Annual Report 2008-2009 - Bharat Petroleum

Annual Report 2008-2009 - Bharat Petroleum

Annual Report 2008-2009 - Bharat Petroleum

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

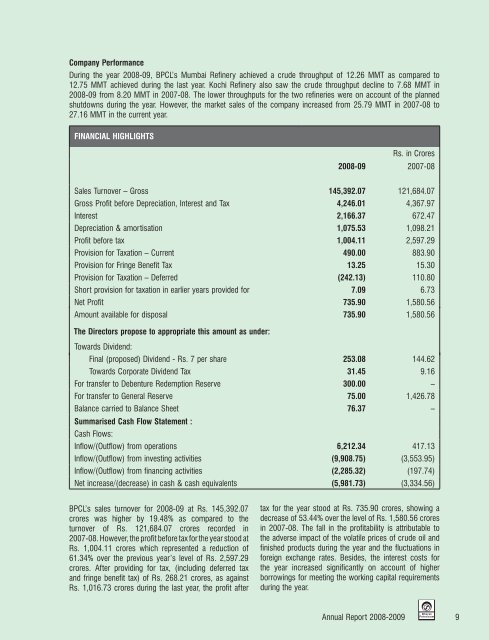

Company Performance<br />

During the year <strong>2008</strong>-09, BPCL’s Mumbai Refinery achieved a crude throughput of 12.26 MMT as compared to<br />

12.75 MMT achieved during the last year. Kochi Refinery also saw the crude throughput decline to 7.68 MMT in<br />

<strong>2008</strong>-09 from 8.20 MMT in 2007-08. The lower throughputs for the two refineries were on account of the planned<br />

shutdowns during the year. However, the market sales of the company increased from 25.79 MMT in 2007-08 to<br />

27.16 MMT in the current year.<br />

FINANCIAL HIGHLIGHTS<br />

Rs. in Crores<br />

<strong>2008</strong>-09 2007-08<br />

Sales Turnover – Gross 145,392.07 121,684.07<br />

Gross Profit before Depreciation, Interest and Tax 4,246.01 4,367.97<br />

Interest 2,166.37 672.47<br />

Depreciation & amortisation 1,075.53 1,098.21<br />

Profit before tax 1,004.11 2,597.29<br />

Provision for Taxation – Current 490.00 883.90<br />

Provision for Fringe Benefit Tax 13.25 15.30<br />

Provision for Taxation – Deferred (242.13) 110.80<br />

Short provision for taxation in earlier years provided for 7.09 6.73<br />

Net Profit 735.90 1,580.56<br />

Amount available for disposal 735.90 1,580.56<br />

The Directors propose to appropriate this amount as under:<br />

Towards Dividend:<br />

Final (proposed) Dividend - Rs. 7 per share 253.08 144.62<br />

Towards Corporate Dividend Tax 31.45 9.16<br />

For transfer to Debenture Redemption Reserve 300.00 –<br />

For transfer to General Reserve 75.00 1,426.78<br />

Balance carried to Balance Sheet 76.37 –<br />

Summarised Cash Flow Statement :<br />

Cash Flows:<br />

Inflow/(Outflow) from operations 6,212.34 417.13<br />

Inflow/(Outflow) from investing activities (9,908.75) (3,553.95)<br />

Inflow/(Outflow) from financing activities (2,285.32) (197.74)<br />

Net increase/(decrease) in cash & cash equivalents (5,981.73) (3,334.56)<br />

BPCL’s sales turnover for <strong>2008</strong>-09 at Rs. 145,392.07<br />

crores was higher by 19.48% as compared to the<br />

turnover of Rs. 121,684.07 crores recorded in<br />

2007-08. However, the profit before tax for the year stood at<br />

Rs. 1,004.11 crores which represented a reduction of<br />

61.34% over the previous year’s level of Rs. 2,597.29<br />

crores. After providing for tax, (including deferred tax<br />

and fringe benefit tax) of Rs. 268.21 crores, as against<br />

Rs. 1,016.73 crores during the last year, the profit after<br />

tax for the year stood at Rs. 735.90 crores, showing a<br />

decrease of 53.44% over the level of Rs. 1,580.56 crores<br />

in 2007-08. The fall in the profitability is attributable to<br />

the adverse impact of the volatile prices of crude oil and<br />

finished products during the year and the fluctuations in<br />

foreign exchange rates. Besides, the interest costs for<br />

the year increased significantly on account of higher<br />

borrowings for meeting the working capital requirements<br />

during the year.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>-<strong>2009</strong> 9