Lintner Revisited: A Quantitative Analysis of Managed ... - CME Group

Lintner Revisited: A Quantitative Analysis of Managed ... - CME Group

Lintner Revisited: A Quantitative Analysis of Managed ... - CME Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

cmegroup.com<br />

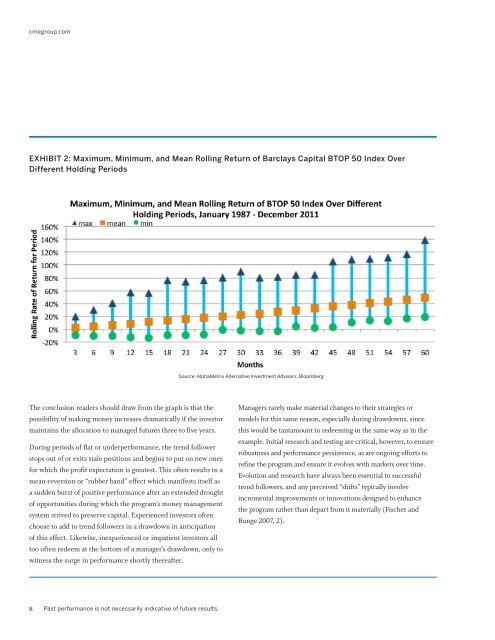

EXHIBIT 2: Maximum, Minimum, and Mean Rolling Return <strong>of</strong> Barclays Capital BTOP 50 Index Over<br />

Different Holding Periods<br />

Source: AlphaMetrix Alternative Investment Advisors, Bloomberg<br />

The conclusion readers should draw from the graph is that the<br />

possibility <strong>of</strong> making money increases dramatically if the investor<br />

maintains the allocation to managed futures three to five years.<br />

During periods <strong>of</strong> flat or underperformance, the trend follower<br />

stops out <strong>of</strong> or exits stale positions and begins to put on new ones<br />

for which the pr<strong>of</strong>it expectation is greatest. This <strong>of</strong>ten results in a<br />

mean-reversion or “rubber band” effect which manifests itself as<br />

a sudden burst <strong>of</strong> positive performance after an extended drought<br />

<strong>of</strong> opportunities during which the program’s money management<br />

system strived to preserve capital. Experienced investors <strong>of</strong>ten<br />

choose to add to trend followers in a drawdown in anticipation<br />

<strong>of</strong> this effect. Likewise, inexperienced or impatient investors all<br />

too <strong>of</strong>ten redeem at the bottom <strong>of</strong> a manager’s drawdown, only to<br />

witness the surge in performance shortly thereafter.<br />

Managers rarely make material changes to their strategies or<br />

models for this same reason, especially during drawdowns, since<br />

this would be tantamount to redeeming in the same way as in the<br />

example. Initial research and testing are critical, however, to ensure<br />

robustness and performance persistence, as are ongoing efforts to<br />

refine the program and ensure it evolves with markets over time.<br />

Evolution and research have always been essential to successful<br />

trend followers, and any perceived “shifts” typically involve<br />

incremental improvements or innovations designed to enhance<br />

the program rather than depart from it materially (Fischer and<br />

Bunge 2007, 2).<br />

8<br />

Past performance is not necessarily indicative <strong>of</strong> future results.

![Definitions & Concepts... [PDF] - Cycles Research Institute](https://img.yumpu.com/26387731/1/190x245/definitions-concepts-pdf-cycles-research-institute.jpg?quality=85)