Expected Loss Covered Bond Model

Expected Loss Covered Bond Model

Expected Loss Covered Bond Model

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

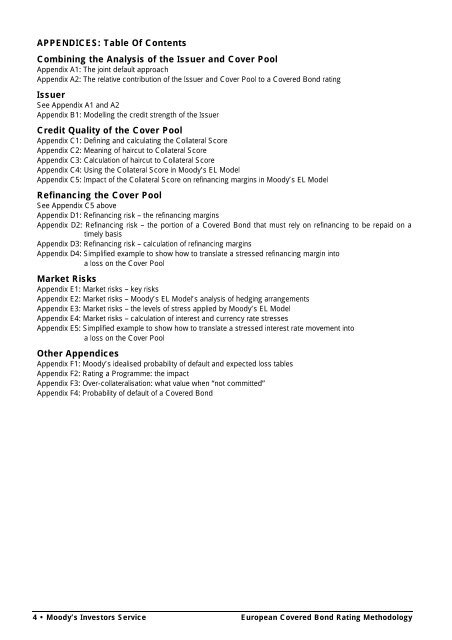

APPENDICES: Table Of Contents<br />

Combining the Analysis of the Issuer and Cover Pool<br />

Appendix A1: The joint default approach<br />

Appendix A2: The relative contribution of the Issuer and Cover Pool to a <strong>Covered</strong> <strong>Bond</strong> rating<br />

Issuer<br />

See Appendix A1 and A2<br />

Appendix B1: <strong>Model</strong>ling the credit strength of the Issuer<br />

Credit Quality of the Cover Pool<br />

Appendix C1: Defining and calculating the Collateral Score<br />

Appendix C2: Meaning of haircut to Collateral Score<br />

Appendix C3: Calculation of haircut to Collateral Score<br />

Appendix C4: Using the Collateral Score in Moody’s EL <strong>Model</strong><br />

Appendix C5: Impact of the Collateral Score on refinancing margins in Moody’s EL <strong>Model</strong><br />

Refinancing the Cover Pool<br />

See Appendix C5 above<br />

Appendix D1: Refinancing risk – the refinancing margins<br />

Appendix D2: Refinancing risk – the portion of a <strong>Covered</strong> <strong>Bond</strong> that must rely on refinancing to be repaid on a<br />

timely basis<br />

Appendix D3: Refinancing risk – calculation of refinancing margins<br />

Appendix D4: Simplified example to show how to translate a stressed refinancing margin into<br />

a loss on the Cover Pool<br />

Market Risks<br />

Appendix E1: Market risks – key risks<br />

Appendix E2: Market risks – Moody’s EL <strong>Model</strong>’s analysis of hedging arrangements<br />

Appendix E3: Market risks – the levels of stress applied by Moody’s EL <strong>Model</strong><br />

Appendix E4: Market risks – calculation of interest and currency rate stresses<br />

Appendix E5: Simplified example to show how to translate a stressed interest rate movement into<br />

a loss on the Cover Pool<br />

Other Appendices<br />

Appendix F1: Moody’s idealised probability of default and expected loss tables<br />

Appendix F2: Rating a Programme: the impact<br />

Appendix F3: Over-collateralisation: what value when “not committed”<br />

Appendix F4: Probability of default of a <strong>Covered</strong> <strong>Bond</strong><br />

4 • Moody’s Investors Service European <strong>Covered</strong> <strong>Bond</strong> Rating Methodology