VAT Guide to Value Added Tax - sri lanka inland revenue ...

VAT Guide to Value Added Tax - sri lanka inland revenue ...

VAT Guide to Value Added Tax - sri lanka inland revenue ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

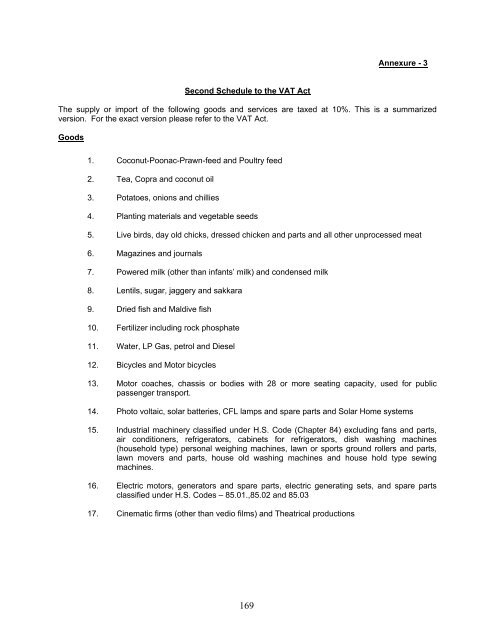

Annexure - 3<br />

Second Schedule <strong>to</strong> the <strong>VAT</strong> Act<br />

The supply or import of the following goods and services are taxed at 10%. This is a summarized<br />

version. For the exact version please refer <strong>to</strong> the <strong>VAT</strong> Act.<br />

Goods<br />

1. Coconut-Poonac-Prawn-feed and Poultry feed<br />

2. Tea, Copra and coconut oil<br />

3. Pota<strong>to</strong>es, onions and chillies<br />

4. Planting materials and vegetable seeds<br />

5. Live birds, day old chicks, dressed chicken and parts and all other unprocessed meat<br />

6. Magazines and journals<br />

7. Powered milk (other than infants’ milk) and condensed milk<br />

8. Lentils, sugar, jaggery and sakkara<br />

9. Dried fish and Maldive fish<br />

10. Fertilizer including rock phosphate<br />

11. Water, LP Gas, petrol and Diesel<br />

12. Bicycles and Mo<strong>to</strong>r bicycles<br />

13. Mo<strong>to</strong>r coaches, chassis or bodies with 28 or more seating capacity, used for public<br />

passenger transport.<br />

14. Pho<strong>to</strong> voltaic, solar batteries, CFL lamps and spare parts and Solar Home systems<br />

15. Industrial machinery classified under H.S. Code (Chapter 84) excluding fans and parts,<br />

air conditioners, refrigera<strong>to</strong>rs, cabinets for refrigera<strong>to</strong>rs, dish washing machines<br />

(household type) personal weighing machines, lawn or sports ground rollers and parts,<br />

lawn movers and parts, house old washing machines and house hold type sewing<br />

machines.<br />

16. Electric mo<strong>to</strong>rs, genera<strong>to</strong>rs and spare parts, electric generating sets, and spare parts<br />

classified under H.S. Codes – 85.01.,85.02 and 85.03<br />

17. Cinematic firms (other than vedio films) and Theatrical productions<br />

169