Sports Direct Is The UK's Leading Sports Retailer - Sports Direct ...

Sports Direct Is The UK's Leading Sports Retailer - Sports Direct ...

Sports Direct Is The UK's Leading Sports Retailer - Sports Direct ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>The</strong> Board may refuse to register a transfer of shares in the Company by a<br />

person if those shares represent at least a 0.25% interest in the Company’s<br />

shares or any class thereof and if, in respect of those shares, such person has<br />

been served with a restriction notice after failure (whether by such person or<br />

by another) to provide the Company with information concerning interests in<br />

those shares required to be provided under the Companies Act 2006 (the 2006<br />

Act), unless (i) the transfer is an approved transfer (as defined in the Articles of<br />

Association of the Company), (ii) the member is not himself in default as regards<br />

supplying the information required and certifies that no person in default as<br />

regards supplying such information is interested in any of the shares the subject<br />

of the transfer, or (iii) the transfer of the shares is required to be registered by<br />

the Uncertificated Securities Regulations 2001.<br />

If the Board refuses to register a transfer of a share in certificated form, it will<br />

send the transferee notice of its refusal within two months after the date on<br />

which the instrument of transfer was lodged with the Company. No fee may be<br />

charged for the registration of any instrument of transfer or other document<br />

relating to or affecting the title to a share.<br />

powers to issue shares<br />

At the Company’s Annual General Meeting on 10 September 2008:<br />

• the directors of the Company were generally and unconditionally<br />

authorised pursuant to section 80 of the Companies Act 1985 (the 1985<br />

Act), in substitution for all prior authorities conferred upon them, but<br />

without prejudice to any allotments made pursuant to the terms of such<br />

authorities, to exercise all the powers of the Company to allot relevant<br />

securities (within the meaning of that section) up to an aggregate nominal<br />

amount of £19,215,078 for the period expiring (unless previously revoked,<br />

varied or renewed) at the conclusion of the next Annual General Meeting<br />

of the Company save that the Company may, before such expiry make an<br />

offer or agreement which would or might require relevant securities to be<br />

allotted after such expiry and the directors may allot relevant securities<br />

in pursuance of such an offer or agreement as if the authority had not<br />

expired;<br />

• the directors were empowered to allot equity securities (within the<br />

meaning of section 94 of the 1985 Act) for cash, pursuant to the general<br />

authorities described above in substitution for all prior powers conferred<br />

upon the Board but without prejudice to any allotments made pursuant to<br />

the terms of such powers, as if section 89(1) of the 1985 Act did not apply<br />

to any such allotment, such power being limited to:<br />

i) the allotment of equity securities in connection with an issue in<br />

favour of holders of ordinary shares in the capital of the Company<br />

in proportion (as nearly as may be) to their existing holdings of<br />

ordinary shares but subject to such exclusions or other<br />

arrangements as the directors deem necessary or expedient in<br />

relation to fractional entitlements or any legal or practical problems<br />

under the laws of any territory, or the requirements of any<br />

regulatory body or stock exchange; and<br />

ii) the allotment of equity securities for cash (otherwise than as<br />

described in (i) above) up to an aggregate amount equal to 5% of<br />

the then issued and unconditionally allotted share capital of the<br />

Company provided always that such power expires (unless<br />

previously revoked, varied or renewed) at the conclusion of the next<br />

Annual General Meeting of the Company, save that the Company<br />

may, before the end of such period, make an offer or agreement<br />

which would or might require equity securities to be allotted after<br />

expiry of this authority and the directors may allot equity securities<br />

in pursuance of such an offer or agreement as if this power had not<br />

expired.<br />

<strong>The</strong> authorities expire at the close of the next Annual General Meeting of the<br />

Company, but a contract to allot shares under these authorities may be made<br />

prior to the expiry of the authority and concluded in whole or part after the<br />

