Annual Report LRP 2007 - Rheinland Pfalz Bank

Annual Report LRP 2007 - Rheinland Pfalz Bank

Annual Report LRP 2007 - Rheinland Pfalz Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

114 <strong>LRP</strong> <strong>2007</strong> CONSOLIDATED FINANCIAL STATEMENTS<br />

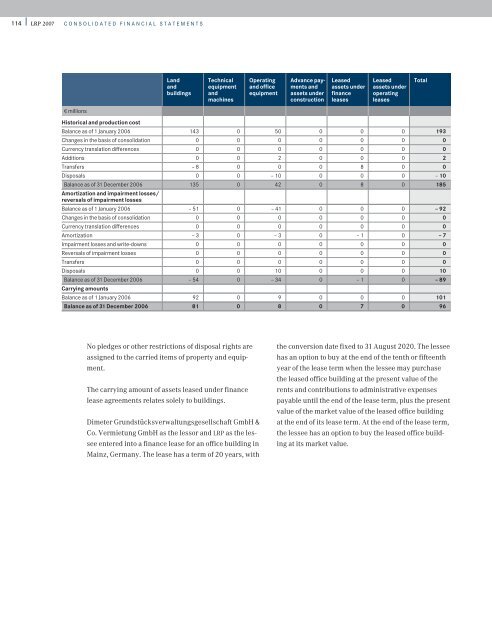

1 millions<br />

Land Technical Operating Advance pay- Leased Leased Total<br />

and equipment and office ments and assets under assets under<br />

buildings and equipment assets under finance operating<br />

machines construction leases leases<br />

Historical and production cost<br />

Balance as of1 January 2006 143 0 50 0 0 0 193<br />

Changes in the basis of consolidation 0 0 0 0 0 0 0<br />

Currency translation differences 0 0 0 0 0 0 0<br />

Additions 0 0 2 0 0 0 2<br />

Transfers – 8 0 0 0 8 0 0<br />

Disposals 0 0 – 10 0 0 0 – 10<br />

Balance as of 31 December 2006 135 0 42 0 8 0 185<br />

Amortization and impairment losses/<br />

reversals of impairment losses<br />

Balance as of1 January 2006 – 51 0 – 41 0 0 0 – 92<br />

Changes in the basis of consolidation 0 0 0 0 0 0 0<br />

Currency translation differences 0 0 0 0 0 0 0<br />

Amortization – 3 0 – 3 0 – 1 0 – 7<br />

Impairment losses and write-downs 0 0 0 0 0 0 0<br />

Reversals of impairment losses 0 0 0 0 0 0 0<br />

Transfers 0 0 0 0 0 0 0<br />

Disposals 0 0 10 0 0 0 10<br />

Balance as of 31 December 2006 – 54 0 – 34 0 – 1 0 – 89<br />

Carrying amounts<br />

Balance as of 1 January 2006 92 0 9 0 0 0 101<br />

Balance as of 31 December 2006 81 0 8 0 7 0 96<br />

No pledges or other restrictions of disposal rights are<br />

assigned to the carried items of property and equipment.<br />

The carrying amount of assets leased under finance<br />

lease agreements relates solely to buildings.<br />

Dimeter Grundstücksverwaltungsgesellschaft GmbH &<br />

Co. Vermietung GmbH as the lessor and <strong>LRP</strong> as the lessee<br />

entered into a finance lease for an office building in<br />

Mainz, Germany. The lease has a term of 20 years, with<br />

the conversion date fixed to 31 August 2020. The lessee<br />

has an option to buy at the end of the tenth or fifteenth<br />

year of the lease term when the lessee may purchase<br />

the leased office building at the present value of the<br />

rents and contributions to administrative expenses<br />

payable until the end of the lease term, plus the present<br />

value of the market value of the leased office building<br />

at the end of its lease term. At the end of the lease term,<br />

the lessee has an option to buy the leased office building<br />

at its market value.