Annual Report LRP 2007 - Rheinland Pfalz Bank

Annual Report LRP 2007 - Rheinland Pfalz Bank

Annual Report LRP 2007 - Rheinland Pfalz Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES<br />

<strong>LRP</strong> <strong>2007</strong><br />

97<br />

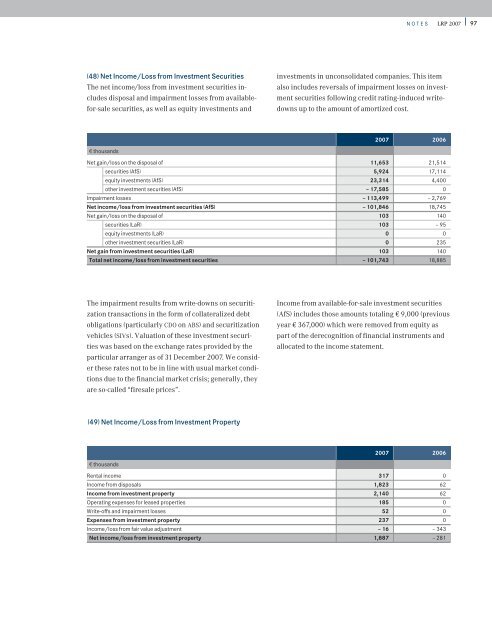

(48) Net Income/Loss from Investment Securities<br />

The net income/loss from investment securities includes<br />

disposal and impairment losses from availablefor-sale<br />

securities, as well as equity investments and<br />

investments in unconsolidated companies. This item<br />

also includes reversals of impairment losses on investment<br />

securities following credit rating-induced writedowns<br />

up to the amount of amortized cost.<br />

<strong>2007</strong> 2006<br />

1 thousands<br />

Net gain/loss on the disposal of 11,653 21,514<br />

securities (AfS) 5,924 17,114<br />

equity investments (AfS) 23,314 4,400<br />

other investment securities (AfS) – 17,585 0<br />

Impairment losses – 113,499 – 2,769<br />

Net income/loss from investment securities (AfS) – 101,846 18,745<br />

Net gain/loss on the disposal of 103 140<br />

securities (LaR) 103 – 95<br />

equity investments (LaR) 0 0<br />

other investment securities (LaR) 0 235<br />

Net gain from investment securities (LaR) 103 140<br />

Total net income/loss from investment securities – 101,743 18,885<br />

The impairment results from write-downs on securitization<br />

transactions in the form of collateralized debt<br />

obligations (particularly CDO on ABS) and securitization<br />

vehicles (SIVs). Valuation of these investment securities<br />

was based on the exchange rates provided by the<br />

particular arranger as of 31 December <strong>2007</strong>. We consider<br />

these rates not to be in line with usual market conditions<br />

due to the financial market crisis; generally, they<br />

are so-called “firesale prices”.<br />

Income from available-for-sale investment securities<br />

(AfS) includes those amounts totaling W 9,000 (previous<br />

year W 367,000) which were removed from equity as<br />

part of the derecognition of financial instruments and<br />

allocated to the income statement.<br />

(49) Net Income/Loss from Investment Property<br />

<strong>2007</strong> 2006<br />

1 thousands<br />

Rental income 317 0<br />

Income from disposals 1,823 62<br />

Income from investment property 2,140 62<br />

Operating expenses for leased properties 185 0<br />

Write-offs and impairment losses 52 0<br />

Expenses from investment property 237 0<br />

Income/loss from fair value adjustment – 16 – 343<br />

Net income/loss from investment property 1,887 – 281