Fall - InsideOutdoor Magazine

Fall - InsideOutdoor Magazine

Fall - InsideOutdoor Magazine

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

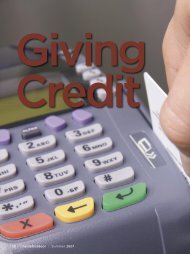

Back Office<br />

Swipe Fee Savvy<br />

An inside look at interchange reform and how to get the card<br />

processing savings you deserve<br />

by Robert Baldwin<br />

If, like most retailers, you’ve longed<br />

for relief from card processing fees,<br />

your hope is now a reality. The Federal<br />

Reserve Board has reduced the debit<br />

card “swipe fees” that retailers like you<br />

pay every time a consumer uses his/her<br />

debit card at your business.<br />

This could mean significant cost<br />

savings for you, but don’t take that<br />

benefit for granted. Some card<br />

processors are looking to profit at your<br />

expense, and if you don’t know how<br />

to ensure you’re actually getting the<br />

savings you’re rightfully due, you might<br />

miss out on a nice chunk of change.<br />

The costs for card processing<br />

services may be among the three<br />

highest expenses your business incurs,<br />

perhaps outmatched only by labor and<br />

merchandise costs. Total processing<br />

costs can be as high as 4 percent of<br />

the total sale for a single transaction,<br />

of which swipe fees (technically,<br />

interchange fees) comprise a large part.<br />

Swipe fees are a percentage of each<br />

transaction amount imposed by the card<br />

brands (Visa, MasterCard and Discover<br />

Network; American Express follows a<br />

different pricing model) that the issuing<br />

banks collect from retailers every time<br />

a consumer uses his/her credit or debit<br />

card. Currently, interchange fees can<br />

range anywhere between 1.5 to 2.5<br />

percent for each card-based purchase.<br />

In July 2010, President Obama<br />

signed the Dodd-Frank Wall Street<br />

Reform and Consumer Protection<br />

Act, commonly known as the financial<br />

reform bill, that, among various other<br />

provisions, directed the Federal Reserve<br />

Board to ensure that debit-swipe fees<br />

are “reasonable and proportional” to<br />

the cost of processing transactions.<br />

With merchants and banks lobbying<br />

fervently on opposite sides of the table,<br />

this directive sparked one of the most<br />

heated debates on financial reform that<br />

our country has seen in recent history.<br />

After much deliberation and almost<br />

one year later, on June 29, 2011, the<br />

Federal Reserve Board issued its<br />

final ruling to lower the cap on debit<br />

interchange fees to 21 cents per<br />

transaction plus 0.05 percent of the<br />

volume of transaction, effective October<br />

1, 2011. Although this is nearly double<br />

the Fed’s initial proposal of 12 cents,<br />

this is a significant reduction from<br />

the average of 44 cents that retailers<br />

currently pay per debit card purchase.<br />

The rules also state that issuers can<br />

charge an additional one cent if they<br />

comply with certain fraud protection<br />

policies and procedures.<br />

The Whirling<br />

Durbin Amendment<br />

While this legislation was intended to<br />

offer financial relief to business owners<br />

like you, it doesn’t require that processors<br />

pass the fee reductions through — and<br />

some won’t. Some processors are looking<br />

to absorb the windfall to benefit their own<br />

bottom lines rather than pass the savings<br />

on. In fact, the CEO of a major processor<br />

recently told Wall Street analysts, “Just<br />

be assured that there will be opportunities<br />

for us to keep some of [the debit fee<br />

reduction]. I mean the thought that a very<br />

large merchant and a very small merchant<br />

are treated exactly the same is not how it<br />

works in a free enterprise system.”<br />

The industry encountered a<br />

similar situation in 2003 with the Wal-<br />

Mart settlement that lowered debit<br />

interchange rates by approximately<br />

one-third. Rather than pass the savings<br />

through to their merchants, many<br />

processors kept the savings to boost<br />

their own profits.<br />

While the ruling was scheduled to<br />

go into effect on October 1, it’s not too<br />

late to take action to ensure you get<br />

100 percent of the savings you rightfully<br />

deserve. Start by following these tips:<br />

1. Know the implications of the<br />

reform. There are more than<br />

300 pages of rules about the<br />

implementation of the Durbin<br />

Amendment, and while most retailers<br />

don’t have time to review them — nor<br />

would we necessarily recommend<br />

it — business owners need to know<br />

how the legislation affects them.<br />

Take the time to fully understand<br />

the information in this article and if<br />

you’re interested, you can also get<br />

more useful information from industry<br />

associations and online.<br />

2. Get your processor’s guarantee<br />

in writing. Ask for written<br />

confirmation from your processor<br />

that it will pass 100 percent of the<br />

Durbin rate decrease directly to your<br />

checking account starting the first<br />

day the legislation is implemented.<br />

No excuses.<br />

3. Verify that you are on interchangeplus<br />

pricing model. There are two<br />

basic types of card processing<br />

pricing models. Tiered pricing or<br />

discount rate models group together<br />

interchange fees and processor<br />

fees, making it difficult for business<br />

owners to determine who is charging<br />

what. Alternatively, interchange-plus<br />

is a simplified model that passes<br />

interchange fees directly to the<br />

44 | <strong>InsideOutdoor</strong> | <strong>Fall</strong> 2011