2009/2010 Stage 2 Problem Statement - SME

2009/2010 Stage 2 Problem Statement - SME

2009/2010 Stage 2 Problem Statement - SME

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2009</strong>-<strong>2010</strong> <strong>SME</strong>/NSSGA Student Design Competition<br />

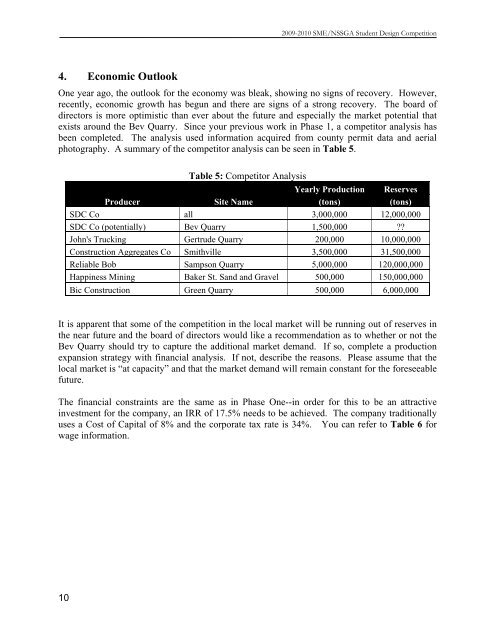

4. Economic Outlook<br />

One year ago, the outlook for the economy was bleak, showing no signs of recovery. However,<br />

recently, economic growth has begun and there are signs of a strong recovery. The board of<br />

directors is more optimistic than ever about the future and especially the market potential that<br />

exists around the Bev Quarry. Since your previous work in Phase 1, a competitor analysis has<br />

been completed. The analysis used information acquired from county permit data and aerial<br />

photography. A summary of the competitor analysis can be seen in Table 5.<br />

Table 5: Competitor Analysis<br />

Yearly Production Reserves<br />

Producer Site Name (tons) (tons)<br />

SDC Co all 3,000,000 12,000,000<br />

SDC Co (potentially) Bev Quarry 1,500,000 ??<br />

John's Trucking Gertrude Quarry 200,000 10,000,000<br />

Construction Aggregates Co Smithville 3,500,000 31,500,000<br />

Reliable Bob Sampson Quarry 5,000,000 120,000,000<br />

Happiness Mining Baker St. Sand and Gravel 500,000 150,000,000<br />

Bic Construction Green Quarry 500,000 6,000,000<br />

It is apparent that some of the competition in the local market will be running out of reserves in<br />

the near future and the board of directors would like a recommendation as to whether or not the<br />

Bev Quarry should try to capture the additional market demand. If so, complete a production<br />

expansion strategy with financial analysis. If not, describe the reasons. Please assume that the<br />

local market is “at capacity” and that the market demand will remain constant for the foreseeable<br />

future.<br />

The financial constraints are the same as in Phase One--in order for this to be an attractive<br />

investment for the company, an IRR of 17.5% needs to be achieved. The company traditionally<br />

uses a Cost of Capital of 8% and the corporate tax rate is 34%. You can refer to Table 6 for<br />

wage information.<br />

10