Berenberg Macro Views German elections: the ... - Berenberg Bank

Berenberg Macro Views German elections: the ... - Berenberg Bank

Berenberg Macro Views German elections: the ... - Berenberg Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Berenberg</strong> <strong>Macro</strong> <strong>Views</strong><br />

Economics<br />

<strong>German</strong> <strong>elections</strong>: <strong>the</strong> morning after<br />

KEY RESULTS<br />

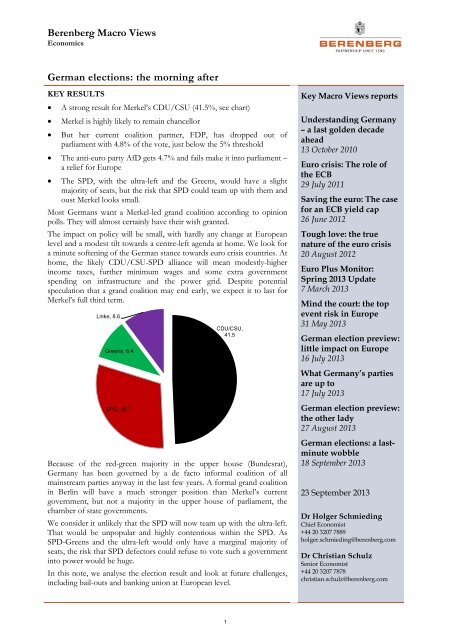

• A strong result for Merkel’s CDU/CSU (41.5%, see chart)<br />

• Merkel is highly likely to remain chancellor<br />

• But her current coalition partner, FDP, has dropped out of<br />

parliament with 4.8% of <strong>the</strong> vote, just below <strong>the</strong> 5% threshold<br />

• The anti-euro party AfD gets 4.7% and fails make it into parliament –<br />

a relief for Europe<br />

• The SPD, with <strong>the</strong> ultra-left and <strong>the</strong> Greens, would have a slight<br />

majority of seats, but <strong>the</strong> risk that SPD could team up with <strong>the</strong>m and<br />

oust Merkel looks small.<br />

Most <strong>German</strong>s want a Merkel-led grand coalition according to opinion<br />

polls. They will almost certainly have <strong>the</strong>ir wish granted.<br />

The impact on policy will be small, with hardly any change at European<br />

level and a modest tilt towards a centre-left agenda at home. We look for<br />

a minute softening of <strong>the</strong> <strong>German</strong> stance towards euro crisis countries. At<br />

home, <strong>the</strong> likely CDU/CSU-SPD alliance will mean modestly-higher<br />

income taxes, fur<strong>the</strong>r minimum wages and some extra government<br />

spending on infrastructure and <strong>the</strong> power grid. Despite potential<br />

speculation that a grand coalition may end early, we expect it to last for<br />

Merkel’s full third term.<br />

Linke, 8.6<br />

Greens, 8.4<br />

CDU/CSU,<br />

41.5<br />

Key <strong>Macro</strong> <strong>Views</strong> reports<br />

Understanding <strong>German</strong>y<br />

– a last golden decade<br />

ahead<br />

13 October 2010<br />

Euro crisis: The role of<br />

<strong>the</strong> ECB<br />

29 July 2011<br />

Saving <strong>the</strong> euro: The case<br />

for an ECB yield cap<br />

26 June 2012<br />

Tough love: <strong>the</strong> true<br />

nature of <strong>the</strong> euro crisis<br />

20 August 2012<br />

Euro Plus Monitor:<br />

Spring 2013 Update<br />

7 March 2013<br />

Mind <strong>the</strong> court: <strong>the</strong> top<br />

event risk in Europe<br />

31 May 2013<br />

<strong>German</strong> election preview:<br />

little impact on Europe<br />

16 July 2013<br />

What <strong>German</strong>y’s parties<br />

are up to<br />

17 July 2013<br />

SPD, 25.7<br />

Because of <strong>the</strong> red-green majority in <strong>the</strong> upper house (Bundesrat),<br />

