Volume 3 Issue 1.indd - Parsons Brinckerhoff

Volume 3 Issue 1.indd - Parsons Brinckerhoff

Volume 3 Issue 1.indd - Parsons Brinckerhoff

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

A New Cyclicality in Container Trade<br />

In summary, during the past few quarters, container trade<br />

has joined the list of cyclical sectors of the U.S. economy,<br />

and done so strongly. Declines in residential investment<br />

have continued unabated, and growth in investment in<br />

non-residential structures has also moved into negative<br />

territory. Long-term, steadily positive, growth in consumer<br />

spending turned sharply negative in mid-2008. Beyond<br />

underlying economic driving factors, drops in import<br />

volumes have also undoubtedly been impacted by supply<br />

chain factors such as drawing down inventories and<br />

changes in sourcing. Finally, export volumes, which had<br />

been increasing during early 2008, have also declined in<br />

the fourth quarter of 2008 and the first quarter of 2009<br />

due to slowing global demand. The result of all of these<br />

factors has led to an unprecedented drop in U.S. container<br />

volumes in 2008 that has continued into 2009.<br />

The good news for GDP growth is that declines in imports,<br />

and the resulting improvement in the trade balance, count<br />

as positives in the calculation of GDP.<br />

After the Recovery: A New Normal<br />

The timing and shape of the economic recovery is the<br />

subject of much uncertainty and debate. The question<br />

here is what will happen to trade volumes, both during a<br />

recovery and thereafter. In the short term, an economic<br />

recovery will lead to a resumption of trade growth,<br />

accelerated by a refilling of goods inventories. It now<br />

seems apparent that this recovery in trade will not occur<br />

until late in 2009, or perhaps in 2010. A specific forecast of<br />

this volume growth is not attempted in this short article.<br />

The important question for longer term planning purposes<br />

is what normal growth will look like after the recovery. The<br />

factors that will determine a new normal include at least<br />

four principal components:<br />

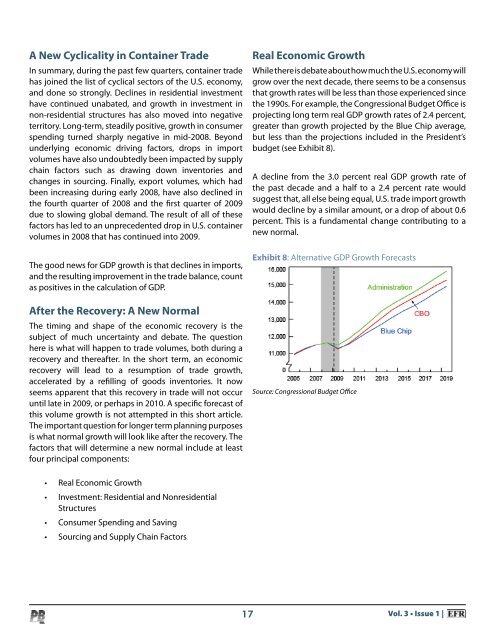

Real Economic Growth<br />

While there is debate about how much the U.S. economy will<br />

grow over the next decade, there seems to be a consensus<br />

that growth rates will be less than those experienced since<br />

the 1990s. For example, the Congressional Budget Office is<br />

projecting long term real GDP growth rates of 2.4 percent,<br />

greater than growth projected by the Blue Chip average,<br />

but less than the projections included in the President’s<br />

budget (see Exhibit 8).<br />

A decline from the 3.0 percent real GDP growth rate of<br />

the past decade and a half to a 2.4 percent rate would<br />

suggest that, all else being equal, U.S. trade import growth<br />

would decline by a similar amount, or a drop of about 0.6<br />

percent. This is a fundamental change contributing to a<br />

new normal.<br />

Exhibit 8: Alternative GDP Growth Forecasts<br />

Source: Congressional Budget Office<br />

• Real Economic Growth<br />

• Investment: Residential and Nonresidential<br />

Structures<br />

• Consumer Spending and Saving<br />

• Sourcing and Supply Chain Factors<br />

17 Vol. 3 • <strong>Issue</strong> 1 |