VAT Guide to Value Added Tax - sri lanka inland revenue ...

VAT Guide to Value Added Tax - sri lanka inland revenue ...

VAT Guide to Value Added Tax - sri lanka inland revenue ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

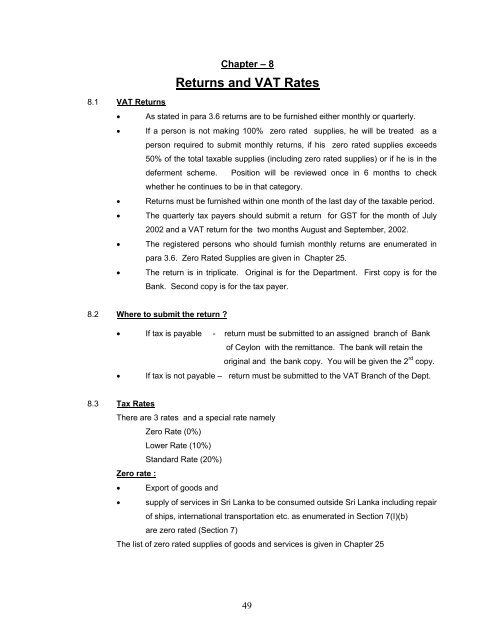

Chapter – 8<br />

Returns and <strong>VAT</strong> Rates<br />

8.1 <strong>VAT</strong> Returns<br />

• As stated in para 3.6 returns are <strong>to</strong> be furnished either monthly or quarterly.<br />

• If a person is not making 100% zero rated supplies, he will be treated as a<br />

person required <strong>to</strong> submit monthly returns, if his zero rated supplies exceeds<br />

50% of the <strong>to</strong>tal taxable supplies (including zero rated supplies) or if he is in the<br />

deferment scheme. Position will be reviewed once in 6 months <strong>to</strong> check<br />

whether he continues <strong>to</strong> be in that category.<br />

• Returns must be furnished within one month of the last day of the taxable period.<br />

• The quarterly tax payers should submit a return for GST for the month of July<br />

2002 and a <strong>VAT</strong> return for the two months August and September, 2002.<br />

• The registered persons who should furnish monthly returns are enumerated in<br />

para 3.6. Zero Rated Supplies are given in Chapter 25.<br />

• The return is in triplicate. Original is for the Department. First copy is for the<br />

Bank. Second copy is for the tax payer.<br />

8.2 Where <strong>to</strong> submit the return ?<br />

• If tax is payable - return must be submitted <strong>to</strong> an assigned branch of Bank<br />

of Ceylon with the remittance. The bank will retain the<br />

original and the bank copy. You will be given the 2 rd copy.<br />

• If tax is not payable – return must be submitted <strong>to</strong> the <strong>VAT</strong> Branch of the Dept.<br />

8.3 <strong>Tax</strong> Rates<br />

There are 3 rates and a special rate namely<br />

Zero Rate (0%)<br />

Lower Rate (10%)<br />

Standard Rate (20%)<br />

Zero rate :<br />

• Export of goods and<br />

• supply of services in Sri Lanka <strong>to</strong> be consumed outside Sri Lanka including repair<br />

of ships, international transportation etc. as enumerated in Section 7(I)(b)<br />

are zero rated (Section 7)<br />

The list of zero rated supplies of goods and services is given in Chapter 25<br />

49