Modeling Climate Policy Instruments in a Stackelberg Game with ...

Modeling Climate Policy Instruments in a Stackelberg Game with ...

Modeling Climate Policy Instruments in a Stackelberg Game with ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

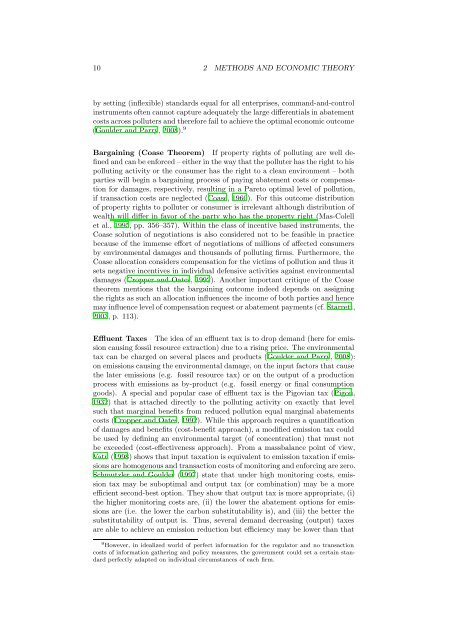

10 2 METHODS AND ECONOMIC THEORY<br />

by sett<strong>in</strong>g (<strong>in</strong>flexible) standards equal for all enterprises, command-and-control<br />

<strong>in</strong>struments often cannot capture adequately the large differentials <strong>in</strong> abatement<br />

costs across polluters and therefore fail to achieve the optimal economic outcome<br />

(Goulder and Parry, 2008). 9<br />

Barga<strong>in</strong><strong>in</strong>g (Coase Theorem) If property rights of pollut<strong>in</strong>g are well def<strong>in</strong>ed<br />

and can be enforced – either <strong>in</strong> the way that the polluter has the right to his<br />

pollut<strong>in</strong>g activity or the consumer has the right to a clean environment – both<br />

parties will beg<strong>in</strong> a barga<strong>in</strong><strong>in</strong>g process of pay<strong>in</strong>g abatement costs or compensation<br />

for damages, respectively, result<strong>in</strong>g <strong>in</strong> a Pareto optimal level of pollution,<br />

if transaction costs are neglected (Coase, 1960). For this outcome distribution<br />

of property rights to polluter or consumer is irrelevant although distribution of<br />

wealth will differ <strong>in</strong> favor of the party who has the property right (Mas-Colell<br />

et al., 1995, pp. 356–357). With<strong>in</strong> the class of <strong>in</strong>centive based <strong>in</strong>struments, the<br />

Coase solution of negotiations is also considered not to be feasible <strong>in</strong> practice<br />

because of the immense effort of negotiations of millions of affected consumers<br />

by environmental damages and thousands of pollut<strong>in</strong>g firms. Furthermore, the<br />

Coase allocation considers compensation for the victims of pollution and thus it<br />

sets negative <strong>in</strong>centives <strong>in</strong> <strong>in</strong>dividual defensive activities aga<strong>in</strong>st environmental<br />

damages (Cropper and Oates, 1992). Another important critique of the Coase<br />

theorem mentions that the barga<strong>in</strong><strong>in</strong>g outcome <strong>in</strong>deed depends on assign<strong>in</strong>g<br />

the rights as such an allocation <strong>in</strong>fluences the <strong>in</strong>come of both parties and hence<br />

may <strong>in</strong>fluence level of compensation request or abatement payments (cf. Starrett,<br />

2003, p. 113).<br />

Effluent Taxes The idea of an effluent tax is to drop demand (here for emission<br />

caus<strong>in</strong>g fossil resource extraction) due to a ris<strong>in</strong>g price. The environmental<br />

tax can be charged on several places and products (Goulder and Parry, 2008):<br />

on emissions caus<strong>in</strong>g the environmental damage, on the <strong>in</strong>put factors that cause<br />

the later emissions (e.g. fossil resource tax) or on the output of a production<br />

process <strong>with</strong> emissions as by-product (e.g. fossil energy or f<strong>in</strong>al consumption<br />

goods). A special and popular case of effluent tax is the Pigovian tax (Pigou,<br />

1932) that is attached directly to the pollut<strong>in</strong>g activity on exactly that level<br />

such that marg<strong>in</strong>al benefits from reduced pollution equal marg<strong>in</strong>al abatements<br />

costs (Cropper and Oates, 1992). While this approach requires a quantification<br />

of damages and benefits (cost-benefit approach), a modified emission tax could<br />

be used by def<strong>in</strong><strong>in</strong>g an environmental target (of concentration) that must not<br />

be exceeded (cost-effectiveness approach). From a massbalance po<strong>in</strong>t of view,<br />

Vatn (1998) shows that <strong>in</strong>put taxation is equivalent to emission taxation if emissions<br />

are homogenous and transaction costs of monitor<strong>in</strong>g and enforc<strong>in</strong>g are zero.<br />

Schmutzler and Goulder (1997) state that under high monitor<strong>in</strong>g costs, emission<br />

tax may be suboptimal and output tax (or comb<strong>in</strong>ation) may be a more<br />

efficient second-best option. They show that output tax is more appropriate, (i)<br />

the higher monitor<strong>in</strong>g costs are, (ii) the lower the abatement options for emissions<br />

are (i.e. the lower the carbon substitutability is), and (iii) the better the<br />

substitutability of output is. Thus, several demand decreas<strong>in</strong>g (output) taxes<br />

are able to achieve an emission reduction but efficiency may be lower than that<br />

9 However, <strong>in</strong> idealized world of perfect <strong>in</strong>formation for the regulator and no transaction<br />

costs of <strong>in</strong>formation gather<strong>in</strong>g and policy measures, the government could set a certa<strong>in</strong> standard<br />

perfectly adapted on <strong>in</strong>dividual circumstances of each firm.