The Finnish Property Market 2009 - KTI

The Finnish Property Market 2009 - KTI

The Finnish Property Market 2009 - KTI

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

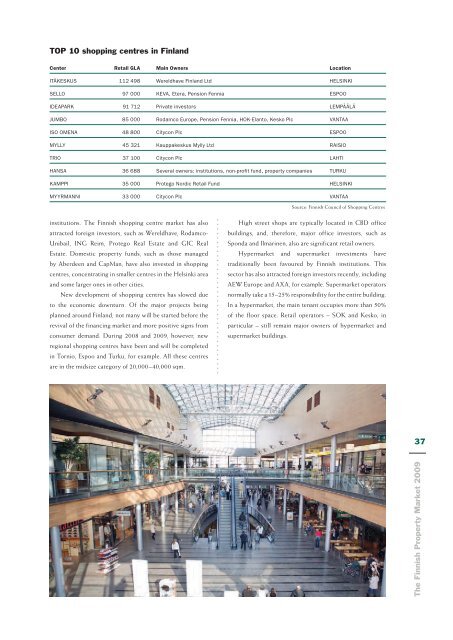

TOP 10 shopping centres in Finland<br />

Center Retail GLA Main Owners Location<br />

ITÄKESKUS 112 498 Wereldhave Finland Ltd HELSINKI<br />

SELLO 97 000 KEVA, Etera, Pension Fennia ESPOO<br />

IDEAPARK 91 712 Private investors LEMPÄÄLÄ<br />

JUMBO 85 000 Rodamco Europe, Pension Fennia, HOK-Elanto, Kesko Plc VANTAA<br />

ISO OMENA 48 800 Citycon Plc ESPOO<br />

MYLLY 45 321 Kauppakeskus Mylly Ltd RAISIO<br />

TRIO 37 100 Citycon Plc LAHTI<br />

HANSA 36 688 Several owners: institutions, non-profit fund, property companies TURKU<br />

KAMPPI 35 000 Protego Nordic Retail Fund HELSINKI<br />

MYYRMANNI 33 000 Citycon Plc VANTAA<br />

Source: <strong>Finnish</strong> Council of Shopping Centres<br />

institutions. <strong>The</strong> <strong>Finnish</strong> shopping centre market has also<br />

attracted foreign investors, such as Wereldhave, Rodamco-<br />

Unibail, ING Reim, Protego Real Estate and GIC Real<br />

Estate. Domestic property funds, such as those managed<br />

by Aberdeen and CapMan, have also invested in shopping<br />

centres, concentrating in smaller centres in the Helsinki area<br />

and some larger ones in other cities.<br />

New development of shopping centres has slowed due<br />

to the economic downturn. Of the major projects being<br />

planned around Finland, not many will be started before the<br />

revival of the financing market and more positive signs from<br />

consumer demand. During 2008 and <strong>2009</strong>, however, new<br />

regional shopping centres have been and will be completed<br />

in Tornio, Espoo and Turku, for example. All these centres<br />

are in the midsize category of 20,000–40,000 sqm.<br />

High street shops are typically located in CBD office<br />

buildings, and, therefore, major office investors, such as<br />

Sponda and Ilmarinen, also are significant retail owners.<br />

Hypermarket and supermarket investments have<br />

traditionally been favoured by <strong>Finnish</strong> institutions. This<br />

sector has also attracted foreign investors recently, including<br />

AEW Europe and AXA, for example. Supermarket operators<br />

normally take a 15–25% responsibility for the entire building.<br />

In a hypermarket, the main tenant occupies more than 50%<br />

of the floor space. Retail operators – SOK and Kesko, in<br />

particular – still remain major owners of hypermarket and<br />

supermarket buildings.<br />

37<br />

<strong>The</strong> <strong>Finnish</strong> <strong>Property</strong> <strong>Market</strong> <strong>2009</strong>