Retirement Plan booklet - sdcera

Retirement Plan booklet - sdcera

Retirement Plan booklet - sdcera

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

17<br />

Calculating<br />

your retirement benefit (continued)<br />

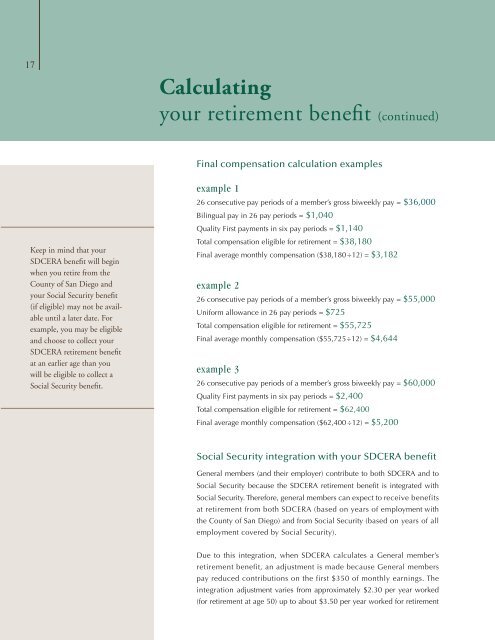

Final compensation calculation examples<br />

Keep in mind that your<br />

SDCERA benefit will begin<br />

when you retire from the<br />

County of San Diego and<br />

your Social Security benefit<br />

(if eligible) may not be available<br />

until a later date. For<br />

example, you may be eligible<br />

and choose to collect your<br />

SDCERA retirement benefit<br />

at an earlier age than you<br />

will be eligible to collect a<br />

Social Security benefit.<br />

example 1<br />

26 consecutive pay periods of a member’s gross biweekly pay = $36,000<br />

Bilingual pay in 26 pay periods = $1,040<br />

Quality First payments in six pay periods = $1,140<br />

Total compensation eligible for retirement = $38,180<br />

Final average monthly compensation ($38,180÷12) = $3,182<br />

example 2<br />

26 consecutive pay periods of a member’s gross biweekly pay = $55,000<br />

Uniform allowance in 26 pay periods = $725<br />

Total compensation eligible for retirement = $55,725<br />

Final average monthly compensation ($55,725÷12) = $4,644<br />

example 3<br />

26 consecutive pay periods of a member’s gross biweekly pay = $60,000<br />

Quality First payments in six pay periods = $2,400<br />

Total compensation eligible for retirement = $62,400<br />

Final average monthly compensation ($62,400 ÷12) = $5,200<br />

Social Security integration with your SDCERA benefit<br />

General members (and their employer) contribute to both SDCERA and to<br />

Social Security because the SDCERA retirement benefit is integrated with<br />

Social Security. Therefore, general members can expect to receive benefits<br />

at retirement from both SDCERA (based on years of employment with<br />

the County of San Diego) and from Social Security (based on years of all<br />

employment covered by Social Security).<br />

Due to this integration, when SDCERA calculates a General member’s<br />

retirement benefit, an adjustment is made because General members<br />

pay reduced contributions on the first $350 of monthly earnings. The<br />

integration adjustment varies from approximately $2.30 per year worked<br />

(for retirement at age 50) up to about $3.50 per year worked for retirement