Fall - InsideOutdoor Magazine

Fall - InsideOutdoor Magazine

Fall - InsideOutdoor Magazine

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

• Management<br />

• Change in Control<br />

Data Points<br />

• Tax Impact<br />

• Performance Goals<br />

• Payment Schedule<br />

• Operational Integration<br />

show is stretching too far with the addition of ancillary<br />

companies and activities, consider this: outdoor participation<br />

Would your buying patterns change<br />

for large rates were brands again that flat in you 2010 already for the third stock year in a row, show<br />

if they OIA decided figures. So to while start activities selling such direct as competitive racing<br />

to customers may be growing, on their it’s likely Web the site participants are coming from<br />

within the outdoor ranks. In other words, outside of some<br />

Yes, I would stop buying<br />

market share from that shift, Brand it’s going 11% to be hard for “core” brands to<br />

Yes, I would experience buy as little much as possible organic growth.<br />

from the brand<br />

19%<br />

Yes, I would reduce my buying<br />

Green from vs. that brand Greenbacks 34%<br />

While 83 percent of global consumers say it is important<br />

No, I would not change my buying<br />

that companies from that implement brand 13%<br />

programs to improve the<br />

environment, less than a quarter say they will pay more for an<br />

I am not sure<br />

23%<br />

eco-friendly product, and willingness to pay more is lowest in<br />

Source: North Shopatron America, where only 12 percent say they will fork over<br />

extra greenbacks for green products, according to new figures<br />

from Nielsen. Among environmental and sustainability efforts<br />

manufacturers have taken, recycled packaging and energy<br />

efficient products are seen as the most broadly helpful.<br />

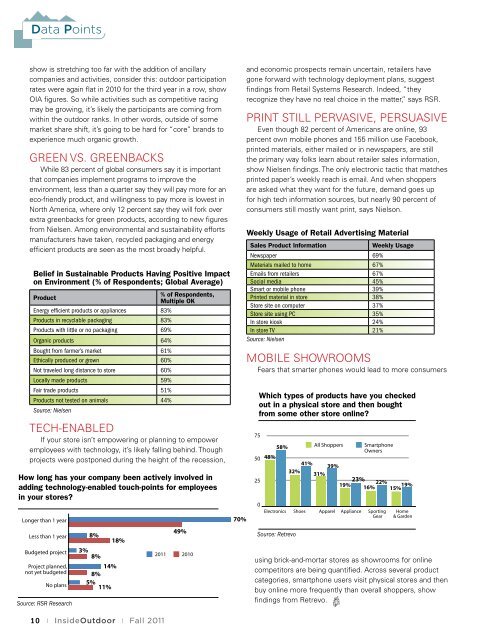

Belief in Sustainable Products Having Positive Impact<br />

Outdoor on Environment Participation, (% of 2006 Respondents; to 2010 Global Average)<br />

Total Outdoor Outings<br />

Product<br />

% of Respondents,<br />

Multiple OK<br />

11.6 Billion 11.4 Billion<br />

Energy efficient products 11.2 Billion or appliances 10.1 Billion 10.1 Billion83%<br />