<strong>German</strong>y has been governed by a de facto informal coalition of all<br />

mainstream parties anyway in <strong>the</strong> last few years. A formal grand coalition<br />

in Berlin will have a much stronger position than Merkel’s current<br />

government, but not a majority in <strong>the</strong> upper house of parliament, <strong>the</strong><br />

chamber of state governments.<br />

We consider it unlikely that <strong>the</strong> SPD will now team up with <strong>the</strong> ultra-left.<br />

That would be unpopular and highly contentious within <strong>the</strong> SPD. As<br />

SPD-Greens and <strong>the</strong> ultra-left would only have a marginal majority of<br />

seats, <strong>the</strong> risk that SPD defectors could refuse to vote such a government<br />

into power would be huge.<br />

In this note, we analyse <strong>the</strong> election result and look at future challenges,<br />

including bail-outs and banking union at European level.<br />

<strong>German</strong> election preview:<br />

<strong>the</strong> o<strong>the</strong>r lady<br />

27 August 2013<br />

<strong>German</strong> <strong>elections</strong>: a lastminute<br />

wobble<br />

18 September 2013<br />

23 September 2013<br />

Dr Holger Schmieding<br />

Chief Economist<br />

+44 20 3207 7889<br />

holger.schmieding@berenberg.com<br />

Dr Christian Schulz<br />

Senior Economist<br />

+44 20 3207 7878<br />

christian.schulz@berenberg.com<br />

1

<strong>Berenberg</strong> <strong>Macro</strong> <strong>Views</strong><br />

Economics<br />

Grand coalition most likely, no Bundesrat majority<br />

Merkel’s CDU/CSU is <strong>the</strong> great winner of Sunday’s <strong>elections</strong>, gaining 7.7<br />

percentage points compared to 2009, mostly at <strong>the</strong> expense of <strong>the</strong> junior<br />

coalition partner FDP (see Chart 1). The CDU/CSU even came close to an<br />

outright majority, winning 311 of 630 seats, just six short of <strong>the</strong> majority.<br />

The SPD also recovered a little from <strong>the</strong> losses of 2009 and obtained 192<br />

seats. The Greens (63 seats) and Left Party (64 seats) sustained significant<br />

losses, and <strong>the</strong> Pirates proved to be a temporary phenomenon.<br />

Against <strong>the</strong> weak trend for small parties, <strong>the</strong> anti-euro AfD achieved 4.7%<br />

of <strong>the</strong> vote from scratch, but failed to enter <strong>the</strong> Bundestag, which made<br />

some headlines. Relative to <strong>the</strong> strength of maverick parties elsewhere<br />

(UKIP in <strong>the</strong> UK, Front National in France, Wilders in <strong>the</strong> Ne<strong>the</strong>rlands,<br />

Strache/Stronach in Austria), <strong>the</strong> 4.7% for <strong>German</strong> AfD is quite contained<br />

anyway. This shows that <strong>German</strong>y’s pro-euro consensus is pretty solid.<br />

Large parties win, small parties<br />

lose. Exception: AfD<br />

Anti-euro party performs well, but<br />

pro-European consensus stable<br />

NO MAJORITY IN THE UPPER HOUSE<br />

A grand coalition or an unlikely alliance between CDU/CSU and Greens<br />

may have a healthy majority in <strong>the</strong> Bundestag, but in <strong>the</strong> upper house, <strong>the</strong><br />

Bundesrat, where <strong>German</strong>y’s 16 states are represented, nei<strong>the</strong>r would have<br />

a majority. Only <strong>the</strong> possible left alliance of SPD, Greens and Linke have a<br />

majority <strong>the</strong>re. Since <strong>the</strong> Bundesrat is involved in almost all decisions<br />

involving serious money, <strong>the</strong> new government will continue to have to<br />

strike deals with that majority.<br />

In <strong>the</strong> separate state election in Hesse on Sunday, <strong>the</strong> CDU-FDP state<br />

government lost its majority, probably paving <strong>the</strong> way for a grand coalition<br />

at state level. But this remains unclear. As a small consolation to <strong>the</strong> FDP,<br />

<strong>the</strong> liberals made it into <strong>the</strong> Hesse state parliament, with 5.0%. But even if<br />

