Fall - InsideOutdoor Magazine

Fall - InsideOutdoor Magazine

Fall - InsideOutdoor Magazine

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Data Points<br />

Numbers worth noting<br />

by Martin Vilaboy<br />

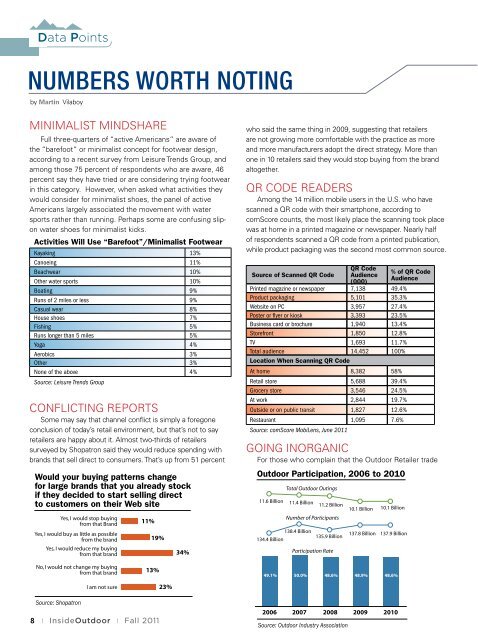

Minimalist Mindshare<br />

Full three-quarters of “active Americans” are aware of<br />

the “barefoot” or minimalist concept for footwear design,<br />

according to a recent survey from Leisure Trends Group, and<br />

among those 75 percent of respondents who are aware, 46<br />

percent say they have tried or are considering trying footwear<br />

in this category. However, when asked what activities they<br />

would consider for minimalist shoes, the panel of active<br />

Americans largely associated the movement with water<br />

sports rather than running. Perhaps some are confusing slipon<br />

water shoes for minimalist kicks.<br />

Activities Will Use “Barefoot”/Minimalist Footwear<br />

Kayaking 13%<br />

Canoeing 11%<br />

Beachwear 10%<br />

Other water sports 10%<br />

Boating 9%<br />

Runs of 2 miles or less 9%<br />

Casual wear 8%<br />

House shoes 7%<br />

Fishing 5%<br />

Runs longer than 5 miles 5%<br />

Yoga Structuring an Earnout 4%<br />

Aerobics 3%<br />

Other Issues for Consideration 3%<br />

None of the above 4%<br />

• Accounting<br />

• Earnout Amount<br />

Source: Leisure Trends Group<br />

• Availability of Capital<br />

• Earnout Period<br />

• Management<br />

Conflicting Reports<br />

• Performance Goals<br />

• Change in Control<br />

• Payment Schedule<br />

Some may say that channel conflict is simply a foregone<br />

• Tax Impact<br />

• Operational Integration<br />

conclusion of today’s retail environment, but that’s not to say<br />

retailers are happy about it. Almost two-thirds of retailers<br />

surveyed by Shopatron said they would reduce spending with<br />

brands that sell direct to consumers. That’s up from 51 percent<br />

Would your buying patterns change<br />

for large brands that you already stock<br />

if they decided to start selling direct<br />

to customers on their Web site<br />

who said the same thing in 2009, suggesting that retailers<br />

are not growing more comfortable with the practice as more<br />

and more manufacturers Structuring adopt the direct an strategy. EarnoutMore than<br />

one in 10 retailers said they Issues would for stop Consideration buying from the brand<br />

altogether.<br />

• Accounting<br />

• Earnout Amount<br />

QR • Code Availability of Readers<br />

Capital<br />

• Earnout Period<br />

Among • Management the 14 million mobile users in • the Performance U.S. who Goals have<br />

scanned a QR code with their smartphone, according to<br />

• Change in Control<br />

• Payment Schedule<br />

comScore counts, the most likely place the scanning took place<br />

was at • Tax home Impact in a printed magazine or newspaper. • Operational Nearly Integration half<br />

of respondents scanned a QR code from a printed publication,<br />

while product packaging was the second most common source.<br />

QR Code<br />

Source of Scanned QR Code Audience<br />

% of QR Code<br />

Would your buying patterns (000) change Audience<br />

Printed for magazine large or brands newspaper that you 7,138 already stock 49.4%<br />

Product if they packaging decided to start 5,101 selling direct 35.3%<br />

Website to customers on PC on their Web 3,957 site 27.4%<br />

Poster or flyer or kiosk 3,393 23.5%<br />

Yes, I would stop buying<br />

Business card or brochure from that Brand 1,94011%<br />

13.4%<br />

Storefront Yes, I would buy as little as possible 1,850 12.8%<br />

TV from the brand 1,693<br />

19%<br />

11.7%<br />

Total audience Yes, I would reduce my buying 14,452 100%<br />

from that brand<br />

34%<br />

Location When Scanning QR Code<br />

At home<br />

No, I would not change my buying<br />

from that brand<br />

8,382 13% 58%<br />

Retail store 5,688 39.4%<br />

Grocery store I am not Polartec sure 3,546 NeoShell 23% Outperforms 24.5% in Dynamic<br />

At work 2,844 19.7%<br />

Source: Shopatron<br />

Outside or on public transit 1,827 18000 12.6%<br />

Restaurant 1,095 16000 7.6%<br />

Source: comScore MobiLens, June 2011<br />

14000<br />

12000<br />

For those who complain that the 10000 Outdoor Retailer trade<br />

Outdoor Participation, 2006 8000 to 2010<br />

Total Outdoor Outings<br />

6000<br />

11.6 Billion 11.4 Billion 11.2 Billion<br />

4000<br />

10.1 Billion 10.1 Billion<br />

HIGH<br />

breathability<br />

Going Inorganic<br />

LOW<br />

breathability<br />

Water Vapor Flux g/m 2 /24hrs<br />

Yes, I would stop buying<br />

from that Brand<br />

Yes, I would buy as little as possible<br />

from the brand<br />

Yes, I would reduce my buying<br />

from that brand<br />

No, I would not change my buying<br />

from that brand<br />

11%<br />

19%<br />

13%<br />

34%<br />

Number of Participants<br />

0 25 50 75 100 125 150 175 2<br />

Pressure Drop Across Sample (PA)<br />

138.4 Billion<br />

137.8 Billion 137.9 Forces Billion air through fabric to illustrate the effect o<br />

135.9 Billion wind and movement on breathability<br />

134.4 Billion<br />

Participation Rate<br />

Source: Polartec<br />

No air<br />

movement<br />

49.1% 50.0% 48.6% 48.9% 48.6%<br />

Slight air<br />

movement<br />

Increasing<br />

air movement<br />

I am not sure<br />

23%<br />

Source: Shopatron<br />

8 | <strong>InsideOutdoor</strong> | <strong>Fall</strong> 2011<br />

2006 2007 2008 2009 2010<br />

Source: Outdoor Industry Association