Modeling Climate Policy Instruments in a Stackelberg Game with ...

Modeling Climate Policy Instruments in a Stackelberg Game with ...

Modeling Climate Policy Instruments in a Stackelberg Game with ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

24 3 MODEL DEVELOPMENT AND ANALYSIS<br />

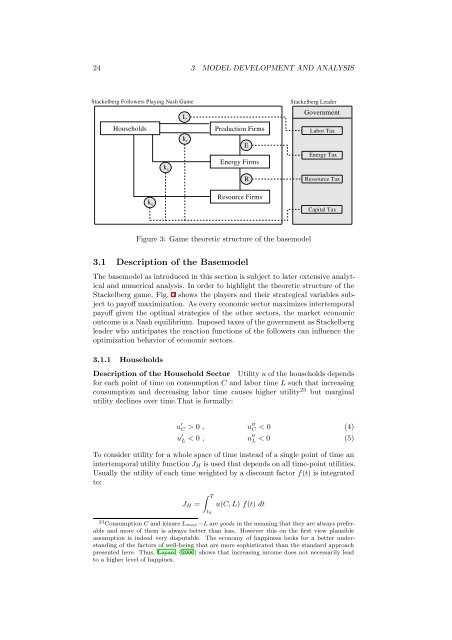

Figure 3: <strong>Game</strong> theoretic structure of the basemodel<br />

3.1 Description of the Basemodel<br />

The basemodel as <strong>in</strong>troduced <strong>in</strong> this section is subject to later extensive analytical<br />

and numerical analysis. In order to highlight the theoretic structure of the<br />

<strong>Stackelberg</strong> game, Fig. 3 shows the players and their strategical variables subject<br />

to payoff maximization. As every economic sector maximizes <strong>in</strong>tertemporal<br />

payoff given the optimal strategies of the other sectors, the market economic<br />

outcome is a Nash equilibrium. Imposed taxes of the government as <strong>Stackelberg</strong><br />

leader who anticipates the reaction functions of the followers can <strong>in</strong>fluence the<br />

optimization behavior of economic sectors.<br />

3.1.1 Households<br />

Description of the Household Sector Utility u of the households depends<br />

for each po<strong>in</strong>t of time on consumption C and labor time L such that <strong>in</strong>creas<strong>in</strong>g<br />

consumption and decreas<strong>in</strong>g labor time causes higher utility 23 but marg<strong>in</strong>al<br />

utility decl<strong>in</strong>es over time.That is formally:<br />

u ′ C > 0 , u′′ C < 0 (4)<br />

u ′ L < 0 , u ′′ L < 0 (5)<br />

To consider utility for a whole space of time <strong>in</strong>stead of a s<strong>in</strong>gle po<strong>in</strong>t of time an<br />

<strong>in</strong>tertemporal utility function J H is used that depends on all time-po<strong>in</strong>t utilities.<br />

Usually the utility of each time weighted by a discount factor f(t) is <strong>in</strong>tegrated<br />

to:<br />

J H =<br />

∫ T<br />

t 0<br />

u(C, L) f(t) dt<br />

23 Consumption C and leisure L max−L are goods <strong>in</strong> the mean<strong>in</strong>g that they are always preferable<br />

and more of them is always better than less. However this on the first view plausible<br />

assumption is <strong>in</strong>deed very disputable. The economy of happ<strong>in</strong>ess looks for a better understand<strong>in</strong>g<br />

of the factors of well-be<strong>in</strong>g that are more sophisticated than the standard approach<br />

presented here. Thus, Layard (2006) shows that <strong>in</strong>creas<strong>in</strong>g <strong>in</strong>come does not necessarily lead<br />

to a higher level of happ<strong>in</strong>es.