Hesse turns to a grand coalition as well, this combination would still only<br />

have 29 out of 69 votes in <strong>the</strong> upper house (see Chart 2), and this will not<br />

change soon. The next scheduled state <strong>elections</strong> are:<br />

- Saxony (CDU/FDP, summer 2014)<br />

- Thuringia (CDU/SPD, summer 2014)<br />

- Brandenburg (SPD/Linke), summer 2014)<br />

- Hamburg (SPD/Greens, spring 2015)<br />

- Bremen (SPD/Greens, spring 2015)<br />

This means that, even in a best case scenario whereby grand coalitions are<br />

formed at each of <strong>the</strong>se <strong>elections</strong>, summer 2014 would be <strong>the</strong> earliest point<br />

at which a Grand coalition could obtain a majority in <strong>the</strong> upper house.<br />

However, a grand coalition should find it relatively easy to bring <strong>the</strong> Greens<br />

onside, with which it would rule all but two states (Saxony and<br />

Brandenburg). That is a far more comfortable position than Merkel’s<br />

outgoing coalition enjoyed.<br />

Even grand coalition without<br />

outright majority in Bundesrat<br />

Hesse may turn to grand coalition<br />

as well<br />

No major <strong>elections</strong> in sight<br />

Greens likely to support grand<br />

coalition<br />

2

<strong>Berenberg</strong> <strong>Macro</strong> <strong>Views</strong><br />

Economics<br />

Chart 1: Winners and losers<br />

Chart 2: No majority in <strong>the</strong> upper house?<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

-8<br />

-10<br />

-12<br />

Rhineland<br />

Palatinate, 4<br />

Lower Saxony,<br />

6<br />

North-Rhine<br />

Westphalia, 6<br />

Bremen, 3<br />

Hamburg, 3<br />

Brandenburg, 4 Saxony, 4<br />

Hesse, 5<br />

Saar, 3<br />

Bavaria, 6<br />

Saxony Anhalt,<br />

4<br />

Thuringia, 4<br />

Changes in voting shares from 2009 <strong>elections</strong>, percentage points. Source:<br />

<strong>German</strong> public television<br />

Schleswig-<br />

Holstein, 4<br />

Baden-<br />

Wuerttemberg,<br />

6<br />

Berlin, 4<br />

Mecklenburg<br />

West<br />

Pomerania, 3<br />

Seats in <strong>the</strong> upper house of parliament (Bundesrat) by coalition. SPD (red), Greens<br />

(green), CDU/CSU (black), FDP (yellow), Linke (violet), 12m sum. Hess before<br />

last night’s <strong>elections</strong>. Source: Bundesrat<br />

3

<strong>Berenberg</strong> <strong>Macro</strong> <strong>Views</strong><br />

Economics<br />

What would a grand coalition do?<br />

Merkel’s CDU/CSU stands for virtually unchanged policies, while <strong>the</strong> SPD<br />

endorses Merkel’s euro policies but wants a partial reversal of <strong>the</strong> 2004<br />

reforms that had turned <strong>German</strong>y into Europe’s growth engine. We expect<br />

<strong>the</strong> two sides to agree on:<br />

- virtually unchanged euro policies<br />

- no euro bonds or o<strong>the</strong>r serious mutualisation of debt<br />

- some discussion over a debt redemption fund, possibly to be relegated<br />

to a committee (which would likely report back that such a fund would<br />

be unconstitutional in <strong>German</strong>y)<br />

- a minor fiscal stimulus through more spending on infrastructure and<br />

<strong>the</strong> power grid<br />

- a modest hike in top marginal income taxes and possibly capital gains<br />

taxes<br />

- more minimum wages for ever more sectors, but not quite a uniform<br />

national minimum wage<br />

- a gradual reduction in subsidies for solar and wind energy.<br />

Slightly more centre-left agenda at<br />

home<br />

Table 1 gives an overview of <strong>the</strong> campaign platforms of <strong>the</strong> major parties;<br />

more can be found in our note What <strong>German</strong>y’s parties are up to of 17 July<br />

