Stochastic Volatility and Seasonality in ... - Interconti, Limited

Stochastic Volatility and Seasonality in ... - Interconti, Limited

Stochastic Volatility and Seasonality in ... - Interconti, Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

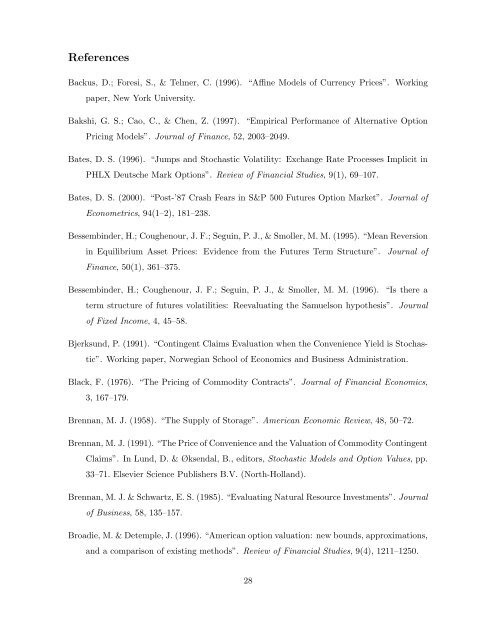

References<br />

Backus, D.; Foresi, S., & Telmer, C. (1996). “Aff<strong>in</strong>e Models of Currency Prices”. Work<strong>in</strong>g<br />

paper, New York University.<br />

Bakshi, G. S.; Cao, C., & Chen, Z. (1997). “Empirical Performance of Alternative Option<br />

Pric<strong>in</strong>g Models”. Journal of F<strong>in</strong>ance, 52, 2003–2049.<br />

Bates, D. S. (1996). “Jumps <strong>and</strong> <strong>Stochastic</strong> <strong>Volatility</strong>: Exchange Rate Processes Implicit <strong>in</strong><br />

PHLX Deutsche Mark Options”. Review of F<strong>in</strong>ancial Studies, 9(1), 69–107.<br />

Bates, D. S. (2000). “Post-’87 Crash Fears <strong>in</strong> S&P 500 Futures Option Market”. Journal of<br />

Econometrics, 94(1–2), 181–238.<br />

Bessemb<strong>in</strong>der, H.; Coughenour, J. F.; Segu<strong>in</strong>, P. J., & Smoller, M. M. (1995). “Mean Reversion<br />

<strong>in</strong> Equilibrium Asset Prices: Evidence from the Futures Term Structure”. Journal of<br />

F<strong>in</strong>ance, 50(1), 361–375.<br />

Bessemb<strong>in</strong>der, H.; Coughenour, J. F.; Segu<strong>in</strong>, P. J., & Smoller, M. M. (1996). “Is there a<br />

term structure of futures volatilities: Reevaluat<strong>in</strong>g the Samuelson hypothesis”. Journal<br />

of Fixed Income, 4, 45–58.<br />

Bjerksund, P. (1991). “Cont<strong>in</strong>gent Claims Evaluation when the Convenience Yield is <strong>Stochastic</strong>”.<br />

Work<strong>in</strong>g paper, Norwegian School of Economics <strong>and</strong> Bus<strong>in</strong>ess Adm<strong>in</strong>istration.<br />

Black, F. (1976). “The Pric<strong>in</strong>g of Commodity Contracts”. Journal of F<strong>in</strong>ancial Economics,<br />

3, 167–179.<br />

Brennan, M. J. (1958). “The Supply of Storage”. American Economic Review, 48, 50–72.<br />

Brennan, M. J. (1991). “The Price of Convenience <strong>and</strong> the Valuation of Commodity Cont<strong>in</strong>gent<br />

Claims”. In Lund, D. & Øksendal, B., editors, <strong>Stochastic</strong> Models <strong>and</strong> Option Values, pp.<br />

33–71. Elsevier Science Publishers B.V. (North-Holl<strong>and</strong>).<br />

Brennan, M. J. & Schwartz, E. S. (1985). “Evaluat<strong>in</strong>g Natural Resource Investments”. Journal<br />

of Bus<strong>in</strong>ess, 58, 135–157.<br />

Broadie, M. & Detemple, J. (1996). “American option valuation: new bounds, approximations,<br />

<strong>and</strong> a comparison of exist<strong>in</strong>g methods”. Review of F<strong>in</strong>ancial Studies, 9(4), 1211–1250.<br />

28

![Definitions & Concepts... [PDF] - Cycles Research Institute](https://img.yumpu.com/26387731/1/190x245/definitions-concepts-pdf-cycles-research-institute.jpg?quality=85)