here - SMDA - NSW Government

here - SMDA - NSW Government

here - SMDA - NSW Government

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

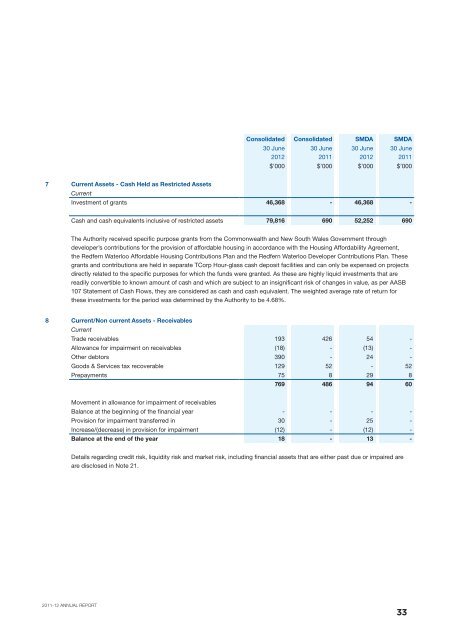

Consolidated Consolidated <strong>SMDA</strong> <strong>SMDA</strong><br />

30 June<br />

2012<br />

30 June<br />

2011<br />

30 June<br />

2012<br />

30 June<br />

2011<br />

$’000 $’000 $’000 $’000<br />

7 Current Assets - Cash Held as Restricted Assets<br />

Current<br />

Investment of grants 46,368 - 46,368 -<br />

Cash and cash equivalents inclusive of restricted assets 79,816 690 52,252 690<br />

The Authority received specific purpose grants from the Commonwealth and New South Wales <strong>Government</strong> through<br />

developer’s contributions for the provision of affordable housing in accordance with the Housing Affordability Agreement,<br />

the Redfern Waterloo Affordable Housing Contributions Plan and the Redfern Waterloo Developer Contributions Plan. These<br />

grants and contributions are held in separate TCorp Hour-glass cash deposit facilities and can only be expensed on projects<br />

directly related to the specific purposes for which the funds were granted. As these are highly liquid investments that are<br />

readily convertible to known amount of cash and which are subject to an insignificant risk of changes in value, as per AASB<br />

107 Statement of Cash Flows, they are considered as cash and cash equivalent. The weighted average rate of return for<br />

these investments for the period was determined by the Authority to be 4.68%.<br />

8 Current/Non current Assets - Receivables<br />

Current<br />

Trade receivables 193 426 54 -<br />

Allowance for impairment on receivables (18) - (13) -<br />

Other debtors 390 - 24 -<br />

Goods & Services tax recoverable 129 52 - 52<br />

Prepayments 75 8 29 8<br />

769 486 94 60<br />

Movement in allowance for impairment of receivables<br />

Balance at the beginning of the financial year - - - -<br />

Provision for impairment transferred in 30 - 25 -<br />

Increase/(decrease) in provision for impairment (12) - (12) -<br />

Balance at the end of the year 18 - 13 -<br />

Details regarding credit risk, liquidity risk and market risk, including financial assets that are either past due or impaired are<br />

are disclosed in Note 21.<br />

2011-12 ANNUAL REPORT<br />

33