2013.<br />

In preparation of coalition talks, which could commence early next week,<br />

<strong>the</strong> SPD will call a party convention at which it will discuss policies and<br />

probably also personnel. Merkel is also likely to have preliminary talks with<br />

<strong>the</strong> Green party, although <strong>the</strong> policy differences, personal animosities and<br />

<strong>the</strong> lack of any majority in <strong>the</strong> upper house of parliament make such an<br />

alliance extremely unlikely. Such talks may prove to be more of a bargaining<br />

chip in Merkel’s negotiations with <strong>the</strong> SPD. Forming a new coalition<br />

government usually takes 1-2 months in <strong>German</strong>y, depending on how<br />

difficult <strong>the</strong> negotiations are and how many coalition variants <strong>the</strong>re are. The<br />

grand coalition in 2005 took two months to form, so it could take a similar<br />

amount of time this year.<br />

Besides <strong>the</strong> actual policies <strong>the</strong> coalition partners will eventually agree,<br />

personnel decisions will be very important. The position of <strong>the</strong> Finance<br />

Minister will grab particular attention in <strong>the</strong> Eurozone, as <strong>the</strong> current<br />

Finance Minister, Schaeuble, a political heavy-weight and respected pro-<br />

European, has played a key role in <strong>the</strong> management of <strong>the</strong> euro crisis so far.<br />

In <strong>the</strong> last grand coalition, Peer Steinbrueck of <strong>the</strong> SPD was finance<br />

minister, but a weakened SPD may not obtain <strong>the</strong> post this time around.<br />

The Bavarian sister party of Merkel’s CDU, <strong>the</strong> CSU, which performed<br />

strongly in both <strong>the</strong> national and <strong>the</strong> regional <strong>elections</strong> last week, may also<br />

claim <strong>the</strong> post.<br />

Policy overview in Table 1<br />

Negotiations to be prepared this<br />

week<br />

Finance minister post up for grabs?<br />

4

<strong>Berenberg</strong> <strong>Macro</strong> <strong>Views</strong><br />

Economics<br />

The challenges: budget, banking union, bail-outs<br />

On <strong>the</strong> domestic front, <strong>the</strong> 2014 federal budget needs to be agreed and<br />

submitted to <strong>the</strong> EU Commission by 15 October, before <strong>the</strong> Bundestag can<br />

pass it by <strong>the</strong> end of <strong>the</strong> year.<br />

It is on <strong>the</strong> European level that <strong>the</strong> new government needs to hit <strong>the</strong><br />

ground running. At <strong>the</strong> Eurozone Finance Minister meeting on 14<br />

October, <strong>the</strong> agreement with <strong>the</strong> European Parliament (EP) on <strong>the</strong> ECB’s<br />

role as banking super visor (Single Supervisory Mechanism, SSM) needs to<br />

be finalised. The much more controversial Directive on bank resolution –<br />

especially <strong>the</strong> questions of <strong>the</strong> legal basis, <strong>the</strong> resolution authority and its<br />

financing – need to be addressed, so that <strong>the</strong> 24 October summit can make<br />

a proposal to <strong>the</strong> EP. The time pressure results from <strong>the</strong> fact that <strong>the</strong> EP<br />

faces <strong>elections</strong> on 22 May 2014. Ideally, <strong>the</strong> parliament could discuss and<br />

pass <strong>the</strong> legislation this year, although that seems extremely ambitious.<br />

Ireland’s bail-out programme expires at <strong>the</strong> end of this year. On 15<br />

January, <strong>the</strong> country has to redeem a government bond of €6.6bn, probably<br />

mostly held by <strong>the</strong> ECB. While that should be possible for Ireland even<br />

without support from <strong>the</strong> Eurozone, extending an enhanced conditionality<br />

credit line (ECCL) of <strong>the</strong> rescue fund ESM to <strong>the</strong> country would help to<br />

smooth <strong>the</strong> transition.<br />

Portugal and Greece are currently going through reviews by <strong>the</strong> troika of<br />

EU, IMF and ECB. Preliminary results may be discussed at <strong>the</strong> 14 October<br />

