CENTRAL JAPAN RAILWAY COMPANY Annual Report 2007

CENTRAL JAPAN RAILWAY COMPANY Annual Report 2007

CENTRAL JAPAN RAILWAY COMPANY Annual Report 2007

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Lease Accounting<br />

On March 30, <strong>2007</strong>, the ASBJ issued ASBJ Statement No.13, “Accounting Standard for Lease Transactions”, which revised the existing accounting standard for lease<br />

transactions issued on June 17, 1993.<br />

Under the existing accounting standard, finance leases that deem to transfer ownership of the leased property to the lessee are to be capitalized, however, other finance leases<br />

are permitted to be accounted for as operating lease transactions if certain “as if capitalized” information is disclosed in the note to the lessee’s financial statements.<br />

The revised accounting standard requires that all finance lease transactions should be capitalized. The revised accounting standard for lease transactions is effective for fiscal<br />

years beginning on or after April 1, 2008 with early adoption permitted for fiscal years beginning on or after April 1, <strong>2007</strong>.<br />

4. ACCOUNTING CHANGES<br />

Effective April 1, 2004, the Company adopted the declining-balance method of depreciation for the buildings and structures of the Shinkansen railway ground facilities, which<br />

had been previously depreciated by the straight-line method which had been different from method adopted for conventional railway network since assuming the Shinkansen<br />

railway ground facilities. This change was made to reinforce the financial position and unify the method of Shinkansen railway ground facilities to that of conventional<br />

railway network in connection with both commencement of Shinagawa station and drastic timetable revisions focusing on completion of improving the Shinkansen trains to<br />

operate at 270 km/hr.<br />

The effects of this change were to increase depreciation by ¥39,455 million and to decrease operating income and income before income taxes and minority interests,<br />

respectively, by approximately ¥39,455 million for the year ended March 31, 2005.<br />

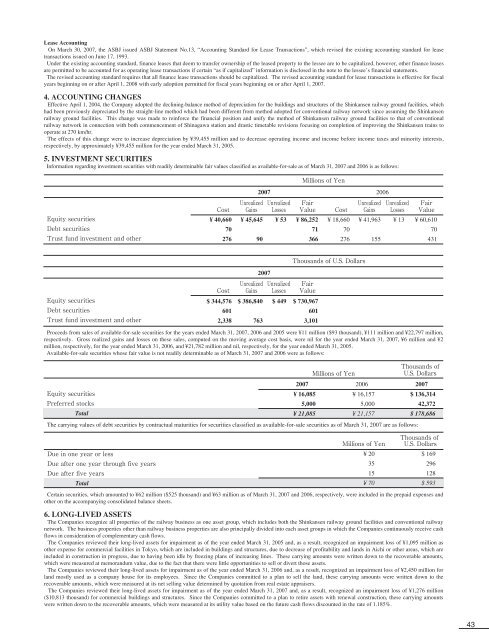

5. INVESTMENT SECURITIES<br />

Information regarding investment securities with readily determinable fair values classified as available-for-sale as of March 31, <strong>2007</strong> and 2006 is as follows:<br />

<br />

<strong>2007</strong><br />

2006<br />

<br />

<br />

<br />

<br />

¥ 40,660<br />

70<br />

276<br />

<br />

<br />

¥ 45,645<br />

90<br />

<br />

<br />

<br />

<br />

¥ 53 ¥ 86,252<br />

71<br />

366<br />

<br />

¥ 18,660<br />

70<br />

276<br />

<br />

<br />

¥ 41,963<br />

155<br />

<br />

<br />

<br />

<br />

¥ 13 ¥ 60,610<br />

70<br />

431<br />

<br />

<br />

<br />

<br />

$ 344,576<br />

601<br />

2,338<br />

<br />

<br />

$ 386,840<br />

<strong>2007</strong><br />

763<br />

<br />

<br />

<br />

<br />

<br />

$ 449 $ 730,967<br />

601<br />

3,101<br />

Proceeds from sales of available-for-sale securities for the years ended March 31, <strong>2007</strong>, 2006 and 2005 were ¥11 million ($93 thousand), ¥111 million and ¥22,797 million,<br />

respectively. Gross realized gains and losses on these sales, computed on the moving average cost basis, were nil for the year ended March 31, <strong>2007</strong>, ¥6 million and ¥2<br />

million, respectively, for the year ended March 31, 2006, and ¥21,782 million and nil, respectively, for the year ended March 31, 2005.<br />

Available-for-sale securities whose fair value is not readily determinable as of March 31, <strong>2007</strong> and 2006 were as follows:<br />

<br />

<br />

Total<br />

<strong>2007</strong> 2006 <strong>2007</strong><br />

¥ 16,085<br />

5,000<br />

¥ 21,085<br />

<br />

¥ 16,157<br />

5,000<br />

¥ 21,157<br />

The carrying values of debt securities by contractual maturities for securities classified as available-for-sale securities as of March 31, <strong>2007</strong> are as follows:<br />

<br />

<br />

<br />

Total<br />

<br />

<br />

<br />

$ 136,314<br />

42,372<br />

$ 178,686<br />

<br />

<br />

Certain securities, which amounted to ¥62 million ($525 thousand) and ¥63 million as of March 31, <strong>2007</strong> and 2006, respectively, were included in the prepaid expenses and<br />

other on the accompanying consolidated balance sheets.<br />

6. LONG-LIVED ASSETS<br />

The Companies recognize all properties of the railway business as one asset group, which includes both the Shinkansen railway ground facilities and conventional railway<br />

network. The business properties other than railway business properties are also principally divided into each asset groups in which the Companies continuously receive cash<br />

flows in consideration of complementary cash flows.<br />

The Companies reviewed their long-lived assets for impairment as of the year ended March 31, 2005 and, as a result, recognized an impairment loss of ¥1,095 million as<br />

other expense for commercial facilities in Tokyo, which are included in buildings and structures, due to decrease of profitability and lands in Aichi or other areas, which are<br />

included in construction in progress, due to having been idle by freezing plans of increasing lines. These carrying amounts were written down to the recoverable amounts,<br />

which were measured at memorandum value, due to the fact that there were little opportunities to sell or divert those assets.<br />

The Companies reviewed their long-lived assets for impairment as of the year ended March 31, 2006 and, as a result, recognized an impairment loss of ¥2,450 million for<br />

land mostly used as a company house for its employees. Since the Companies committed to a plan to sell the land, these carrying amounts were written down to the<br />

recoverable amounts, which were measured at its net selling value determined by quotation from real estate appraisers.<br />

The Companies reviewed their long-lived assets for impairment as of the year ended March 31, <strong>2007</strong> and, as a result, recognized an impairment loss of ¥1,276 million<br />

($10,813 thousand) for commercial buildings and structures. Since the Companies committed to a plan to retire assets with renewal construction, these carrying amounts<br />

were written down to the recoverable amounts, which were measured at its utility value based on the future cash flows discounted in the rate of 1.185%.<br />

¥ 20<br />

35<br />

15<br />

¥ 70<br />

$ 169<br />

296<br />

128<br />

$ 593<br />

43