VRS Handbook for Members - Virginia Retirement System

VRS Handbook for Members - Virginia Retirement System

VRS Handbook for Members - Virginia Retirement System

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Continued from page 15<br />

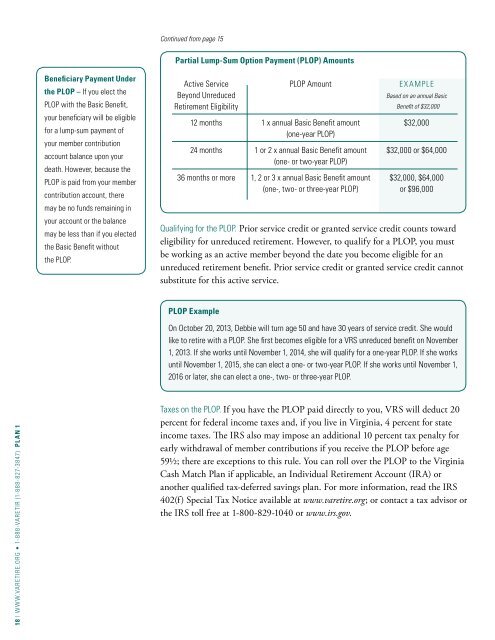

Partial Lump-Sum Option Payment (PLOP) Amounts<br />

Beneficiary Payment Under<br />

the PLOP – If you elect the<br />

PLOP with the Basic Benefit,<br />

your beneficiary will be eligible<br />

<strong>for</strong> a lump-sum payment of<br />

your member contribution<br />

account balance upon your<br />

death. However, because the<br />

PLOP is paid from your member<br />

contribution account, there<br />

may be no funds remaining in<br />

your account or the balance<br />

may be less than if you elected<br />

the Basic Benefit without<br />

the PLOP.<br />

Active Service PLOP Amount Example<br />

Beyond Unreduced<br />

<strong>Retirement</strong> Eligibility<br />

Based on an annual Basic<br />

Benefit of $32,000<br />

12 months 1 x annual Basic Benefit amount $32,000<br />

(one-year PLOP)<br />

24 months 1 or 2 x annual Basic Benefit amount $32,000 or $64,000<br />

(one- or two-year PLOP)<br />

36 months or more 1, 2 or 3 x annual Basic Benefit amount $32,000, $64,000<br />

(one-, two- or three-year PLOP) or $96,000<br />

Qualifying <strong>for</strong> the PLOP. Prior service credit or granted service credit counts toward<br />

eligibility <strong>for</strong> unreduced retirement. However, to qualify <strong>for</strong> a PLOP, you must<br />

be working as an active member beyond the date you become eligible <strong>for</strong> an<br />

unreduced retirement benefit. Prior service credit or granted service credit cannot<br />

substitute <strong>for</strong> this active service.<br />

PLOP Example<br />

On October 20, 2013, Debbie will turn age 50 and have 30 years of service credit. She would<br />

like to retire with a PLOP. She first becomes eligible <strong>for</strong> a <strong>VRS</strong> unreduced benefit on November<br />

1, 2013. If she works until November 1, 2014, she will qualify <strong>for</strong> a one-year PLOP. If she works<br />

until November 1, 2015, she can elect a one- or two-year PLOP. If she works until November 1,<br />

2016 or later, she can elect a one-, two- or three-year PLOP.<br />

18 | www.varetire.org • 1-888-VARETIR (1-888-827-3847) Plan 1<br />

Taxes on the PLOP. If you have the PLOP paid directly to you, <strong>VRS</strong> will deduct 20<br />

percent <strong>for</strong> federal income taxes and, if you live in <strong>Virginia</strong>, 4 percent <strong>for</strong> state<br />

income taxes. The IRS also may impose an additional 10 percent tax penalty <strong>for</strong><br />

early withdrawal of member contributions if you receive the PLOP be<strong>for</strong>e age<br />

59½; there are exceptions to this rule. You can roll over the PLOP to the <strong>Virginia</strong><br />

Cash Match Plan if applicable, an Individual <strong>Retirement</strong> Account (IRA) or<br />

another qualified tax-deferred savings plan. For more in<strong>for</strong>mation, read the IRS<br />

402(f) Special Tax Notice available at www.varetire.org; or contact a tax advisor or<br />

the IRS toll free at 1-800-829-1040 or www.irs.gov.