VRS Handbook for Members - Virginia Retirement System

VRS Handbook for Members - Virginia Retirement System

VRS Handbook for Members - Virginia Retirement System

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

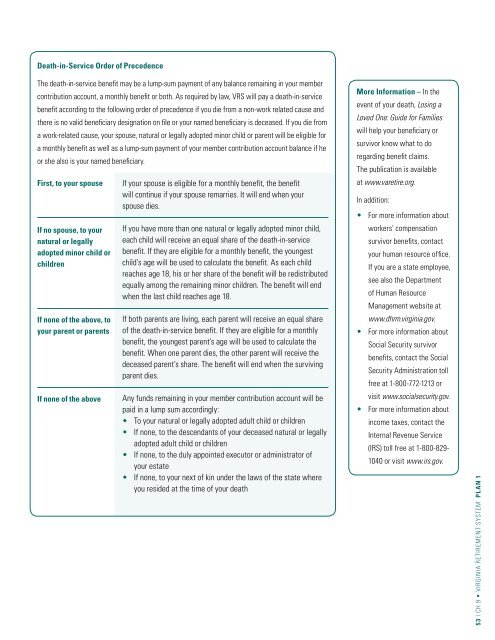

Death-in-Service Order of Precedence<br />

The death-in-service benefit may be a lump-sum payment of any balance remaining in your member<br />

contribution account, a monthly benefit or both. As required by law, <strong>VRS</strong> will pay a death-in-service<br />

benefit according to the following order of precedence if you die from a non-work related cause and<br />

there is no valid beneficiary designation on file or your named beneficiary is deceased. If you die from<br />

a work-related cause, your spouse, natural or legally adopted minor child or parent will be eligible <strong>for</strong><br />

a monthly benefit as well as a lump-sum payment of your member contribution account balance if he<br />

or she also is your named beneficiary.<br />

First, to your spouse<br />

If no spouse, to your<br />

natural or legally<br />

adopted minor child or<br />

children<br />

If none of the above, to<br />

your parent or parents<br />

If none of the above<br />

If your spouse is eligible <strong>for</strong> a monthly benefit, the benefit<br />

will continue if your spouse remarries. It will end when your<br />

spouse dies.<br />

If you have more than one natural or legally adopted minor child,<br />

each child will receive an equal share of the death-in-service<br />

benefit. If they are eligible <strong>for</strong> a monthly benefit, the youngest<br />

child’s age will be used to calculate the benefit. As each child<br />

reaches age 18, his or her share of the benefit will be redistributed<br />

equally among the remaining minor children. The benefit will end<br />

when the last child reaches age 18.<br />

If both parents are living, each parent will receive an equal share<br />

of the death-in-service benefit. If they are eligible <strong>for</strong> a monthly<br />

benefit, the youngest parent’s age will be used to calculate the<br />

benefit. When one parent dies, the other parent will receive the<br />

deceased parent’s share. The benefit will end when the surviving<br />

parent dies.<br />

Any funds remaining in your member contribution account will be<br />

paid in a lump sum accordingly:<br />

• To your natural or legally adopted adult child or children<br />

• If none, to the descendants of your deceased natural or legally<br />

adopted adult child or children<br />

• If none, to the duly appointed executor or administrator of<br />

your estate<br />

• If none, to your next of kin under the laws of the state where<br />

you resided at the time of your death<br />

More In<strong>for</strong>mation – In the<br />

event of your death, Losing a<br />

Loved One: Guide <strong>for</strong> Families<br />

will help your beneficiary or<br />

survivor know what to do<br />

regarding benefit claims.<br />

The publication is available<br />

at www.varetire.org.<br />

In addition:<br />

• For more in<strong>for</strong>mation about<br />

workers’ compensation<br />

survivor benefits, contact<br />

your human resource office.<br />

If you are a state employee,<br />

see also the Department<br />

of Human Resource<br />

Management website at<br />

www.dhrm.virginia.gov.<br />

• For more in<strong>for</strong>mation about<br />

Social Security survivor<br />

benefits, contact the Social<br />

Security Administration toll<br />

free at 1-800-772-1213 or<br />

visit www.socialsecurity.gov.<br />

• For more in<strong>for</strong>mation about<br />

income taxes, contact the<br />

Internal Revenue Service<br />

(IRS) toll free at 1-800-829-<br />

1040 or visit www.irs.gov.<br />

53 | CH 9 • VIRGINIA RETIREMENT SYSTEM Plan 1