here - SMDA - NSW Government

here - SMDA - NSW Government

here - SMDA - NSW Government

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

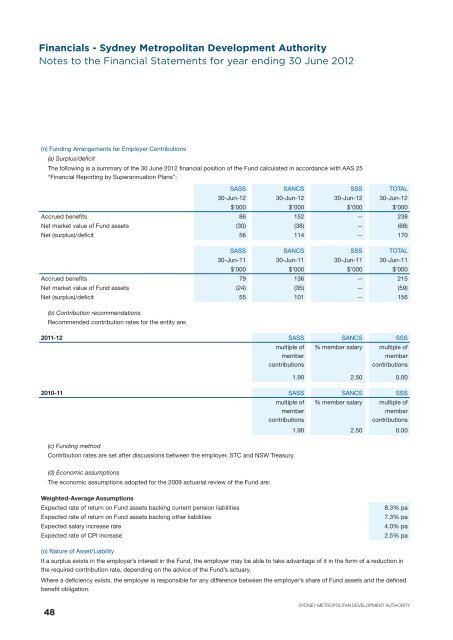

Financials - Sydney Metropolitan Development Authority<br />

Notes to the Financial Statements for year ending 30 June 2012<br />

(n) Funding Arrangements for Employer Contributions<br />

(a) Surplus/deficit<br />

The following is a summary of the 30 June 2012 financial position of the Fund calculated in accordance with AAS 25<br />

“Financial Reporting by Superannuation Plans”:<br />

SASS SANCS SSS TOTAL<br />

30-Jun-12 30-Jun-12 30-Jun-12 30-Jun-12<br />

$’000 $’000 $’000 $’000<br />

Accrued benefits 86 152 -- 238<br />

Net market value of Fund assets (30) (38) -- (68)<br />

Net (surplus)/deficit 56 114 -- 170<br />

SASS SANCS SSS TOTAL<br />

30-Jun-11 30-Jun-11 30-Jun-11 30-Jun-11<br />

$’000 $’000 $’000 $’000<br />

Accrued benefits 79 136 -- 215<br />

Net market value of Fund assets (24) (35) -- (59)<br />

Net (surplus)/deficit 55 101 -- 156<br />

(b) Contribution recommendations<br />

Recommended contribution rates for the entity are:<br />

2011-12 SASS SANCS SSS<br />

multiple of<br />

member<br />

contributions<br />

% member salary multiple of<br />

member<br />

contributions<br />

1.90 2.50 0.00<br />

2010-11 SASS SANCS SSS<br />

multiple of<br />

member<br />

contributions<br />

(c) Funding method<br />

Contribution rates are set after discussions between the employer, STC and <strong>NSW</strong> Treasury.<br />

% member salary multiple of<br />

member<br />

contributions<br />

1.90 2.50 0.00<br />

(d) Economic assumptions<br />

The economic assumptions adopted for the 2009 actuarial review of the Fund are:<br />

Weighted-Average Assumptions<br />

Expected rate of return on Fund assets backing current pension liabilities<br />

Expected rate of return on Fund assets backing other liabilities<br />

Expected salary increase rate<br />

Expected rate of CPI increase<br />

8.3% pa<br />

7.3% pa<br />

4.0% pa<br />

2.5% pa<br />

(o) Nature of Asset/Liability<br />

If a surplus exists in the employer’s interest in the Fund, the employer may be able to take advantage of it in the form of a reduction in<br />

the required contribution rate, depending on the advice of the Fund’s actuary.<br />

W<strong>here</strong> a deficiency exists, the employer is responsible for any difference between the employer’s share of Fund assets and the defined<br />

benefit obligation.<br />

48<br />

SYDNEY METROPOLITAN DEVELOPMENT AUTHORITY