Annual Report LRP 2007 - Rheinland Pfalz Bank

Annual Report LRP 2007 - Rheinland Pfalz Bank

Annual Report LRP 2007 - Rheinland Pfalz Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

132 <strong>LRP</strong> <strong>2007</strong> CONSOLIDATED FINANCIAL STATEMENTS<br />

OFF-BALANCE-SHEET TRANSACTIONS AND<br />

OBLIGATIONS<br />

(80) Contingent Liabilities and Other Obligations<br />

as well as Contingent Assets<br />

Contingent liabilities arise from contractually agreed<br />

possible future obligations that are not yet likely to materialize<br />

(probability of occurrence less than 50 %).<br />

These obligations may arise both from guarantees given<br />

and from credit lines granted to customers for a<br />

specified period, but not yet drawn down. Recognized<br />

amounts reflect the possible obligations that may arise<br />

if credit lines or guarantees granted are utilized in the<br />

maximum amount. The probability of an outflow of assets<br />

is reviewed on a regular basis and, if there are indications<br />

of a probable drawdown, a provision is recognized.<br />

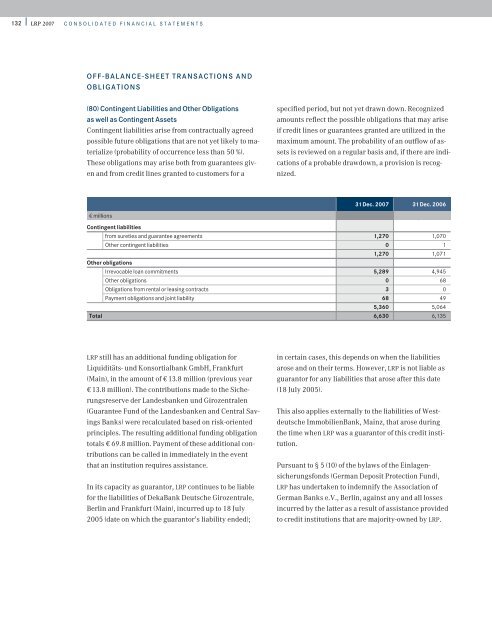

31Dec. <strong>2007</strong> 31Dec. 2006<br />

1 millions<br />

Contingent liabilities<br />

from sureties and guarantee agreements 1,270 1,070<br />

Other contingent liabilities 0 1<br />

1,270 1,071<br />

Other obligations<br />

Irrevocable loan commitments 5,289 4,945<br />

Other obligations 0 68<br />

Obligations from rental or leasing contracts 3 0<br />

Payment obligations and joint liability 68 49<br />

5,360 5,064<br />

Total 6,630 6,135<br />

<strong>LRP</strong> still has an additional funding obligation for<br />

Liquiditäts- und Konsortialbank GmbH, Frankfurt<br />

(Main), in the amount of W 13.8 million (previous year<br />

W 13.8 million). The contributions made to the Sicherungsreserve<br />

der Landesbanken und Girozentralen<br />

(Guarantee Fund of the Landesbanken and Central Savings<br />

<strong>Bank</strong>s) were recalculated based on risk-oriented<br />

principles. The resulting additional funding obligation<br />

totals W 69.8 million. Payment of these additional contributions<br />

can be called in immediately in the event<br />

that an institution requires assistance.<br />

In its capacity as guarantor, <strong>LRP</strong> continues to be liable<br />

for the liabilities of Deka<strong>Bank</strong> Deutsche Girozentrale,<br />

Berlin and Frankfurt (Main), incurred up to 18 July<br />

2005 (date on which the guarantor’s liability ended);<br />

in certain cases, this depends on when the liabilities<br />

arose and on their terms. However, <strong>LRP</strong> is not liable as<br />

guarantor for any liabilities that arose after this date<br />

(18 July 2005).<br />

This also applies externally to the liabilities of Westdeutsche<br />

Immobilien<strong>Bank</strong>, Mainz, that arose during<br />

the time when <strong>LRP</strong> was a guarantor of this credit institution.<br />

Pursuant to § 5 (10) of the bylaws of the Einlagensicherungsfonds<br />

(German Deposit Protection Fund),<br />

<strong>LRP</strong> has undertaken to indemnify the Association of<br />

German <strong>Bank</strong>s e.V., Berlin, against any and all losses<br />

incurred by the latter as a result of assistance provided<br />

to credit institutions that are majority-owned by <strong>LRP</strong>.