Expected Loss Covered Bond Model

Expected Loss Covered Bond Model

Expected Loss Covered Bond Model

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

APPENDIX D3: REFINANCING RISK – CALCULATION OF REFINANCING MARGINS<br />

Moody’s has built a refinancing margin generator which calculates the refinancing margins used in the Moody’s EL<br />

<strong>Model</strong>. The generator is defined as (the “Formula”):<br />

dS = η(ζ − S)dt + σdW<br />

Where:<br />

dS is the spread change;<br />

η is the speed the time series reverts to its long term meanζ ;<br />

dt is the change in time;<br />

2<br />

σ is the volatility of the spread time series; and<br />

dW represents the standard Wiener process. 11<br />

The parameters of the Formula (adjusted for timing) were set by minimising the differences of the results produced<br />

for parts of the Formula and the data historically observed on refinancing margins. This exercise was repeated to<br />

calculate the long-term mean and standard deviation for each rating category for each collateral type. 12<br />

The<br />

Formula is then run for a large number of simulations. From these simulations refinancing curves are generated by<br />

working to the desired confidence levels. The confidence levels used for calculating refinancing margins are:<br />

• 99% for margins used when refinancing must be completed within six months; and<br />

• 95% for margins when more than six months is available for refinancing.<br />

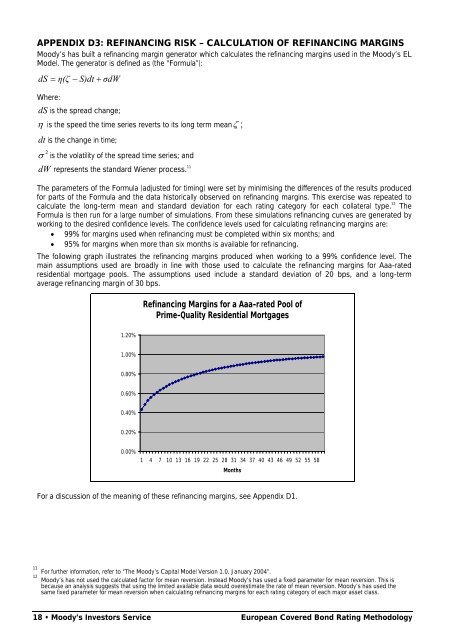

The following graph illustrates the refinancing margins produced when working to a 99% confidence level. The<br />

main assumptions used are broadly in line with those used to calculate the refinancing margins for Aaa-rated<br />

residential mortgage pools. The assumptions used include a standard deviation of 20 bps, and a long-term<br />

average refinancing margin of 30 bps.<br />

Refinancing Margins for a Aaa-rated Pool of<br />

Prime-Quality Residential Mortgages<br />

1.20%<br />

1.00%<br />

0.80%<br />

0.60%<br />

0.40%<br />

0.20%<br />

0.00%<br />

1 4 7 10 13 16 19 22 25 28 31 34 37 40 43 46 49 52 55 58<br />

Months<br />

For a discussion of the meaning of these refinancing margins, see Appendix D1.<br />

11<br />

For further information, refer to “The Moody’s Capital <strong>Model</strong> Version 1.0, January 2004”.<br />

12<br />

Moody’s has not used the calculated factor for mean reversion. Instead Moody’s has used a fixed parameter for mean reversion. This is<br />

because an analysis suggests that using the limited available data would overestimate the rate of mean reversion. Moody’s has used the<br />

same fixed parameter for mean reversion when calculating refinancing margins for each rating category of each major asset class.<br />

18 • Moody’s Investors Service European <strong>Covered</strong> <strong>Bond</strong> Rating Methodology