Sports Direct Is The UK's Leading Sports Retailer - Sports Direct ...

Sports Direct Is The UK's Leading Sports Retailer - Sports Direct ...

Sports Direct Is The UK's Leading Sports Retailer - Sports Direct ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Borrowings and borrowing costs<br />

Borrowings are recognised initially at fair value, net of transaction costs<br />

incurred, and subsequently at amortised cost. Any difference between the<br />

proceeds (net of transaction costs) and the redemption value is recognised in<br />

the income statement over the period of the borrowings using the effective<br />

interest method.<br />

Borrowings are classified as current liabilities unless the Group has an<br />

unconditional right to defer settlement of the liability for at least 12 months<br />

from the balance sheet date.<br />

Borrowing costs, being interest and other costs incurred in connection with the<br />

servicing of borrowings, are recognised as an expense when incurred.<br />

provisions<br />

A provision is recognised when the Group has a present legal or constructive<br />

obligation as a result of a past event, it is probable that an outflow of resources<br />

will be required to settle the obligation and a reliable estimate can be made of<br />

the amount of the obligation.<br />

<strong>The</strong> Group provides for dilapidations costs following advice from chartered<br />

surveyors and previous experience of exit costs. <strong>The</strong> estimated cost of fulfilling<br />

the leasehold dilapidations obligations is discounted to present value and<br />

analysed between non-capital and capital components. <strong>The</strong> capital element<br />

is recognised as a decommissioning cost and depreciated over the life of the<br />

asset. <strong>The</strong> non-capital element is taken to the income statement in the first year<br />

of the lease where the cost it represents is of no lasting benefit to the Group<br />

or its landlord. ‘Wear and tear’ costs are expensed to the income statement.<br />

Provisions for onerous lease contracts are recognised when the Group believes<br />

the unavoidable costs of meeting the lease obligations exceed the economic<br />

benefits expected to be received under the lease.<br />

leases<br />

Leases of property, plant and equipment where the Group has substantially all<br />

the risks and rewards of ownership are classified as finance leases. Finance<br />

leases are capitalised at the lease’s inception at the lower of the fair value of<br />

the leased asset and the present value of the minimum lease payments. Each<br />

lease payment is allocated between the liability and finance charges so as to<br />

achieve a constant rate on the finance balance outstanding. <strong>The</strong> asset subject to<br />

the finance lease is depreciated over the shorter of its useful life and the lease<br />

term. <strong>The</strong> corresponding rental obligations, net of finance charges, are included<br />

as a liability.<br />

Leases of property, plant and equipment where the Group does not have<br />

substantially all the risks and rewards of ownership are classified as operating<br />

leases. Payments made under operating leases are charged to the income<br />

statement on a straight-line basis over the lease term. Incentives provided by<br />

the lessor are credited to the income statement on a straight-line basis over the<br />

minimum lease term.<br />

Rental income from operating leases where the Group acts as a lessor is<br />

recognised on a straight-line basis over the term of the relevant lease.<br />

derivative financial instruments<br />

<strong>The</strong> most significant exposure to foreign exchange fluctuations relates to<br />

purchases made in foreign currencies, principally the US dollar. <strong>The</strong> Group’s<br />

policy is to reduce substantially the risk associated with purchases denominated<br />

in foreign currencies by using forward fixed rate currency purchase contracts,<br />

taking into account any foreign currency cash flows. <strong>The</strong> foreign exchange<br />

contracts do not meet the criteria for treatment as an effective hedge and<br />

accordingly any gain or loss is recognised immediately in the income statement.<br />

Derivative financial instruments are measured at fair value. Gains or losses on<br />

derivative financial instruments related to financing activities are included in<br />

finance costs when recognised in the income statement.<br />

treasury shares<br />

<strong>The</strong> purchase price of the Group’s own shares that it acquires is recognised<br />

as ‘Treasury Shares’ within equity. <strong>The</strong> difference between the market value<br />

and the average purchase price of shares sold out of Treasury is transferred to<br />

retained earnings.<br />

employee Benefit trust<br />

<strong>The</strong> cost of shares acquired by the <strong>Sports</strong> <strong>Direct</strong> Employee Benefit Trust is<br />

recognised within ‘Own share reserve’ in equity.<br />

share-based payments<br />

<strong>The</strong> Group issues equity-settled share-based payments to certain directors<br />

and employees. <strong>The</strong>se are measured at fair value at the date of grant which is<br />

expensed to the consolidated income statement on a straight-line basis over the<br />

vesting period, based on the Group’s estimate of shares that will eventually vest.<br />