Eurozone Finance Minister meeting as well, and both may be less flattering<br />

than recently. The junior partner in <strong>the</strong> Portuguese coalition has demanded<br />

an easing of austerity. The Portuguese programme expires in mid 2014, and<br />

<strong>the</strong> decision as to whe<strong>the</strong>r <strong>the</strong> country needs a second full bail-out or just a<br />

flexible credit line is likely to depend on <strong>the</strong> outcome of <strong>the</strong> negotiations.<br />

Greece may be even more complicated. Being on track to achieve a<br />

primary surplus at <strong>the</strong> end of <strong>the</strong> year, <strong>the</strong> country has delivered on <strong>the</strong><br />

conditions set last November to qualify for fur<strong>the</strong>r debt relief. But <strong>the</strong> IMF<br />

is also insisting on relief of up to €11bn to allow Greece to make faster<br />

progress towards hitting <strong>the</strong> debt ratio of 120% by 2020. On top of that, it<br />

is pressuring <strong>the</strong> Eurozone to commit ESM loans of €11bn to fund Greece<br />

through 2015 as well. Some reward for Greece’s efforts is likely to find<br />

support in <strong>German</strong>y’s new political constellation, although any new<br />

government will also keep <strong>the</strong> pressure on Greece to continue <strong>the</strong> reform<br />

process and catch up delays, for example in <strong>the</strong> privatisation process.<br />

The SPD has been sympa<strong>the</strong>tic to <strong>the</strong> Eurozone growth pact proposed by<br />

France last year. More investment to spur growth both in <strong>German</strong>y and <strong>the</strong><br />

Eurozone are likely to be at <strong>the</strong> top of <strong>the</strong>ir agenda. However, even <strong>the</strong><br />

Social Democrats are unlikely to be much more generous when it comes to<br />

funding.<br />

The tough love approach in <strong>the</strong> Eurozone – core Europe plus ECB help,<br />

Euro-periphery accepts <strong>the</strong> conditions attached – has survived changes of<br />

government in all peripheral countries. It will also survive <strong>the</strong> change in <strong>the</strong><br />

composition of government in <strong>German</strong>y. Give or take a few details,<br />

2014 budget first test at home<br />

<strong>Bank</strong>ing union on <strong>the</strong> agenda in 3<br />

weeks already<br />

Ireland could get a credit line to<br />

smooth bail-out exit<br />

Portugal between Irish-style credit<br />

line and second bail-out<br />

Carrot and stick for Greece<br />

A new “growth pact” for Europe?<br />

Tough love remains <strong>the</strong> Eurozone<br />

script<br />

6

<strong>Berenberg</strong> <strong>Macro</strong> <strong>Views</strong><br />

Economics<br />

Disclaimer<br />

This document was compiled by <strong>the</strong> above mentioned authors of <strong>the</strong> economics department of Joh.<br />

<strong>Berenberg</strong>, Gossler & Co. KG (hereinafter referred to as “<strong>the</strong> <strong>Bank</strong>”),. The <strong>Bank</strong> has made any effort to<br />

carefully research and process all information. The information has been obtained from sources which we<br />

believe to be reliable such as, for example, Thomson Reuters, Bloomberg and <strong>the</strong> relevant specialised press.<br />

However, we do not assume liability for <strong>the</strong> correctness and completeness of all information given. The<br />

provided information has not been checked by a third party, especially an independent auditing firm. We<br />

explicitly point to <strong>the</strong> stated date of preparation. The information given can become incorrect due to passage<br />

of time and/or as a result of legal, political, economic or o<strong>the</strong>r changes. We do not assume responsibility to<br />

indicate such changes and/or to publish an updated document. The forecasts contained in this document or<br />

o<strong>the</strong>r statements on rates of return, capital gains or o<strong>the</strong>r accession are <strong>the</strong> personal opinion of <strong>the</strong> author<br />

and we do not assume liability for <strong>the</strong> realisation of <strong>the</strong>se.<br />

