The Finnish Property Market 2009 - KTI

The Finnish Property Market 2009 - KTI

The Finnish Property Market 2009 - KTI

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

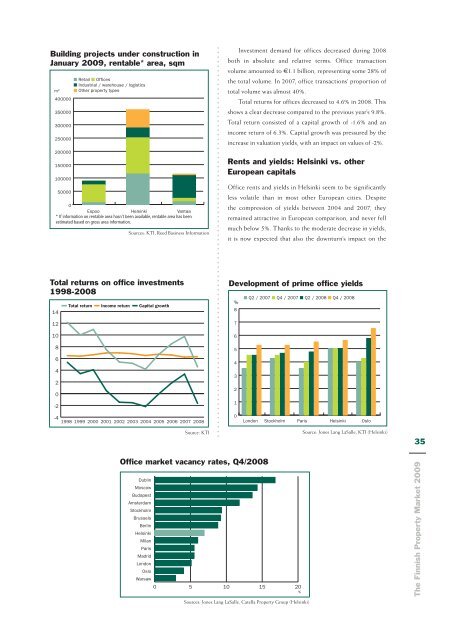

Building projects under construction in<br />

January <strong>2009</strong>, rentable* area, sqm<br />

m 2<br />

400000<br />

350000<br />

300000<br />

250000<br />

200000<br />

150000<br />

100000<br />

50000<br />

■ Retail ■ Offices<br />

■ Industrial / warehouse / logistics<br />

■ Other property types<br />

0<br />

Espoo Helsinki Vantaa<br />

* If information on rentable area hasn’t been available, rentable area has been<br />

estimated based on gross area information.<br />

Sources: <strong>KTI</strong>, Reed Business Information<br />

Investment demand for offices decreased during 2008<br />

both in absolute and relative terms. Office transaction<br />

volume amounted to €1.1 billion, representing some 28% of<br />

the total volume. In 2007, office transactions’ proportion of<br />

total volume was almost 40%.<br />

Total returns for offices decreased to 4.6% in 2008. This<br />

shows a clear decrease compared to the previous year’s 9.8%.<br />

Total return consisted of a capital growth of -1.6% and an<br />

income return of 6.3%. Capital growth was pressured by the<br />

increase in valuation yields, with an impact on values of -2%.<br />

Rents and yields: Helsinki vs. other<br />

European capitals<br />

Office rents and yields in Helsinki seem to be significantly<br />

less volatile than in most other European cities. Despite<br />

the compression of yields between 2004 and 2007, they<br />

remained attractive in European comparison, and never fell<br />

much below 5%. Thanks to the moderate decrease in yields,<br />

it is now expected that also the downturn’s impact on the<br />

Total returns on office investments<br />

1998-2008<br />

14<br />

12<br />

10<br />

Total return<br />

Income return<br />

Capital growth<br />

Development of prime office yields<br />

■ Q2 / 2007 ■ Q4 / 2007 ■ Q2 / 2008 ■ Q4 / 2008<br />

%<br />

8<br />

7<br />

6<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

London Stockholm Paris Helsinki Oslo<br />

Source: <strong>KTI</strong><br />

Source: Jones Lang LaSalle, <strong>KTI</strong> (Helsinki)<br />

35<br />

Office market vacancy rates, Q4/2008<br />

Dublin<br />

Moscow<br />

Budapest<br />

Amsterdam<br />

Stockholm<br />

Brussels<br />

Berlin<br />

Helsinki<br />

Milan<br />

Paris<br />

Madrid<br />

London<br />

Oslo<br />

Warsaw<br />

0 5 10 15 20<br />

%<br />

<strong>The</strong> <strong>Finnish</strong> <strong>Property</strong> <strong>Market</strong> <strong>2009</strong><br />

Sources: Jones Lang LaSalle, Catella <strong>Property</strong> Group (Helsinki)