Annual Report 2008-2009 - Bharat Petroleum

Annual Report 2008-2009 - Bharat Petroleum

Annual Report 2008-2009 - Bharat Petroleum

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

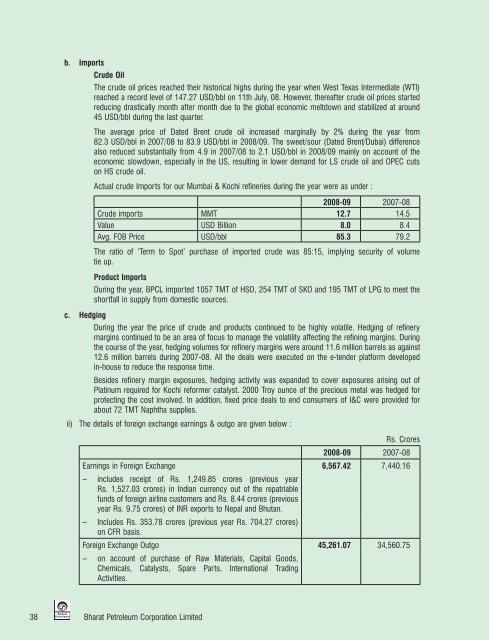

. Imports<br />

Crude Oil<br />

The crude oil prices reached their historical highs during the year when West Texas Intermediate (WTI)<br />

reached a record level of 147.27 USD/bbl on 11th July, 08. However, thereafter crude oil prices started<br />

reducing drastically month after month due to the global economic meltdown and stabilized at around<br />

45 USD/bbl during the last quarter.<br />

The average price of Dated Brent crude oil increased marginally by 2% during the year from<br />

82.3 USD/bbl in 2007/08 to 83.9 USD/bbl in <strong>2008</strong>/09. The sweet/sour (Dated Brent/Dubai) difference<br />

also reduced substantially from 4.9 in 2007/08 to 2.1 USD/bbl in <strong>2008</strong>/09 mainly on account of the<br />

economic slowdown, especially in the US, resulting in lower demand for LS crude oil and OPEC cuts<br />

on HS crude oil.<br />

Actual crude Imports for our Mumbai & Kochi refineries during the year were as under :<br />

<strong>2008</strong>-09 2007-08<br />

Crude imports MMT 12.7 14.5<br />

Value USD Billion 8.0 8.4<br />

Avg. FOB Price USD/bbl 85.3 79.2<br />

The ratio of ‘Term to Spot’ purchase of imported crude was 85:15, implying security of volume<br />

tie up.<br />

Product Imports<br />

During the year, BPCL imported 1057 TMT of HSD, 254 TMT of SKO and 195 TMT of LPG to meet the<br />

shortfall in supply from domestic sources.<br />

c. Hedging<br />

During the year the price of crude and products continued to be highly volatile. Hedging of refinery<br />

margins continued to be an area of focus to manage the volatility affecting the refining margins. During<br />

the course of the year, hedging volumes for refinery margins were around 11.6 million barrels as against<br />

12.6 million barrels during 2007-08. All the deals were executed on the e-tender platform developed<br />

in-house to reduce the response time.<br />

Besides refinery margin exposures, hedging activity was expanded to cover exposures arising out of<br />

Platinum required for Kochi reformer catalyst. 2000 Troy ounce of the precious metal was hedged for<br />

protecting the cost involved. In addition, fixed price deals to end consumers of I&C were provided for<br />

about 72 TMT Naphtha supplies.<br />

ii) The details of foreign exchange earnings & outgo are given below :<br />

Rs. Crores<br />

<strong>2008</strong>-09 2007-08<br />

Earnings in Foreign Exchange 6,567.42 7,440.16<br />

– includes receipt of Rs. 1,249.85 crores (previous year<br />

Rs. 1,527.03 crores) in Indian currency out of the repatriable<br />

funds of foreign airline customers and Rs. 8.44 crores (previous<br />

year Rs. 9.75 crores) of INR exports to Nepal and Bhutan.<br />

– Includes Rs. 353.78 crores (previous year Rs. 704.27 crores)<br />

on CFR basis.<br />

Foreign Exchange Outgo 45,261.07 34,560.75<br />

– on account of purchase of Raw Materials, Capital Goods,<br />

Chemicals, Catalysts, Spare Parts, International Trading<br />

Activities.<br />

38 <strong>Bharat</strong> <strong>Petroleum</strong> Corporation Limited