Eisai Co., Ltd. Annual Report 2001 - Eisai GmbH

Eisai Co., Ltd. Annual Report 2001 - Eisai GmbH

Eisai Co., Ltd. Annual Report 2001 - Eisai GmbH

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The amount available for dividends under the <strong>Co</strong>de is based on retained earnings excluding legal reserve as recorded on the books<br />

of the <strong>Co</strong>mpany. At March 31, <strong>2001</strong>, retained earnings of the <strong>Co</strong>mpany included ¥219,005 million ($1,766,169 thousand), which was<br />

designated as both general and special reserves but available for future dividends subject to approval by the shareholders and legal<br />

reserve requirements.<br />

Year-end dividends are approved by the shareholders at a meeting held subsequent to the fiscal year to which the dividends are<br />

applicable. In addition, a semiannual dividend may be paid upon resolution of the Board of Directors, subject to certain limitations<br />

imposed by the <strong>Co</strong>de.<br />

Stock option plan for the <strong>Co</strong>mpany’s directors and applicable persons<br />

The <strong>Co</strong>mpany’s nine Board of Directors’ members were allocated options for a maximum of 69,000 new common stocks and 17 other<br />

applicable persons in the <strong>Co</strong>mpany will be allocated options for a maximum of 78,000 new common stocks.<br />

After the date of the option grant, in the event that a stock split or a consolidation of stocks occurs, an adjustment in stock options<br />

granted will be made in accordance with the rate of stock split or stock consolidation. In addition, after the date of the stock option<br />

grant, in the event the <strong>Co</strong>mpany merges or consolidates with another company, the number of options granted will be adjusted as<br />

deemed necessary.<br />

The stock option exercise price of the newly issued stock for the purpose of the stock option is ¥3,090 ($24.92).<br />

After the date of the option grant, in the event of a stock split or stock consolidation, the stock option excercise price will be<br />

adjusted according to the percentage change with amounts of less than one yen being rounded up.<br />

In addition, after the stock option grant, if the <strong>Co</strong>mpany issues new stocks at the price less than the current price on the market<br />

(excluding new stock issuance for convertible bonds redemption, warrants with pre-emptive rights and the application of the <strong>Co</strong>de 280-<br />

19), the exercise price will be adjusted with amounts of less than one yen being rounded up.<br />

Such stock options can be exercised from September 1, 2000 to June 29, 2010.<br />

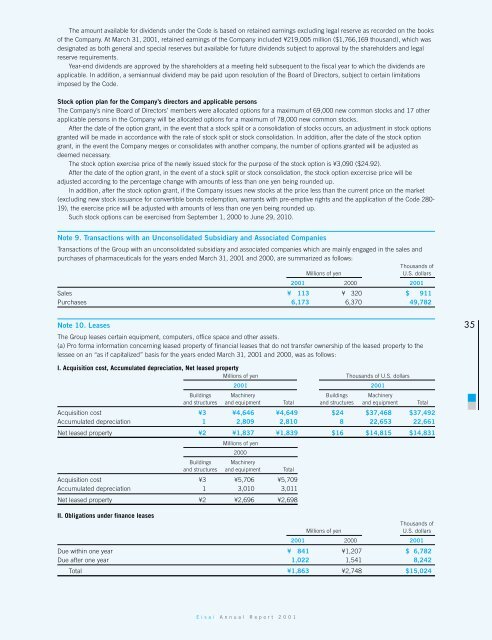

Note 9. Transactions with an Unconsolidated Subsidiary and Associated <strong>Co</strong>mpanies<br />

Transactions of the Group with an unconsolidated subsidiary and associated companies which are mainly engaged in the sales and<br />

purchases of pharmaceuticals for the years ended March 31, <strong>2001</strong> and 2000, are summarized as follows:<br />

Thousands of<br />

Millions of yen U.S. dollars<br />

<strong>2001</strong> 2000 <strong>2001</strong><br />

Sales ¥ 113 ¥ 320 $ 911<br />

Purchases 6,173 6,370 49,782<br />

Note 10. Leases<br />

The Group leases certain equipment, computers, office space and other assets.<br />

(a) Pro forma information concerning leased property of financial leases that do not transfer ownership of the leased property to the<br />

lessee on an “as if capitalized” basis for the years ended March 31, <strong>2001</strong> and 2000, was as follows:<br />

I. Acquisition cost, Accumulated depreciation, Net leased property<br />

Millions of yen Thousands of U.S. dollars<br />

<strong>2001</strong> <strong>2001</strong><br />

Buildings Machinery Buildings Machinery<br />

and structures and equipment Total and structures and equipment Total<br />

Acquisition cost ¥3 ¥4,646 ¥4,649 $24 $37,468 $37,492<br />

Accumulated depreciation 1 2,809 2,810 8 22,653 22,661<br />

Net leased property ¥2 ¥1,837 ¥1,839 $16 $14,815 $14,831<br />

Millions of yen<br />

2000<br />

Buildings Machinery<br />

and structures and equipment Total<br />

Acquisition cost ¥3 ¥5,706 ¥5,709<br />

Accumulated depreciation 1 3,010 3,011<br />

Net leased property ¥2 ¥2,696 ¥2,698<br />

II. Obligations under finance leases<br />

<strong>Eisai</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2001</strong><br />

Millions of yen<br />

Thousands of<br />

U.S. dollars<br />

<strong>2001</strong> 2000 <strong>2001</strong><br />

Due within one year ¥ 841 ¥1,207 $ 6,782<br />

Due after one year 1,022 1,541 8,242<br />

Total ¥1,863 ¥2,748 $15,024<br />

35