Comprehensive Annual Financial Report June 30, 2011 - Western ...

Comprehensive Annual Financial Report June 30, 2011 - Western ...

Comprehensive Annual Financial Report June 30, 2011 - Western ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

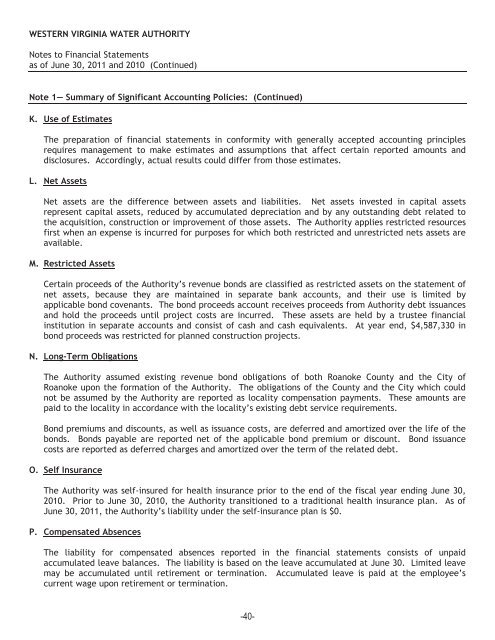

WESTERN VIRGINIA WATER AUTHORITY<br />

Notes to <strong>Financial</strong> Statements<br />

as of <strong>June</strong> <strong>30</strong>, <strong>2011</strong> and 2010 (Continued)<br />

Note 1— Summary of Significant Accounting Policies: (Continued)<br />

K. Use of Estimates<br />

The preparation of financial statements in conformity with generally accepted accounting principles<br />

requires management to make estimates and assumptions that affect certain reported amounts and<br />

disclosures. Accordingly, actual results could differ from those estimates.<br />

L. Net Assets<br />

Net assets are the difference between assets and liabilities. Net assets invested in capital assets<br />

represent capital assets, reduced by accumulated depreciation and by any outstanding debt related to<br />

the acquisition, construction or improvement of those assets. The Authority applies restricted resources<br />

first when an expense is incurred for purposes for which both restricted and unrestricted nets assets are<br />

available.<br />

M. Restricted Assets<br />

Certain proceeds of the Authority’s revenue bonds are classified as restricted assets on the statement of<br />

net assets, because they are maintained in separate bank accounts, and their use is limited by<br />

applicable bond covenants. The bond proceeds account receives proceeds from Authority debt issuances<br />

and hold the proceeds until project costs are incurred. These assets are held by a trustee financial<br />

institution in separate accounts and consist of cash and cash equivalents. At year end, $4,587,3<strong>30</strong> in<br />

bond proceeds was restricted for planned construction projects.<br />

N. Long-Term Obligations<br />

The Authority assumed existing revenue bond obligations of both Roanoke County and the City of<br />

Roanoke upon the formation of the Authority. The obligations of the County and the City which could<br />

not be assumed by the Authority are reported as locality compensation payments. These amounts are<br />

paid to the locality in accordance with the locality’s existing debt service requirements.<br />

Bond premiums and discounts, as well as issuance costs, are deferred and amortized over the life of the<br />

bonds. Bonds payable are reported net of the applicable bond premium or discount. Bond issuance<br />

costs are reported as deferred charges and amortized over the term of the related debt.<br />

O. Self Insurance<br />

The Authority was self-insured for health insurance prior to the end of the fiscal year ending <strong>June</strong> <strong>30</strong>,<br />

2010. Prior to <strong>June</strong> <strong>30</strong>, 2010, the Authority transitioned to a traditional health insurance plan. As of<br />

<strong>June</strong> <strong>30</strong>, <strong>2011</strong>, the Authority’s liability under the self-insurance plan is $0.<br />

P. Compensated Absences<br />

The liability for compensated absences reported in the financial statements consists of unpaid<br />

accumulated leave balances. The liability is based on the leave accumulated at <strong>June</strong> <strong>30</strong>. Limited leave<br />

may be accumulated until retirement or termination. Accumulated leave is paid at the employee’s<br />

current wage upon retirement or termination.<br />

-40-