here - SMDA - NSW Government

here - SMDA - NSW Government

here - SMDA - NSW Government

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

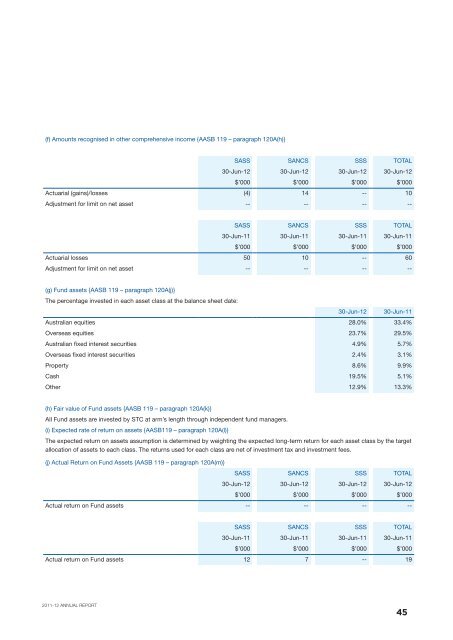

(f) Amounts recognised in other comprehensive income {AASB 119 – paragraph 120A(h)}<br />

SASS SANCS SSS TOTAL<br />

30-Jun-12 30-Jun-12 30-Jun-12 30-Jun-12<br />

$’000 $’000 $’000 $’000<br />

Actuarial (gains)/losses (4) 14 -- 10<br />

Adjustment for limit on net asset -- -- -- --<br />

SASS SANCS SSS TOTAL<br />

30-Jun-11 30-Jun-11 30-Jun-11 30-Jun-11<br />

$’000 $’000 $’000 $’000<br />

Actuarial losses 50 10 -- 60<br />

Adjustment for limit on net asset -- -- -- --<br />

(g) Fund assets {AASB 119 – paragraph 120A(j)}<br />

The percentage invested in each asset class at the balance sheet date:<br />

30-Jun-12 30-Jun-11<br />

Australian equities 28.0% 33.4%<br />

Overseas equities 23.7% 29.5%<br />

Australian fixed interest securities 4.9% 5.7%<br />

Overseas fixed interest securities 2.4% 3.1%<br />

Property 8.6% 9.9%<br />

Cash 19.5% 5.1%<br />

Other 12.9% 13.3%<br />

(h) Fair value of Fund assets {AASB 119 – paragraph 120A(k)}<br />

All Fund assets are invested by STC at arm’s length through independent fund managers.<br />

(i) Expected rate of return on assets {AASB119 – paragraph 120A(l)}<br />

The expected return on assets assumption is determined by weighting the expected long-term return for each asset class by the target<br />

allocation of assets to each class. The returns used for each class are net of investment tax and investment fees.<br />

(j) Actual Return on Fund Assets {AASB 119 – paragraph 120A(m)}<br />

SASS SANCS SSS TOTAL<br />

30-Jun-12 30-Jun-12 30-Jun-12 30-Jun-12<br />

$’000 $’000 $’000 $’000<br />

Actual return on Fund assets -- -- -- --<br />

SASS SANCS SSS TOTAL<br />

30-Jun-11 30-Jun-11 30-Jun-11 30-Jun-11<br />

$’000 $’000 $’000 $’000<br />

Actual return on Fund assets 12 7 -- 19<br />

2011-12 ANNUAL REPORT<br />

45