Products Number in recyclable of Participants packaging 83%<br />

Products with little or no packaging 69%<br />

138.4 Billion<br />

Organic products 135.9 Billion<br />

134.4 Billion<br />

137.8 Billion 137.9 Billion<br />

64%<br />

Bought from farmer’s market 61%<br />

Participation Rate<br />

Ethically produced or grown 60%<br />

Not traveled long distance to store 60%<br />

49.1% Locally 50.0% made products 48.6% 48.9% 48.6% 59%<br />

Fair trade products 51%<br />

Products not tested on animals 44%<br />

Source: Nielsen<br />

2006 2007 2008 2009 2010<br />

Source: Tech-Enabled<br />

Outdoor Industry Association<br />

If your store isn’t empowering or planning to empower<br />

employees with technology, it’s likely falling behind. Though<br />

projects were postponed during the height of the recession,<br />

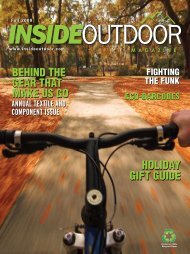

How long has your company been actively involved in<br />

adding technology-enabled touch-points for employees<br />

in your stores?<br />

Longer than 1 year<br />

Less than 1 year<br />

Budgeted project<br />

Project planned,<br />

not yet budgeted<br />

No plans<br />

Source: RSR Research<br />

8%<br />

3%<br />

8%<br />

14%<br />

8%<br />

5% 11%<br />

18%<br />

49%<br />

2011 2010<br />

70%<br />

Outdoor Participation, 2006 to 2010<br />

Total Outdoor Outings18000<br />

HIGH<br />

breathability<br />

11.6 Billion 11.4 Billion 16000<br />

11.2 Billion 10.1 Billion 10.1 Billion<br />

14000<br />

Number of Participants<br />

12000<br />

138.4 Billion<br />

137.8 Billion 137.9 Billion<br />

135.9 Billion<br />

134.4 Billion<br />

10000<br />

and economic prospects remain uncertain, retailers have<br />

gone forward Participation with technology Rate 8000deployment plans, suggest<br />

findings from Retail Systems 6000 Research. Indeed, “they<br />

recognize<br />

49.1%<br />

they<br />

50.0%<br />

have no<br />

48.6%<br />

real choice in the matter,” says RSR.<br />

4000 48.9% 48.6%<br />

LOW<br />

breathability<br />

Water Vapor Flux g/m 2 /24hrs<br />

Print Still Pervasive, Persuasive<br />

0 25 50 75 100 125 150 175 200<br />

Even though 82 percent of Americans are online, 93<br />

Pressure Drop Across Sample (PA)<br />

percent 2006own mobile 2007 phones 2008 and 2009 155<br />

Forces<br />

million<br />

air 2010 through<br />

use<br />

fabric<br />

Facebook,<br />

to illustrate the effect of<br />

wind and movement on breathability<br />

printed Source: materials, Outdoor Industry either Association mailed or in No newspapers, air Slight air are still Increasing<br />

movement movement air movement<br />

the primary way folks learn about retailer sales information,<br />

show Nielsen findings. Source: Polartec The only electronic tactic that matches<br />

printed paper’s weekly reach is email. And when shoppers<br />

are asked what they want for the future, demand goes up<br />

for high How tech long information has your sources, company but been nearly actively 90 percent involved of in<br />

consumers adding still technology-enabled mostly want print, says touch-points Nielson. for employees<br />

in your stores?<br />

Weekly Usage of Retail Advertising Material<br />

Sales Longer Product than Information<br />

1 year<br />

Weekly Usage<br />

Newspaper 69% 49%<br />

Less than 1 year 8%<br />

Materials mailed to home 18% 67%<br />

Emails Budgeted from retailers project 3% 67%<br />

Social media 8% 2011 2010<br />

45%<br />

Smart or Project mobile planned, phone 14% 39%<br />

Printed not material yet budgeted in store 8% 38%<br />

Store site on computer No plans 5% 37%<br />

11%<br />

Store site using PC 35%<br />

In store kiosk 24%<br />

Source: RSR Research<br />

In store TV 21%<br />

Source: Nielsen<br />

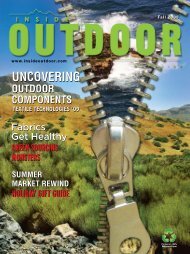

Mobile Showrooms<br />

Fears that smarter phones would lead to more consumers<br />

Which types of products have you checked<br />

out in a physical store and then bought<br />

from some other store online?<br />

75<br />

50<br />

25<br />

0<br />

48%<br />

58%<br />

Source: Retrevo<br />

All Shoppers<br />

41%<br />

39%<br />

32%<br />

31%<br />

Smartphone<br />

Owners<br />

19% 23% 16% 22% 15% 19%<br />

Electronics Shoes Apparel Appliance Sporting<br />

Gear<br />

Home<br />

& Garden<br />

using brick-and-mortar stores as showrooms for online<br />

competitors are being quantified. Across several product<br />

categories, smartphone users visit physical stores and then<br />

buy online more frequently than overall shoppers, show<br />

findings from Retrevo.<br />

70<br />

10 | <strong>InsideOutdoor</strong> | <strong>Fall</strong> 2011<br />

Privately Owned Retailers’ Inventories