This document is only for information purposes. It does not constitute a financial analysis within <strong>the</strong> meaning<br />

of § 34b or § 31 Subs. 2 of <strong>the</strong> <strong>German</strong> Securities Trading Act (Wertpapierhandelsgesetz), no investment<br />

advice or recommendation to buy financial instruments. It does not replace consulting regarding legal, tax or<br />

financial matters.<br />

Remarks regarding foreign investors<br />

The preparation of this document is subject to regulation by <strong>German</strong> law. The distribution of this document<br />

in o<strong>the</strong>r jurisdictions may be restricted by law, and persons, into whose possession this document comes,<br />

should inform <strong>the</strong>mselves about, and observe, any such restrictions.<br />

United Kingdom<br />

This document is meant exclusively for institutional investors and market professionals, but not for private<br />

customers. It is not for distribution to or <strong>the</strong> use of private investors or private customers.<br />

United States of America<br />

This document has been prepared exclusively by Joh. <strong>Berenberg</strong>, Gossler & Co. KG. Although <strong>Berenberg</strong><br />

Capital Markets LLC, an affiliate of <strong>the</strong> <strong>Bank</strong> and registered US broker-dealer, distributes this document to<br />

certain customers, <strong>Berenberg</strong> Capital Markets LLC does not provide input into its contents, nor does this<br />

document constitute research of <strong>Berenberg</strong> Capital Markets LLC. In addition, this document is meant<br />

exclusively for institutional investors and market professionals, but not for private customers. It is not for<br />

distribution to or <strong>the</strong> use of private investors or private customers.<br />

This document is classified as objective for <strong>the</strong> purposes of FINRA rules. Please contact <strong>Berenberg</strong> Capital<br />

Markets LLC (+1 617.292.8200), if you require additional information.<br />

Copyright<br />

The <strong>Bank</strong> reserves all <strong>the</strong> rights in this document. No part of <strong>the</strong> document or its content may be rewritten,<br />

copied, photocopied or duplicated in any form by any means or redistributed without <strong>the</strong> <strong>Bank</strong>’s prior written<br />

consent.<br />

© May 2013 Joh. <strong>Berenberg</strong>, Gossler & Co. KG<br />

8

<strong>Berenberg</strong> <strong>Macro</strong> <strong>Views</strong><br />

Economics<br />

Contacts: Investment <strong>Bank</strong>ing<br />

Equity Research<br />

E-mail: firstname.lastname@berenberg.com; Internet www.berenberg.de<br />

BANKS ECONOMICS MID-CAP GENERAL<br />

Nick Anderson +44 (0) 20 3207 7838 Dr. Holger Schmieding +44 (0) 20 3207 7889 Gunnar Cohrs +44 (0) 20 3207 7894<br />

James Chappell +44 (0) 20 3207 7844 Dr. Christian Schulz +44 (0) 20 3207 7878 Bjoern Lippe +44 (0) 20 3207 7845<br />

Andrew Lowe +44 (0) 20 3465 2743 Robert Wood +44 (0) 20 3207 7822 Anna Patrice +44 (0) 20 3207 7863<br />

Eoin Mullany +44 (0) 20 3207 7854 Stanislaus von Thurn und Taxis +44 (0) 20 3207 2631<br />

Eleni Papoula +44 (0) 20 3465 2741 FOOD MANUFACTURING<br />

Michelle Wilson +44 (0) 20 3465 2663 Fintan Ryan +44 (0) 20 3465 2748<br />

Andrew Steele +44 (0) 20 3207 7926 REAL ESTATE<br />

BEVERAGES James Targett +44 (0) 20 3207 7873 Kai Klose +44 (0) 20 3207 7888<br />

Philip Morrisey +44 (0) 20 3207 7892 Estelle Weingrod +44 (0) 20 3207 7931<br />

Josh Puddle +44 (0) 20 3207 7881 GENERAL RETAIL & LUXURY GOODS<br />

Bassel Choughari +44 (0) 20 3465 2675 TECHNOLOGY<br />

BUSINESS SERVICES John Guy +44 (0) 20 3465 2674 Adnaan Ahmad +44 (0) 20 3207 7851<br />

William Foggon +44 (0) 20 3207 7882 Sebastian Grabert +44 (0) 20 3207 7834<br />

Simon Mezzanotte +44 (0) 20 3207 7917 HEALTHCARE Daud Khan +44 (0) 20 3465 2638<br />

