here - SMDA - NSW Government

here - SMDA - NSW Government

here - SMDA - NSW Government

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financials - Sydney Metropolitan Development Authority<br />

Notes to the Financial Statements for year ending 30 June 2012<br />

(o) Changes in accounting policies<br />

In the current period, the Authority has<br />

adopted all of the new and revised<br />

Standards and Interpretations that are<br />

relevant to its operations and which are<br />

effective for current reporting period<br />

beginning on 1 July 2011. As a result,<br />

the Authority has changed its accounting<br />

policies and disclosure in relation to the<br />

presentation of financial statements.<br />

When the presentation or classification<br />

of items in the financial statements<br />

are amended, comparative<br />

amounts are reclassified unless the<br />

reclassification is impracticable.<br />

When comparative amounts are<br />

reclassified, the Authority discloses:<br />

––<br />

the nature of the reclassification;<br />

––<br />

the amount of each item or class<br />

of items that is reclassified; and<br />

––<br />

the reason for the reclassification.<br />

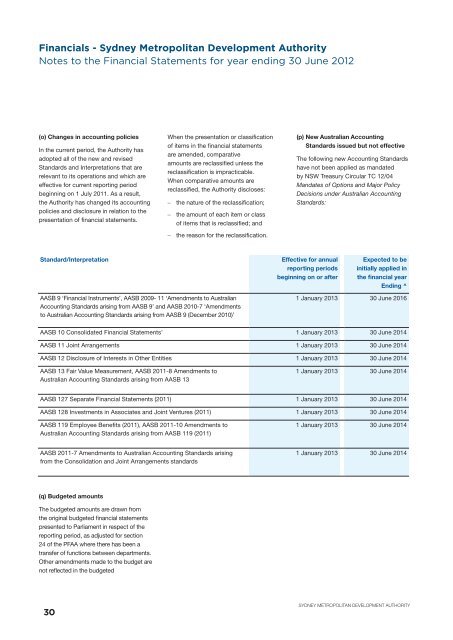

(p) New Australian Accounting<br />

Standards issued but not effective<br />

The following new Accounting Standards<br />

have not been applied as mandated<br />

by <strong>NSW</strong> Treasury Circular TC 12/04<br />

Mandates of Options and Major Policy<br />

Decisions under Australian Accounting<br />

Standards:<br />

Standard/Interpretation<br />

Effective for annual<br />

reporting periods<br />

beginning on or after<br />

Expected to be<br />

initially applied in<br />

the financial year<br />

Ending ^<br />

AASB 9 ‘Financial Instruments’, AASB 2009- 11 ‘Amendments to Australian<br />

Accounting Standards arising from AASB 9’ and AASB 2010-7 ‘Amendments<br />

to Australian Accounting Standards arising from AASB 9 (December 2010)’<br />

1 January 2013 30 June 2016<br />

AASB 10 Consolidated Financial Statements’ 1 January 2013 30 June 2014<br />

AASB 11 Joint Arrangements 1 January 2013 30 June 2014<br />

AASB 12 Disclosure of Interests in Other Entities 1 January 2013 30 June 2014<br />

AASB 13 Fair Value Measurement, AASB 2011-8 Amendments to<br />

Australian Accounting Standards arising from AASB 13<br />

1 January 2013 30 June 2014<br />

AASB 127 Separate Financial Statements (2011) 1 January 2013 30 June 2014<br />

AASB 128 Investments in Associates and Joint Ventures (2011) 1 January 2013 30 June 2014<br />

AASB 119 Employee Benefits (2011), AASB 2011-10 Amendments to<br />

Australian Accounting Standards arising from AASB 119 (2011)<br />

1 January 2013 30 June 2014<br />

AASB 2011-7 Amendments to Australian Accounting Standards arising<br />

from the Consolidation and Joint Arrangements standards<br />

1 January 2013 30 June 2014<br />

(q) Budgeted amounts<br />

The budgeted amounts are drawn from<br />

the original budgeted financial statements<br />

presented to Parliament in respect of the<br />

reporting period, as adjusted for section<br />

24 of the PFAA w<strong>here</strong> t<strong>here</strong> has been a<br />

transfer of functions between departments.<br />

Other amendments made to the budget are<br />

not reflected in the budgeted<br />

30<br />

SYDNEY METROPOLITAN DEVELOPMENT AUTHORITY