VAT Guide to Value Added Tax - sri lanka inland revenue ...

VAT Guide to Value Added Tax - sri lanka inland revenue ...

VAT Guide to Value Added Tax - sri lanka inland revenue ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GST = (CIF + CD + Surcharge + Ex.Spl.Duty +Cess) x 12.5%<br />

= (100 + 10 + 10 + 0 + )) x 12.5<br />

100<br />

= 15<br />

and NSL = (CIF + CD) x 1.25 x 6.5%<br />

= (100 + 10) 125 x 6.5<br />

100 100<br />

= 8.93<br />

and the effective rate = 15 + 8.93 = 23.93%<br />

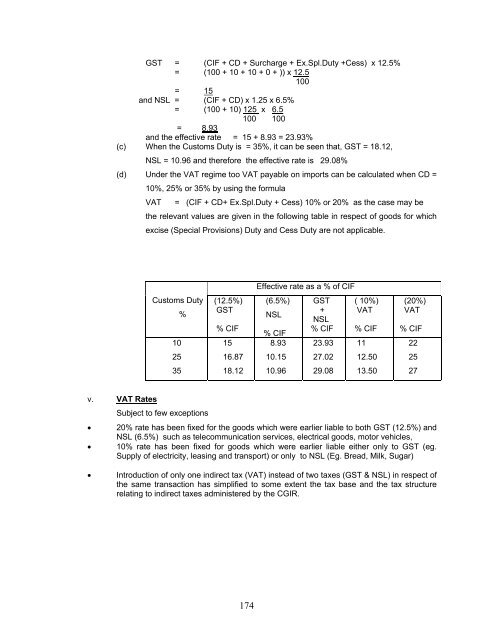

(c) When the Cus<strong>to</strong>ms Duty is = 35%, it can be seen that, GST = 18.12,<br />

NSL = 10.96 and therefore the effective rate is 29.08%<br />

(d) Under the <strong>VAT</strong> regime <strong>to</strong>o <strong>VAT</strong> payable on imports can be calculated when CD =<br />

10%, 25% or 35% by using the formula<br />

<strong>VAT</strong> = (CIF + CD+ Ex.Spl.Duty + Cess) 10% or 20% as the case may be<br />

the relevant values are given in the following table in respect of goods for which<br />

excise (Special Provisions) Duty and Cess Duty are not applicable.<br />

Effective rate as a % of CIF<br />

Cus<strong>to</strong>ms Duty<br />

%<br />

10<br />

(12.5%)<br />

GST<br />

% CIF<br />

15<br />

(6.5%)<br />

NSL<br />

% CIF<br />

8.93<br />

GST<br />

+<br />

NSL<br />

% CIF<br />

23.93<br />

( 10%)<br />

<strong>VAT</strong><br />

% CIF<br />

11<br />

(20%)<br />

<strong>VAT</strong><br />

% CIF<br />

22<br />

25<br />

16.87<br />

10.15<br />

27.02<br />

12.50<br />

25<br />

35<br />

18.12<br />

10.96<br />

29.08<br />

13.50<br />

27<br />

v. <strong>VAT</strong> Rates<br />

Subject <strong>to</strong> few exceptions<br />

• 20% rate has been fixed for the goods which were earlier liable <strong>to</strong> both GST (12.5%) and<br />

NSL (6.5%) such as telecommunication services, electrical goods, mo<strong>to</strong>r vehicles,<br />

• 10% rate has been fixed for goods which were earlier liable either only <strong>to</strong> GST (eg.<br />

Supply of electricity, leasing and transport) or only <strong>to</strong> NSL (Eg. Bread, Milk, Sugar)<br />

• Introduction of only one indirect tax (<strong>VAT</strong>) instead of two taxes (GST & NSL) in respect of<br />

the same transaction has simplified <strong>to</strong> some extent the tax base and the tax structure<br />

relating <strong>to</strong> indirect taxes administered by the CGIR.<br />

174