Annual Report LRP 2007 - Rheinland Pfalz Bank

Annual Report LRP 2007 - Rheinland Pfalz Bank

Annual Report LRP 2007 - Rheinland Pfalz Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES<br />

<strong>LRP</strong> <strong>2007</strong><br />

133<br />

(81) Letters of Comfort<br />

Except for political risks, the <strong>Bank</strong> ensures that LRI<br />

Landesbank <strong>Rheinland</strong>-<strong>Pfalz</strong> International S.A., Luxembourg,<br />

is in a position to fulfill its obligations.<br />

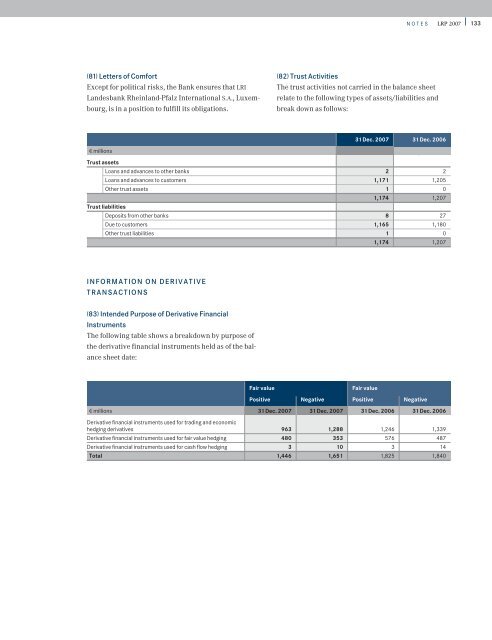

(82) Trust Activities<br />

The trust activities not carried in the balance sheet<br />

relate to the following types of assets/liabilities and<br />

break down as follows:<br />

31Dec. <strong>2007</strong> 31Dec. 2006<br />

1 millions<br />

Trust assets<br />

Loans and advances to other banks 2 2<br />

Loans and advances to customers 1,171 1,205<br />

Other trust assets 1 0<br />

1,174 1,207<br />

Trust liabilities<br />

Deposits from other banks 8 27<br />

Due to customers 1,165 1,180<br />

Other trust liabilities 1 0<br />

1,174 1,207<br />

INFORMATION ON DERIVATIVE<br />

TRANSACTIONS<br />

(83) Intended Purpose of Derivative Financial<br />

Instruments<br />

The following table shows a breakdown by purpose of<br />

the derivative financial instruments held as of the balance<br />

sheet date:<br />

Fair value<br />

Fair value<br />

Positive Negative Positive Negative<br />

1 millions 31Dec. <strong>2007</strong> 31Dec. <strong>2007</strong> 31Dec. 2006 31Dec. 2006<br />

Derivative financial instruments used for trading and economic<br />

hedging derivatives 963 1,288 1,246 1,339<br />

Derivative financial instruments used for fair value hedging 480 353 576 487<br />

Derivative financial instruments used for cash flow hedging 3 10 3 14<br />

Total 1,446 1,651 1,825 1,840