VAT Guide to Value Added Tax - sri lanka inland revenue ...

VAT Guide to Value Added Tax - sri lanka inland revenue ...

VAT Guide to Value Added Tax - sri lanka inland revenue ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

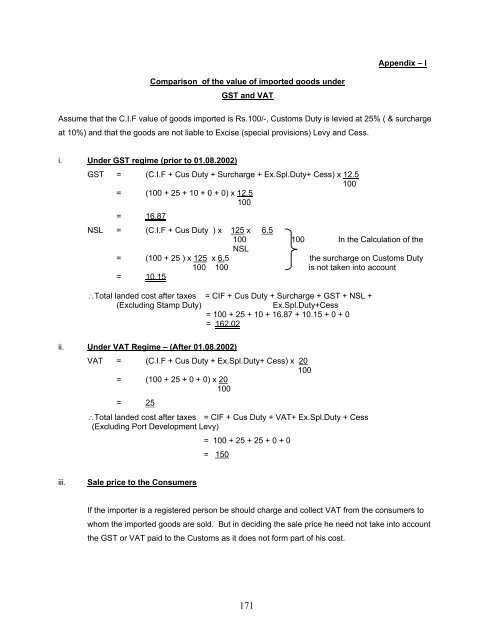

Appendix – I<br />

Comparison of the value of imported goods under<br />

GST and <strong>VAT</strong><br />

Assume that the C.I.F value of goods imported is Rs.100/-, Cus<strong>to</strong>ms Duty is levied at 25% ( & surcharge<br />

at 10%) and that the goods are not liable <strong>to</strong> Excise (special provisions) Levy and Cess.<br />

i. Under GST regime (prior <strong>to</strong> 01.08.2002)<br />

GST = (C.I.F + Cus Duty + Surcharge + Ex.Spl.Duty+ Cess) x 12.5<br />

100<br />

= (100 + 25 + 10 + 0 + 0) x 12.5<br />

100<br />

= 16.87<br />

NSL = (C.I.F + Cus Duty ) x 125 x 6.5<br />

100 100 In the Calculation of the<br />

NSL<br />

= (100 + 25 ) x 125 x 6.5 the surcharge on Cus<strong>to</strong>ms Duty<br />

100 100 is not taken in<strong>to</strong> account<br />

= 10.15<br />

∴Total landed cost after taxes = CIF + Cus Duty + Surcharge + GST + NSL +<br />

(Excluding Stamp Duty)<br />

Ex.Spl.Duty+Cess<br />

= 100 + 25 + 10 + 16.87 + 10.15 + 0 + 0<br />

= 162.02<br />

ii. Under <strong>VAT</strong> Regime – (After 01.08.2002)<br />

<strong>VAT</strong> = (C.I.F + Cus Duty + Ex.Spl.Duty+ Cess) x 20<br />

100<br />

= (100 + 25 + 0 + 0) x 20<br />

100<br />

= 25<br />

∴Total landed cost after taxes = CIF + Cus Duty + <strong>VAT</strong>+ Ex.Spl.Duty + Cess<br />

(Excluding Port Development Levy)<br />

= 100 + 25 + 25 + 0 + 0<br />

= 150<br />

iii.<br />

Sale price <strong>to</strong> the Consumers<br />

If the importer is a registered person be should charge and collect <strong>VAT</strong> from the consumers <strong>to</strong><br />

whom the imported goods are sold. But in deciding the sale price he need not take in<strong>to</strong> account<br />

the GST or <strong>VAT</strong> paid <strong>to</strong> the Cus<strong>to</strong>ms as it does not form part of his cost.<br />

171