Fair value is measured by use of a Monte Carlo method. <strong>The</strong> expected life<br />

used in the model has been adjusted, based on management’s best estimate,<br />

for the effects of non-transferability, exercise restrictions, and behavioural<br />

considerations. No share-based payment charge was recognised for the 52<br />

weeks ended 26 April 2009 as the directors did not consider it material to the<br />

Group’s financial results or position.<br />

equity instruments<br />

An equity instrument is any contract that evidences a residual interest in the<br />

assets of the Group after deducting all of its liabilities. Equity instruments<br />

issued by the Group are recorded at the proceeds received, net of any direct<br />

issue costs.<br />

dividends<br />

Dividends are recognised as a liability in the Group’s financial statements and<br />

as a deduction from equity in the period in which the dividends are declared.<br />

Where such dividends are proposed subject to the approval of shareholders,<br />

the dividends are regarded as declared once shareholder approval has been<br />

obtained.<br />

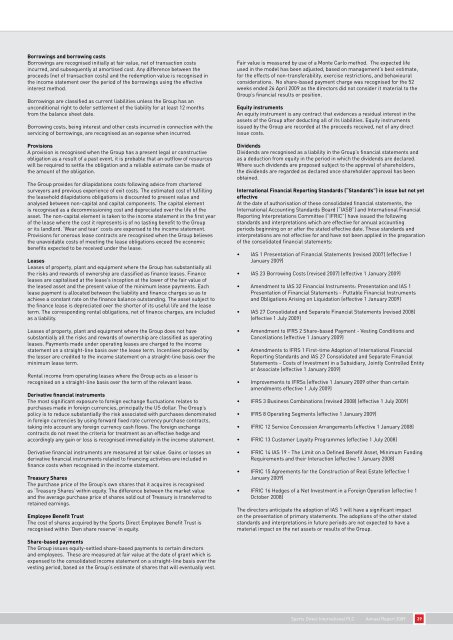

international financial reporting standards (“standards”) in issue but not yet<br />

effective<br />

At the date of authorisation of these consolidated financial statements, the<br />

International Accounting Standards Board (“IASB”) and International Financial<br />

Reporting Interpretations Committee (“IFRIC”) have issued the following<br />

standards and interpretations which are effective for annual accounting<br />

periods beginning on or after the stated effective date. <strong>The</strong>se standards and<br />

interpretations are not effective for and have not been applied in the preparation<br />

of the consolidated financial statements:<br />

• IAS 1 Presentation of Financial Statements (revised 2007) (effective 1<br />

January 2009)<br />

• IAS 23 Borrowing Costs (revised 2007) (effective 1 January 2009)<br />

• Amendment to IAS 32 Financial Instruments: Presentation and IAS 1<br />

Presentation of Financial Statements - Puttable Financial Instruments<br />

and Obligations Arising on Liquidation (effective 1 January 2009)<br />

• IAS 27 Consolidated and Separate Financial Statements (revised 2008)<br />

(effective 1 July 2009)<br />

• Amendment to IFRS 2 Share-based Payment - Vesting Conditions and<br />

Cancellations (effective 1 January 2009)<br />

• Amendments to IFRS 1 First-time Adoption of International Financial<br />

Reporting Standards and IAS 27 Consolidated and Separate Financial<br />

Statements - Costs of Investment in a Subsidiary, Jointly Controlled Entity<br />

or Associate (effective 1 January 2009)<br />

• Improvements to IFRSs (effective 1 January 2009 other than certain<br />

amendments effective 1 July 2009)<br />

• IFRS 3 Business Combinations (revised 2008) (effective 1 July 2009)<br />

• IFRS 8 Operating Segments (effective 1 January 2009)<br />

• IFRIC 12 Service Concession Arrangements (effective 1 January 2008)<br />

• IFRIC 13 Customer Loyalty Programmes (effective 1 July 2008)<br />

• IFRIC 14 IAS 19 - <strong>The</strong> Limit on a Defined Benefit Asset, Minimum Funding<br />

Requirements and their Interaction (effective 1 January 2008)<br />

• IFRIC 15 Agreements for the Construction of Real Estate (effective 1<br />

January 2009)<br />

• IFRIC 16 Hedges of a Net Investment in a Foreign Operation (effective 1<br />

October 2008)<br />

<strong>The</strong> directors anticipate the adoption of IAS 1 will have a significant impact<br />

on the presentation of primary statements. <strong>The</strong> adoptions of the other stated<br />

standards and interpretations in future periods are not expected to have a<br />

material impact on the net assets or results of the Group.<br />

<strong>Sports</strong> <strong>Direct</strong> International PLC Annual Report 2009 39

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)