Arash Roshan Zamir +44 (0) 20 3465 2636 Scott Bardo +44 (0) 20 3207 7869 Ali Khwaja +44 (0) 20 3207 7852<br />

Konrad Zomer +44 (0) 20 3207 7920 Alistair Campbell +44 (0) 20 3207 7876 Tammy Qiu +44 (0) 20 3465 2673<br />

Charles Cooper +44 (0) 20 3465 2637<br />

CAPITAL GOODS Louise Hinds +44 (0) 20 3465 2747 TELECOMMUNICATIONS<br />

Frederik Bitter +44 (0) 20 3207 7916 Adrian Howd +44 (0) 20 3207 7874 Wassil El Hebil +44 (0) 20 3207 7862<br />

Benjamin Glaeser +44 (0) 20 3207 7918 Tom Jones +44 (0) 20 3207 7877 Usman Ghazi +44 (0) 20 3207 7824<br />

William Mackie +44 (0) 20 3207 7837 Stuart Gordon +44 (0) 20 3207 7858<br />

Margaret Paxton +44 (0) 20 3207 7934 HOUSEHOLD & PERSONAL CARE Laura Janssens +44 (0) 20 3465 2639<br />

Alexander Virgo +44 (0) 20 3207 7856 Jade Barkett +44 (0) 20 3207 7937 Paul Marsch +44 (0) 20 3207 7857<br />

Felix Wienen +44 (0) 20 3207 7915 Seth Peterson +44 (0) 20 3207 7891 Barry Zeitoune +44 (0) 20 3207 7859<br />

CHEMICALS INSURANCE TOBACCO<br />

Asad Farid +44 (0) 20 3207 7932 Tom Carstairs +44 (0) 20 3207 7823 Erik Bloomquist +44 (0) 20 3207 7870<br />

John Philipp Klein +44 (0) 20 3207 7930 Peter Eliot +44 (0) 20 3207 7880 Kate Kalashnikova +44 (0) 20 3465 2665<br />

Jaideep Pandya +44 (0) 20 3207 7890 Kai Mueller +44 (0) 20 3465 2681<br />

Mat<strong>the</strong>w Preston +44 (0) 20 3207 7913 UTILITIES<br />

CONSTRUCTION Sami Taipalus +44 (0) 20 3207 7866 Robert Chantry +44 (0) 20 3207 7861<br />

Chris Moore +44 (0) 20 3465 2737 Andrew Fisher +44 (0) 20 3207 7937<br />

Robert Muir +44 (0) 20 3207 7860 MEDIA Oliver Salvesen +44 (0) 20 3207 7818<br />

Michael Watts +44 (0) 20 3207 7928 Robert Berg +44 (0) 20 3465 2680 Lawson Steele +44 (0) 20 3207 7887<br />

Emma Coulby +44 (0) 20 3207 7821<br />

DIVERSIFIED FINANCIALS Laura Janssens +44 (0) 20 3465 2639<br />

Pras Jeyanandhan +44 (0) 20 3207 7899 Sarah Simon +44 (0) 20 3207 7830<br />

Sales<br />

Specialist Sales Sales E-mail: firstname.lastname@berenberg.com; Internet www.berenberg.de<br />

BANKS LONDON BENELUX<br />

Iro Papadopoulou +44 (0) 20 3207 7924 John von <strong>Berenberg</strong>-Consbruch +44 (0) 20 3207 7805 Miel Bakker (London) +44 (0) 20 3207 7808<br />

Matt Chawner +44 (0) 20 3207 7847 Susette Mantzel (Hamburg) +49 (0) 40 350 60 694<br />

CONSUMER Toby Flaux +44 (0) 20 3465 2745 Alexander Wace (London) +44 (0) 20 3465 2670<br />

Rupert Trotter +44 (0) 20 3207 7815 Sean Heath +44 (0) 20 3465 2742<br />

David Hogg +44 (0) 20 3465 2628 SCANDINAVIA<br />

INSURANCE Zubin Hubner +44 (0) 20 3207 7885 Ronald Bernette (London) +44 (0) 20 3207 7828<br />

