Fall - InsideOutdoor Magazine

Fall - InsideOutdoor Magazine

Fall - InsideOutdoor Magazine

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Back Office<br />

A Clean Exit<br />

Understanding earnouts in a business transaction<br />

by Phil Josephson<br />

“If you don’t want to work you have<br />

to work to earn enough money so that<br />

you won’t have to work.” - Ogden Nash<br />

An earnout agreement is useful<br />

between a buyer and a seller of a<br />

closely held business, particularly when<br />

the seller and the buyer have different<br />

views on the price of the business or<br />

when used as a financing device to<br />

consummate a transaction. An earnout<br />

agreement is a portion of the selling<br />

price which is made contingent upon<br />

attainment of identified thresholds.<br />

While useful, earnouts have downsides<br />

and are inherent with litigation risk.<br />

Drafting an earnout can be difficult,<br />

especially when anticipating all possible<br />

future scenarios. As a result, earnout<br />

language may be ambiguous, and<br />

those that do not draft adequately may<br />

invite and encourage future litigation.<br />

Loosely drafted earnouts may lead<br />

to litigation issues such as implied<br />

covenants to use reasonable efforts<br />

to develop and promote the acquired<br />

business, making representations that<br />

buyer can make earnout payments,<br />

revenues of another target acquired<br />

during the earnout period applied to<br />

the earnout, integration of the acquired<br />

business as a trigger to an acceleration<br />

of the earnout due to a merger, or<br />

misrepresentations by the seller that<br />

lead to skewed earnout payments.<br />

Another issue arises when trying<br />

to enforce an earnout. In such cases,<br />

courts have had trouble proving or<br />

calculating damages.<br />

But earnouts do not need to be<br />

invitations to litigation. Parties should<br />

pay close attention to the accounting,<br />

tax, securities, financial and non-financial<br />

consequences of each aspect of the<br />

earnout agreement. They should specify<br />

in detail the nature of the threshold<br />

42 | <strong>InsideOutdoor</strong> | <strong>Fall</strong> 2011<br />

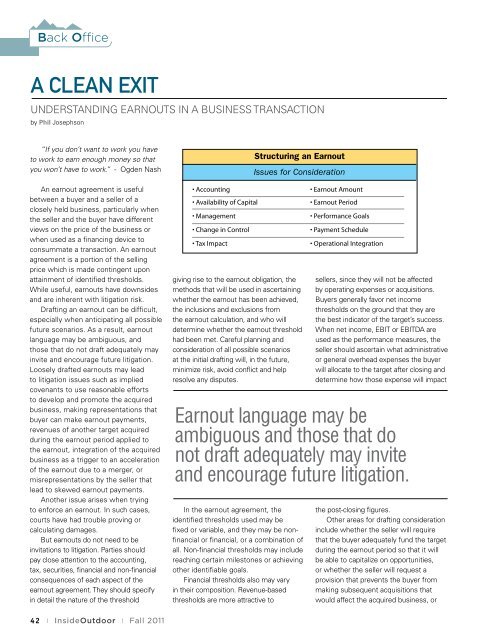

• Accounting<br />

• Availability of Capital<br />

• Management<br />

• Change in Control<br />

• Tax Impact<br />

Structuring an Earnout<br />

Issues for Consideration<br />

• Earnout Amount<br />

• Earnout Period<br />

• Performance Goals<br />

• Payment Schedule<br />

• Operational Integration<br />

giving rise to the earnout obligation, the sellers, since they will not be affected<br />

methods that will be used in ascertaining by operating expenses or acquisitions.<br />

whether Would the earnout your buying has been patterns achieved, change Buyers generally favor net income<br />

the for inclusions large and brands exclusions that from you already thresholds stock on the ground that they are<br />

the if earnout they calculation, decided and to who start will selling the direct best indicator of the target’s success.<br />

determine to customers whether the on earnout their threshold Web siteWhen net income, EBIT or EBITDA are<br />

had been met. Careful planning and used as the performance measures, the<br />

Yes, I would stop buying<br />

consideration of all from possible that Brand scenarios<br />

11%<br />

seller should ascertain what administrative<br />

at the Yes, initial I would drafting buy as little will, as in possible the future, or general overhead expenses the buyer<br />

from the brand<br />

19%<br />

minimize risk, avoid conflict and help will allocate to the target after closing and<br />

Yes, I would reduce my buying<br />

resolve any disputes. from that brand<br />

determine 34% how those expense will impact<br />

No, I would not change my buying<br />

from that brand<br />

13%<br />

Earnout language may be<br />

I am not sure<br />

23%<br />

Source: Shopatron<br />

ambiguous and those that do<br />

not draft adequately may invite<br />

and encourage future litigation.<br />

Outdoor Participation, 2006 to 2010<br />

In the earnout agreement, the the post-closing figures.<br />

identified thresholds used may be<br />

Other areas for drafting consideration<br />

Total Outdoor Outings<br />

fixed or variable, and they may be nonfinancial<br />

11.6 Billion or financial, 11.4 Billion or a 11.2<br />

include whether the seller will require<br />

combination Billion<br />

of that the buyer adequately fund the target<br />

all. Non-financial thresholds may include 10.1 Billion 10.1 Billion<br />

during the earnout period so that it will<br />

reaching certain Number milestones of Participants or achieving be able to capitalize on opportunities,<br />

other identifiable 138.4 Billion goals.<br />

or whether the seller will request a<br />

137.8 Billion 137.9 Billion<br />

Financial thresholds 135.9 also Billion<br />

134.4 Billion<br />

may vary provision that prevents the buyer from<br />

in their composition. Revenue-based making subsequent acquisitions that<br />

Participation Rate<br />

thresholds are more attractive to<br />

would affect the acquired business, or<br />

49.1% 50.0% 48.6% 48.9% 48.6%