Lintner Revisited: A Quantitative Analysis of Managed ... - CME Group

Lintner Revisited: A Quantitative Analysis of Managed ... - CME Group

Lintner Revisited: A Quantitative Analysis of Managed ... - CME Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

cmegroup.com<br />

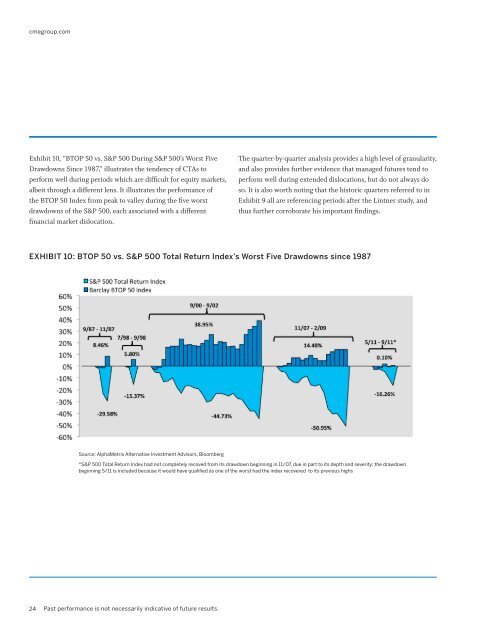

Exhibit 10, “BTOP 50 vs. S&P 500 During S&P 500’s Worst Five<br />

Drawdowns Since 1987,” illustrates the tendency <strong>of</strong> CTAs to<br />

perform well during periods which are difficult for equity markets,<br />

albeit through a different lens. It illustrates the performance <strong>of</strong><br />

the BTOP 50 Index from peak to valley during the five worst<br />

drawdowns <strong>of</strong> the S&P 500, each associated with a different<br />

financial market dislocation.<br />

The quarter-by-quarter analysis provides a high level <strong>of</strong> granularity,<br />

and also provides further evidence that managed futures tend to<br />

perform well during extended dislocations, but do not always do<br />

so. It is also worth noting that the historic quarters referred to in<br />

Exhibit 9 all are referencing periods after the <strong>Lintner</strong> study, and<br />

thus further corroborate his important findings.<br />

EXHIBIT 10: BTOP 50 vs. S&P 500 Total Return Index’s Worst Five Drawdowns since 1987<br />

Source: AlphaMetrix Alternative Investment Advisors, Bloomberg<br />

*S&P 500 Total Return Index had not completely recoved from its drawdown beginning in 11/07, due in part to its depth and severity; the drawdown<br />

beginning 5/11 is included because it would have qualified as one <strong>of</strong> the worst had the index recovered to its previous highs<br />

24<br />

Past performance is not necessarily indicative <strong>of</strong> future results.

![Definitions & Concepts... [PDF] - Cycles Research Institute](https://img.yumpu.com/26387731/1/190x245/definitions-concepts-pdf-cycles-research-institute.jpg?quality=85)