Trevor Moss +44 (0) 20 3207 7893 Ben Hutton +44 (0) 20 3207 7804 Marco Weiss (Hamburg) +49 (0) 40 350 60 719<br />

James Mat<strong>the</strong>ws +44 (0) 20 3207 7807<br />

HEALTHCARE David Mortlock +44 (0) 20 3207 7850<br />

Frazer Hall +44 (0) 20 3207 7875 Peter Nichols +44 (0) 20 3207 7810 Sales Trading<br />

Richard Payman +44 (0) 20 3207 7825 HAMBURG<br />

TECHNOLOGY George Smibert +44 (0) 20 3207 7911 Paul Dontenwill +49 (0) 40 350 60 563<br />

Jean Beaubois +44 (0) 20 3207 7835 Anita Surana +44 (0) 20 3207 7855 Christian Endras +49 (0) 40 350 60 359<br />

Paul Walker +44 (0) 20 3465 2632 Gregor Labahn +49 (0) 40 350 60 571<br />

UTILITIES Chris McKeand +49 (0) 40 350 60 798<br />

Benita Barretto +44 (0) 20 3207 7829 FRANKFURT Fin Schaffer +49 (0) 40 350 60 596<br />

Michael Brauburger +49 (0) 69 91 30 90 741 Lars Schwartau +49 (0) 40 350 60 450<br />

INDUSTRIALS Nina Buechs +49 (0) 69 91 30 90 735 Marvin Schweden +49 (0) 40 350 60 576<br />

Chris Armstrong +44 (0) 20 3207 7809 André Grosskurth +49 (0) 69 91 30 90 734 Tim Storm +49 (0) 40 350 60 415<br />

Kaj Alftan +44 (0) 20 3207 7879 Boris Koegel +49 (0) 69 91 30 90 740 Philipp Wiechmann +49 (0) 40 350 60 346<br />

Joerg Wenzel +49 (0) 69 91 30 90 743<br />

CRM<br />

LONDON<br />

LONDON PARIS Stewart Cook +44 (0) 20 3465 2752<br />

Greg Swallow +44 (0) 20 3207 7833 Christophe Choquart +33 (0) 1 5844 9508 Simon Messman +44 (0) 20 3465 2754<br />

Laura Cooper +44 (0) 20 3207 7806 Dalila Farigoule +33 (0) 1 5844 9510 Stephen O'Donohoe +44 (0) 20 3465 2753<br />

Clémence La Clavière-Peyraud +33 (0) 1 5844 9521<br />

CORPORATE ACCESS Olivier Thibert +33 (0) 1 5844 9512 PARIS<br />

LONDON Sylvain Granjoux +33 (0) 1 5844 9509<br />

Patricia Nehring +44 (0) 20 3207 7811 ZURICH<br />

Stephan Hofer +41 (0) 44 283 2029<br />

EVENTS Carsten Kinder +41 (0) 44 283 2024 Sovereign Wealth Funds<br />

LONDON Gianni Lavigna +41 (0) 44 283 2038 LONDON<br />

Natalie Meech +44 (0) 20 3207 7831 Benjamin Stillfried +41 (0) 44 283 2033 Max von Doetinchem +44 (0) 20 3207 7826<br />

Charlotte Kilby +44 (0) 20 3207 7832<br />

Charlotte Reeves +44 (0) 20 3465 2671<br />

Hannah Whitehead +44 (0) 20 3207 7922<br />

US Sales<br />

E-mail: firstname.lastname@berenberg-us.com<br />

BERENBERG CAPITAL MARKETS LLC<br />

Member FINRA & SIPC Andrew Holder +1 (617) 292 8222 Kelleigh Faldi +1 (617) 292 8288<br />

Colin Andrade +1 (617) 292 8230 Kieran O'Sullivan +1 (617) 292 8292<br />

Cathal Carroll +1 (646) 445 7206 Emily Mouret +1 (646) 445 7204<br />

Burr Clark +1 (617) 292 8282 Jonathan Saxon +1 (646) 445 7202<br />

Julie Doherty +1 (617) 292 8228<br />

9