Sports Direct Is The UK's Leading Sports Retailer - Sports Direct ...

Sports Direct Is The UK's Leading Sports Retailer - Sports Direct ...

Sports Direct Is The UK's Leading Sports Retailer - Sports Direct ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

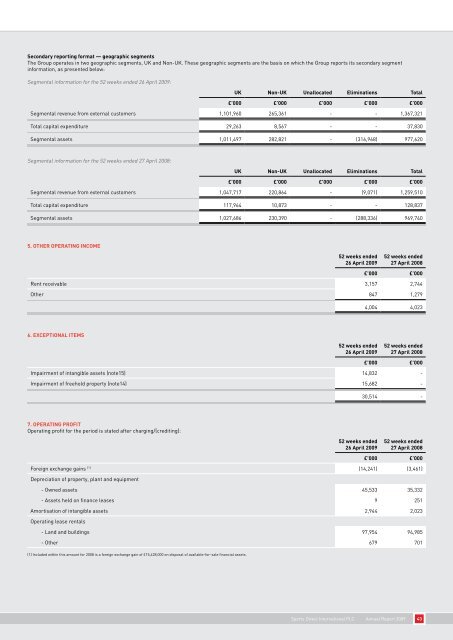

secondary reporting format — geographic segments<br />

<strong>The</strong> Group operates in two geographic segments, UK and Non-UK. <strong>The</strong>se geographic segments are the basis on which the Group reports its secondary segment<br />

information, as presented below:<br />

Segmental information for the 52 weeks ended 26 April 2009:<br />

uk non-uk unallocated eliminations total<br />

£’000 £’000 £’000 £’000 £’000<br />

Segmental revenue from external customers 1,101,960 265,361 - - 1,367,321<br />

Total capital expenditure 29,263 8,567 - - 37,830<br />

Segmental assets 1,011,497 282,821 - (316,968) 977,620<br />

Segmental information for the 52 weeks ended 27 April 2008:<br />

uk non-uk unallocated eliminations total<br />

£’000 £’000 £’000 £’000 £’000<br />

Segmental revenue from external customers 1,047,717 220,864 - (9,071) 1,259,510<br />

Total capital expenditure 117,964 10,873 - - 128,837<br />

Segmental assets 1,027,686 230,390 - (288,336) 969,740<br />

5. other operatinG inCome<br />

52 weeks ended<br />

26 april 2009<br />

52 weeks ended<br />

27 april 2008<br />

£’000 £’000<br />

Rent receivable 3,157 2,744<br />

Other 847 1,279<br />

6. exCeptional items<br />

52 weeks ended<br />

26 april 2009<br />

4,004 4,023<br />

52 weeks ended<br />

27 april 2008<br />

£’000 £’000<br />

Impairment of intangible assets (note15) 14,832 -<br />

Impairment of freehold property (note14) 15,682 -<br />

7. operatinG profit<br />

Operating profit for the period is stated after charging/(crediting):<br />

52 weeks ended<br />

26 april 2009<br />

30,514 -<br />

52 weeks ended<br />

27 april 2008<br />

£’000 £’000<br />

Foreign exchange gains (1) (14,241) (3,461)<br />

Depreciation of property, plant and equipment<br />

- Owned assets 45,533 35,332<br />

- Assets held on finance leases 9 251<br />

Amortisation of intangible assets 2,944 2,023<br />

Operating lease rentals<br />

- Land and buildings 97,954 94,985<br />

- Other 679 701<br />

(1) Included within this amount for 2008 is a foreign exchange gain of £15,428,000 on disposal of available-for-sale financial assets.<br />

<strong>Sports</strong> <strong>Direct</strong> International PLC Annual Report 2009 43

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)