Annual General Meeting, and at that meeting similar authorities will be sought<br />

from shareholders.<br />

the Company’s power to purChase shares<br />

At the Company’s Annual General Meeting on 10 September 2008 the Company<br />

was generally and unconditionally authorised to make market purchases (within<br />

the meaning of section 163(3) of the 1985 Act) of ordinary shares of 10p each in<br />

the Company subject to the following conditions:<br />

• the maximum aggregate number of ordinary shares authorised to be<br />

purchased is 57,645,236, representing 10% of the Company’s issued<br />

ordinary share capital;<br />

• the minimum price (exclusive of expenses) which may be paid for an<br />

ordinary share is 10p (being the nominal value of an ordinary share);<br />

• the maximum price (exclusive of expenses) which may be paid for each<br />

ordinary share is the higher of: (i) an amount equal to 105% of the average<br />

of the middle market quotations for the Ordinary Shares as derived<br />

from the London Stock Exchange Daily Official List of the five business<br />

days immediately preceding the day on which the share is contracted<br />

to be purchased; and (ii) an amount equal to the higher of the price of<br />

the last independent trade of an ordinary share and the highest current<br />

independent bid for an ordinary share as derived from the London Stock<br />

Exchange Trading System.<br />

<strong>The</strong> above authority expires at the close of the next Annual General Meeting<br />

of the Company, but at that meeting a similar authority will be sought from<br />

shareholders.<br />

shareholders<br />

No shareholder enjoys any special control rights, and, except as set out above<br />

and below, there are no restrictions in the transfer of shares or of voting rights.<br />

Mike Ashley and the Company have entered into a Relationship Agreement,<br />

pursuant to which Mike Ashley undertook to the Company that, for so long as he<br />

is entitled to exercise, or to control the exercise of, 15% or more of the rights to<br />

vote at general meetings of the Company, he will;<br />

• conduct all transactions and relationships with any member of the Group<br />

on arm’s length terms and on a normal commercial basis and with the<br />

approval of the non-executive directors;<br />

• exercise his voting rights or other rights in support of the Company<br />

being managed in accordance with the Listing Rules and the principles<br />

of good governance set out in the Combined Code and not exercise any of<br />

his voting or other rights and powers to procure any amendment to the<br />

Articles of Association of the Company;<br />

• other than through his interest in the Company, not have any interest in<br />

any business which sell sports apparel and equipment subject to certain<br />

rights, after notification to the Company, to acquire any such interest<br />

of less than 20% of the business concerned, and certain other limited<br />

exceptions, without receiving the prior approval of the non-executive<br />

directors;<br />

• and not solicit for employment or employ any senior employee of the<br />

Company.<br />

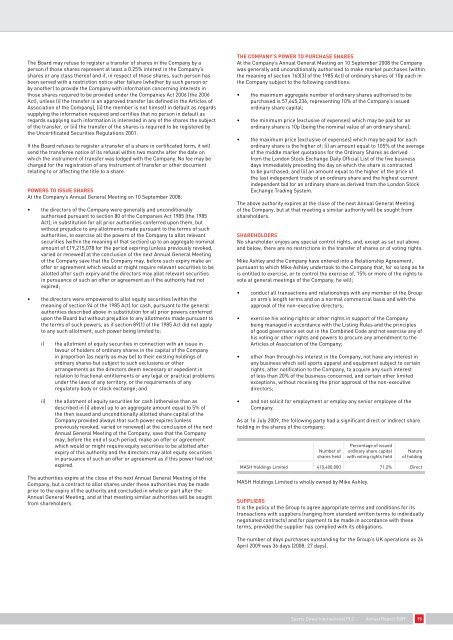

As at 16 July 2009, the following party had a significant direct or indirect share<br />

holding in the shares of the company:<br />

Number of<br />

shares held<br />

Percentage of issued<br />

ordinary share capital<br />

with voting rights held<br />

Nature<br />

of holding<br />

MASH Holdings Limited 410,400,000 71.2% <strong>Direct</strong><br />

MASH Holdings Limited is wholly owned by Mike Ashley.<br />

suppliers<br />

It is the policy of the Group to agree appropriate terms and conditions for its<br />

transactions with suppliers (ranging from standard written terms to individually<br />

negotiated contracts) and for payment to be made in accordance with these<br />

terms, provided the supplier has complied with its obligations.<br />

<strong>The</strong> number of days purchases outstanding for the Group’s UK operations as 26<br />

April 2009 was 36 days (2008: 27 days).<br />

<strong>Sports</strong> <strong>Direct</strong> International PLC Annual Report 2009 15

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)