Financials - PepsiCo

Financials - PepsiCo

Financials - PepsiCo

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

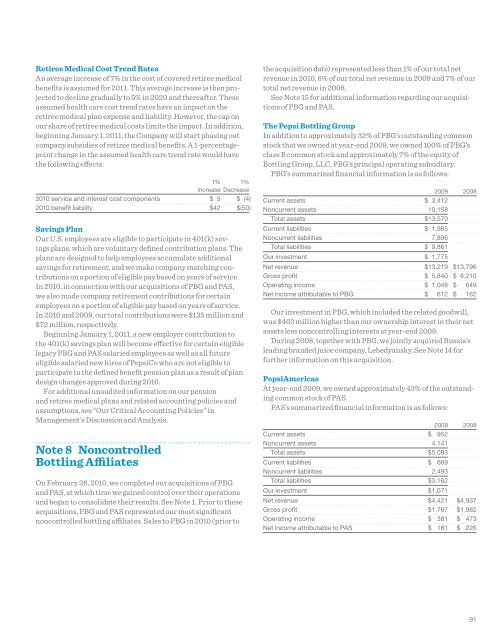

Retiree Medical Cost Trend Rates<br />

An average increase of 7% in the cost of covered retiree medical<br />

benefits is assumed for 2011. This average increase is then projected<br />

to decline gradually to 5% in 2020 and thereafter. These<br />

assumed health care cost trend rates have an impact on the<br />

retiree medical plan expense and liability. However, the cap on<br />

our share of retiree medical costs limits the impact. In addition,<br />

beginning January 1, 2011, the Company will start phasing out<br />

company subsidies of retiree medical benefits. A 1-percentagepoint<br />

change in the assumed health care trend rate would have<br />

the following effects:<br />

1% 1%<br />

Increase Decrease<br />

2010 service and interest cost components $ 5 $ (4)<br />

2010 benefit liability $42 $(50)<br />

Savings Plan<br />

Our U.S. employees are eligible to participate in 401(k) savings<br />

plans, which are voluntary defined contribution plans. The<br />

plans are designed to help employees accumulate additional<br />

savings for retirement, and we make company matching contributions<br />

on a portion of eligible pay based on years of service.<br />

In 2010, in connection with our acquisitions of PBG and PAS,<br />

we also made company retirement contributions for certain<br />

employees on a portion of eligible pay based on years of service.<br />

In 2010 and 2009, our total contributions were $135 million and<br />

$72 million, respectively.<br />

Beginning January 1, 2011, a new employer contribution to<br />

the 401(k) savings plan will become effective for certain eligible<br />

legacy PBG and PAS salaried employees as well as all future<br />

eligible salaried new hires of <strong>PepsiCo</strong> who are not eligible to<br />

participate in the defined benefit pension plan as a result of plan<br />

design changes approved during 2010.<br />

For additional unaudited information on our pension<br />

and retiree medical plans and related accounting policies and<br />

assumptions, see “Our Critical Accounting Policies” in<br />

Management’s Discussion and Analysis.<br />

Note 8 Noncontrolled<br />

Bottling Affiliates<br />

On February 26, 2010, we completed our acquisitions of PBG<br />

and PAS, at which time we gained control over their operations<br />

and began to consolidate their results. See Note 1. Prior to these<br />

acquisitions, PBG and PAS represented our most significant<br />

noncontrolled bottling affiliates. Sales to PBG in 2010 (prior to<br />

the acquisition date) represented less than 1% of our total net<br />

revenue in 2010, 6% of our total net revenue in 2009 and 7% of our<br />

total net revenue in 2008.<br />

See Note 15 for additional information regarding our acquisitions<br />

of PBG and PAS.<br />

The Pepsi Bottling Group<br />

In addition to approximately 32% of PBG’s outstanding common<br />

stock that we owned at year-end 2009, we owned 100% of PBG’s<br />

class B common stock and approximately 7% of the equity of<br />

Bottling Group, LLC, PBG’s principal operating subsidiary.<br />

PBG’s summarized financial information is as follows:<br />

2009 2008<br />

Current assets $ 3,412<br />

Noncurrent assets 10,158<br />

Total assets $13,570<br />

Current liabilities $ 1,965<br />

Noncurrent liabilities 7,896<br />

Total liabilities $ 9,861<br />

Our investment $ 1,775<br />

Net revenue $13,219 $13,796<br />

Gross profit $ 5,840 $ 6,210<br />

Operating income $ 1,048 $ 649<br />

Net income attributable to PBG $ 612 $ 162<br />

Our investment in PBG, which included the related goodwill,<br />

was $463 million higher than our ownership interest in their net<br />

assets less noncontrolling interests at year-end 2009.<br />

During 2008, together with PBG, we jointly acquired Russia’s<br />

leading branded juice company, Lebedyansky. See Note 14 for<br />

further information on this acquisition.<br />

PepsiAmericas<br />

At year-end 2009, we owned approximately 43% of the outstanding<br />

common stock of PAS.<br />

PAS’s summarized financial information is as follows:<br />

2009 2008<br />

Current assets $ 952<br />

Noncurrent assets 4,141<br />

Total assets $5,093<br />

Current liabilities $ 669<br />

Noncurrent liabilities 2,493<br />

Total liabilities $3,162<br />

Our investment $1,071<br />

Net revenue $4,421 $4,937<br />

Gross profit $1,767 $1,982<br />

Operating income $ 381 $ 473<br />

Net income attributable to PAS $ 181 $ 226<br />

91