866 Robert Chantry +44 (0) 20 3207 7861<br />

CONSTRUCTION Andrew Fisher +44 (0) 20 3207 7937<br />

Barnaby Benedict +44 (0) 20 3465 2669 MEDIA Oliver Salvesen +44 (0) 20 3207 7818<br />

Chris Moore +44 (0) 20 3465 2737 Robert Berg +44 (0) 20 3465 2680 Lawson Steele +44 (0) 20 3207 7887<br />

Robert Muir +44 (0) 20 3207 7860 Emma Coulby +44 (0) 20 3207 7821<br />

Michael Watts +44 (0) 20 3207 7928 Laura Janssens +44 (0) 20 3465 2639<br />

Sarah Simon +44 (0) 20 3207 7830<br />

Equity Sales<br />

E-mail: firstname.lastname@berenberg.com; Internet www.berenberg.com<br />

Specialist Sales Sales Sales<br />

BANKS LONDON SOVEREIGN WEALTH FUNDS<br />

Iro Papadopoulou +44 (0) 20 3207 7924 John von <strong>Berenberg</strong>-Consbruch +44 (0) 20 3207 7805 Max von Doetinchem +44 (0) 20 3207 7826<br />

Matt Chawner +44 (0) 20 3207 7847<br />

CONSUMER Toby Flaux +44 (0) 20 3465 2745 Sales Trading<br />

Rupert Trotter +44 (0) 20 3207 7815 Karl Hancock +44 (0) 20 3207 7803 HAMBURG<br />

Sean Heath +44 (0) 20 3465 2742 Paul Dontenwill +49 (0) 40 350 60 563<br />

INSURANCE James Hipkiss +44 (0) 20 3465 2620 Alex<strong>and</strong>er Heinz +49 (0) 40 350 60 359<br />

Trevor Moss +44 (0) 20 3207 7893 David Hogg +44 (0) 20 3465 2628 Gregor Labahn +49 (0) 40 350 60 571<br />

Zubin Hubner +44 (0) 20 3207 7885 Chris McKe<strong>and</strong> +49 (0) 40 350 60 798<br />

HEALTHCARE Ben Hutton +44 (0) 20 3207 7804 Fin Schaffer +49 (0) 40 350 60 596<br />

Frazer Hall +44 (0) 20 3207 7875 James Matthews +44 (0) 20 3207 7807 Lars Schwartau +49 (0) 40 350 60 450<br />

David Mortlock +44 (0) 20 3207 7850 Marvin Schweden +49 (0) 40 350 60 576<br />

INDUSTRIALS Peter Nichols +44 (0) 20 3207 7810 Tim Storm +49 (0) 40 350 60 415<br />

Chris Armstrong +44 (0) 20 3207 7809 Richard Payman +44 (0) 20 3207 7825 Philipp Wiechmann +49 (0) 40 350 60 346<br />

Kaj Alftan +44 (0) 20 3207 7879 George Smibert +44 (0) 20 3207 7911<br />

Anita Surana +44 (0) 20 3207 7855 LONDON<br />

MEDIA Paul Walker +44 (0) 20 3465 2632 Mike Berry +44 (0) 20 3465 2755<br />

Julia Thannheiser +44 (0) 20 3465 2676 Stewart Cook +44 (0) 20 3465 2752<br />

FRANKFURT Simon Messman +44 (0) 20 3465 2754<br />

TECHNOLOGY Michael Brauburger +49 (0) 69 91 30 90 741 Stephen O'Donohoe +44 (0) 20 3465 2753<br />

Jean Beaubois +44 (0) 20 3207 7835 Nina Buechs +49 (0) 69 91 30 90 735<br />

André Grosskurth +49 (0) 69 91 30 90 734 PARIS<br />

TELECOMMUNICATIONS Boris Koegel +49 (0) 69 91 30 90 740 Sylvain Granjoux +33 (0) 1 5844 9509<br />

Julia Thannheiser +44 (0) 20 3465 2676 Joerg Wenzel +49 (0) 69 91 30 90 743<br />

CORPORATE ACCESS<br />

UTILITIES PARIS Patricia Nehring +44 (0) 20 3207 7811<br />

Benita Barretto +44 (0) 20 3207 7829 Miel Bakker (London) +44 (0) 20 3207 7808<br />

Dalila Farigoule +33 (0) 1 5844 9510 CRM<br />

Sales Clémence La Clavière-Peyraud +33 (0) 1 5844 9521 Greg Swallow +44 (0) 20 3207 7833<br />

BENELUX Olivier Thibert +33 (0) 1 5844 9512 Laura Cooper +44 (0) 20 3207 7806<br />

Miel Bakker (London) +44 (0) 20 3207 7808<br />

Susette Mantzel (Hamburg) +49 (0) 40 350 60 694 ZURICH EVENTS<br />

Alex<strong>and</strong>er Wace (London) +44 (0) 20 3465 2670 Stephan Hofer +41 (0) 44 283 2029 Natalie Meech +44 (0) 20 3207 7831<br />

Carsten Kinder +41 (0) 44 283 2024 Charlotte Kilby +44 (0) 20 3207 7832<br />

SCANDINAVIA Gianni Lavigna +41 (0) 44 283 2038 Charlotte Reeves +44 (0) 20 3465 2671<br />

Ronald Bernette (London) +44 (0) 20 3207 7828 James Nettleton +41 (0) 44 283 2026 Sarah Weyman +44 (0) 20 3207 7801<br />

Marco Weiss (Hamburg) +49 (0) 40 350 60 719 Benjamin Stillfried +41 (0) 44 283 2033 Hannah Whitehead +44 (0) 20 3207 7922<br />

US Sales<br />

E-mail: firstname.lastname@berenberg-us.com<br />

BERENBERG CAPITAL MARKETS LLC<br />

Member FINRA & SIPC<br />

Andrew Holder +1 (617) 292 8222 Julie Doherty +1 (617) 292 8228 Jonathan Paterson +1 (646) 445 7212<br />

Colin Andrade +1 (617) 292 8230 Kelleigh Faldi +1 (617) 292 8288 Jonathan Saxon +1 (646) 445 7202<br />

Cathal Carroll +1 (646) 445 7206 Emily Mouret +1 (646) 445 7204<br />

Burr Clark +1 (617) 292 8282 Kieran O'Sullivan +1 (617) 292 8292<br />

7