Sports Direct Is The UK's Leading Sports Retailer - Sports Direct ...

Sports Direct Is The UK's Leading Sports Retailer - Sports Direct ...

Sports Direct Is The UK's Leading Sports Retailer - Sports Direct ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

notes to the finanCial statements for the 52 weeks ended 26 april 2009 Continued<br />

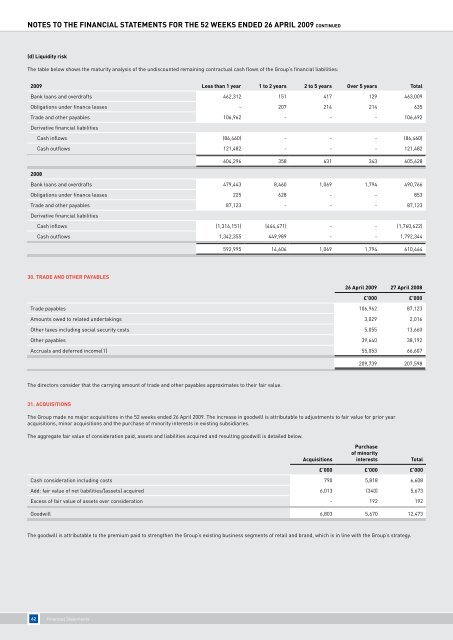

(d) liquidity risk<br />

<strong>The</strong> table below shows the maturity analysis of the undiscounted remaining contractual cash flows of the Group’s financial liabilities:<br />

2009 less than 1 year 1 to 2 years 2 to 5 years over 5 years total<br />

Bank loans and overdrafts 462,312 151 417 129 463,009<br />

Obligations under finance leases - 207 214 214 635<br />

Trade and other payables 106,962 - - - 106,692<br />

Derivative financial liabilities<br />

Cash inflows (86,460) - - - (86,460)<br />

Cash outflows 121,482 - - - 121,482<br />

604,296 358 631 343 605,628<br />

2008<br />

Bank loans and overdrafts 479,443 8,460 1,069 1,794 490,766<br />

Obligations under finance leases 225 628 - - 853<br />

Trade and other payables<br />

Derivative financial liabilities<br />

87,123 - - - 87,123<br />

Cash inflows (1,316,151) (444,471) - - (1,760,622)<br />

Cash outflows 1,342,355 449,989 - - 1,792,344<br />

30. trade and other payaBles<br />

592,995 14,606 1,069 1,794 610,464<br />

26 april 2009 27 april 2008<br />

£’000 £’000<br />

Trade payables 106,962 87,123<br />

Amounts owed to related undertakings 3,029 2,016<br />

Other taxes including social security costs 5,055 13,660<br />

Other payables 39,640 38,192<br />

Accruals and deferred income(1) 55,053 66,607<br />

<strong>The</strong> directors consider that the carrying amount of trade and other payables approximates to their fair value.<br />

31. aCquisitions<br />

209,739 207,598<br />

<strong>The</strong> Group made no major acquisitions in the 52 weeks ended 26 April 2009. <strong>The</strong> increase in goodwill is attributable to adjustments to fair value for prior year<br />

acquisitions, minor acquisitions and the purchase of minority interests in existing subsidiaries.<br />

<strong>The</strong> aggregate fair value of consideration paid, assets and liabilities acquired and resulting goodwill is detailed below.<br />

acquisitions<br />

purchase<br />

of minority<br />

interests total<br />

£’000 £’000 £’000<br />

Cash consideration including costs 790 5,818 6,608<br />

Add: fair value of net liabilities/(assets) acquired 6,013 (340) 5,673<br />

Excess of fair value of assets over consideration - 192 192<br />

Goodwill 6,803 5,670 12,473<br />

<strong>The</strong> goodwill is attributable to the premium paid to strengthen the Group’s existing business segments of retail and brand, which is in line with the Group’s strategy.<br />

62<br />

Financial Statements

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)