Eisai Co., Ltd. Annual Report 2001 - Eisai GmbH

Eisai Co., Ltd. Annual Report 2001 - Eisai GmbH

Eisai Co., Ltd. Annual Report 2001 - Eisai GmbH

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

(n) Derivatives and Hedging Activities<br />

The Group uses derivative financial instruments to manage its exposures to fluctuations in foreign exchange. Foreign exchange forward<br />

contracts are utilized by the Group to reduce foreign currency exchange risks. The Group does not enter into derivatives for trading or<br />

speculative purposes.<br />

Effective April 1, 2000, the Group adopted a new accounting standard for derivative financial instruments and a revised accounting<br />

standard for foreign currency transactions. These standards require that: a) all derivatives be recognized as either assets or liabilities<br />

and measured at fair value, and gains or losses on derivative transactions are recognized in the income statement and b) for derivatives<br />

used for hedging purposes, if derivatives qualify for hedge accounting because of high correlation and effectiveness between the<br />

hedging instruments and the hedged items, gains or losses on derivatives are deferred until maturity of the hedged transactions.<br />

The foreign exchange forward contracts employed to hedge foreign exchange exposures for export sales and contract research are<br />

measured at the fair value and the unrealized gains / losses are recognized in income. Forward contracts applied for forecasted (or<br />

committed) transactions are also measured at the fair value but the unrealized gains / losses are deferred until the underlying<br />

transactions are completed.<br />

Effect on income before income taxes and minority interests of adopting the new accounting standards for derivative financial<br />

instruments was immaterial.<br />

(o) Per share information<br />

The computation of net income per share is based on the weighted average number of shares of common stock outstanding during<br />

each year, retroactively adjusted for stock splits. The weighted average number of common shares used in the computation was<br />

296,433,302 shares for <strong>2001</strong> and 296,422,817 shares for 2000.<br />

Diluted net income per share of common stock assumes full conversion of the outstanding convertible bonds at the beginning of<br />

the year with an applicable adjustment for related interest expense, net of tax.<br />

Cash dividends per share presented in the accompanying consolidated statements of income are dividends applicable to the<br />

respective years including dividends to be paid after the end of the year.<br />

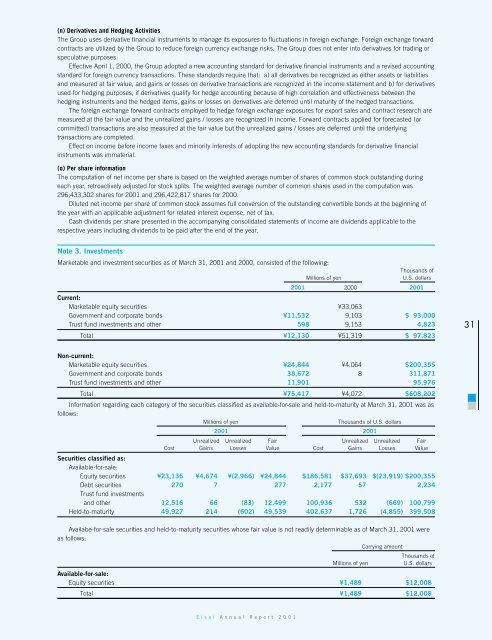

Note 3. Investments<br />

Marketable and investment securities as of March 31, <strong>2001</strong> and 2000, consisted of the following:<br />

Millions of yen<br />

Thousands of<br />

U.S. dollars<br />

<strong>2001</strong> 2000 <strong>2001</strong><br />

Current:<br />

Marketable equity securities ¥33,063<br />

Government and corporate bonds ¥11,532 9,103 $ 93,000<br />

Trust fund investments and other 598 9,153 4,823<br />

Total ¥12,130 ¥51,319 $ 97,823<br />

Non-current:<br />

Marketable equity securities ¥24,844 ¥4,064 $200,355<br />

Government and corporate bonds 38,672 8 311,871<br />

Trust fund investments and other 11,901 95,976<br />

Total ¥75,417 ¥4,072 $608,202<br />

Information regarding each category of the securities classified as available-for-sale and held-to-maturity at March 31, <strong>2001</strong> was as<br />

follows:<br />

Millions of yen Thousands of U.S. dollars<br />

<strong>2001</strong> <strong>2001</strong><br />

Unrealized Unrealized Fair Unrealized Unrealized Fair<br />

<strong>Co</strong>st Gains Losses Value <strong>Co</strong>st Gains Losses Value<br />

Securities classified as:<br />

Available-for-sale:<br />

Equity securities ¥23,136 ¥4,674 ¥(2,966) ¥24,844 $186,581 $37,693 $(23,919) $200,355<br />

Debt securities<br />

Trust fund investments<br />

270 7 277 2,177 57 2,234<br />

and other 12,516 66 (83) 12,499 100,936 532 (669) 100,799<br />

Held-to-maturity 49,927 214 (602) 49,539 402,637 1,726 (4,855) 399,508<br />

Availabe-for-sale securities and held-to-maturity securities whose fair value is not readily determinable as of March 31, <strong>2001</strong> were<br />

as follows:<br />

Carrying amount<br />

Thousands of<br />

Millions of yen U.S. dollars<br />

Available-for-sale:<br />

Equity securities ¥1,489 $12,008<br />

Total ¥1,489 $12,008<br />

<strong>Eisai</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2001</strong><br />

31