Download - Ministry of Finance, Economic Affairs, Planning & Social ...

Download - Ministry of Finance, Economic Affairs, Planning & Social ...

Download - Ministry of Finance, Economic Affairs, Planning & Social ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

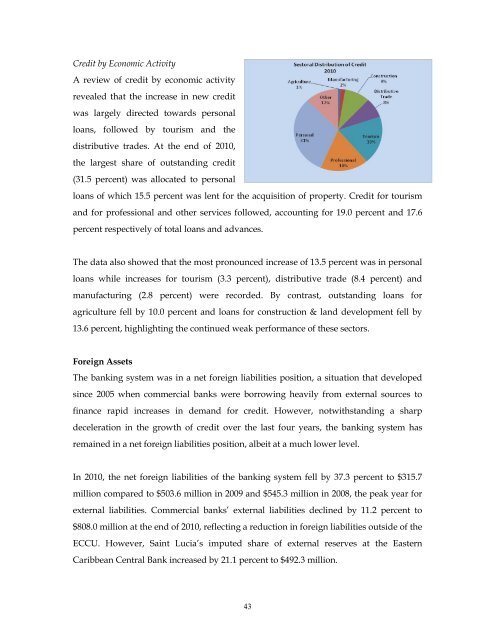

Credit by <strong>Economic</strong> Activity<br />

A review <strong>of</strong> credit by economic activity<br />

revealed that the increase in new credit<br />

was largely directed towards personal<br />

loans, followed by tourism and the<br />

distributive trades. At the end <strong>of</strong> 2010,<br />

the largest share <strong>of</strong> outstanding credit<br />

(31.5 percent) was allocated to personal<br />

loans <strong>of</strong> which 15.5 percent was lent for the acquisition <strong>of</strong> property. Credit for tourism<br />

and for pr<strong>of</strong>essional and other services followed, accounting for 19.0 percent and 17.6<br />

percent respectively <strong>of</strong> total loans and advances.<br />

The data also showed that the most pronounced increase <strong>of</strong> 13.5 percent was in personal<br />

loans while increases for tourism (3.3 percent), distributive trade (8.4 percent) and<br />

manufacturing (2.8 percent) were recorded. By contrast, outstanding loans for<br />

agriculture fell by 10.0 percent and loans for construction & land development fell by<br />

13.6 percent, highlighting the continued weak performance <strong>of</strong> these sectors.<br />

Foreign Assets<br />

The banking system was in a net foreign liabilities position, a situation that developed<br />

since 2005 when commercial banks were borrowing heavily from external sources to<br />

finance rapid increases in demand for credit. However, notwithstanding a sharp<br />

deceleration in the growth <strong>of</strong> credit over the last four years, the banking system has<br />

remained in a net foreign liabilities position, albeit at a much lower level.<br />

In 2010, the net foreign liabilities <strong>of</strong> the banking system fell by 37.3 percent to $315.7<br />

million compared to $503.6 million in 2009 and $545.3 million in 2008, the peak year for<br />

external liabilities. Commercial banks‟ external liabilities declined by 11.2 percent to<br />

$808.0 million at the end <strong>of</strong> 2010, reflecting a reduction in foreign liabilities outside <strong>of</strong> the<br />

ECCU. However, Saint Lucia‟s imputed share <strong>of</strong> external reserves at the Eastern<br />

Caribbean Central Bank increased by 21.1 percent to $492.3 million.<br />

43