VAT Guide to Value Added Tax - sri lanka inland revenue ...

VAT Guide to Value Added Tax - sri lanka inland revenue ...

VAT Guide to Value Added Tax - sri lanka inland revenue ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

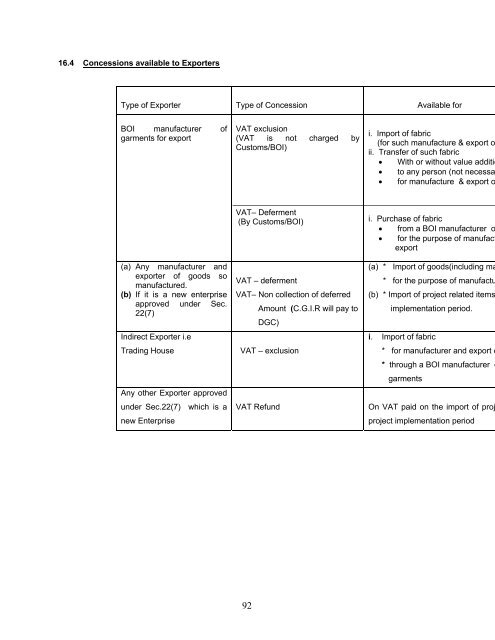

16.4 Concessions available <strong>to</strong> Exporters<br />

Type of Exporter Type of Concession Available for<br />

BOI manufacturer of<br />

garments for export<br />

<strong>VAT</strong> exclusion<br />

(<strong>VAT</strong> is not charged by<br />

Cus<strong>to</strong>ms/BOI)<br />

i. Import of fabric<br />

(for such manufacture & export o<br />

ii. Transfer of such fabric<br />

• With or without value additio<br />

• <strong>to</strong> any person (not necessa<br />

• for manufacture & export o<br />

(a) Any manufacturer and<br />

exporter of goods so<br />

manufactured.<br />

(b) If it is a new enterprise<br />

approved under Sec.<br />

22(7)<br />

Indirect Exporter i.e<br />

Trading House<br />

Any other Exporter approved<br />

under Sec.22(7) which is a<br />

new Enterprise<br />

<strong>VAT</strong>– Deferment<br />

(By Cus<strong>to</strong>ms/BOI)<br />

<strong>VAT</strong> – deferment<br />

<strong>VAT</strong>– Non collection of deferred<br />

Amount (C.G.I.R will pay <strong>to</strong><br />

DGC)<br />

<strong>VAT</strong> – exclusion<br />

<strong>VAT</strong> Refund<br />

i. Purchase of fabric<br />

• from a BOI manufacturer o<br />

• for the purpose of manufact<br />

export<br />

(a) * Import of goods(including ma<br />

* for the purpose of manufactu<br />

(b) * Import of project related items<br />

implementation period.<br />

i. Import of fabric<br />

* for manufacturer and export o<br />

* through a BOI manufacturer c<br />

garments<br />

On <strong>VAT</strong> paid on the import of proj<br />

project implementation period<br />

92