Consolidated Financial Statements 1st Semester 2009 - Sonae Sierra

Consolidated Financial Statements 1st Semester 2009 - Sonae Sierra

Consolidated Financial Statements 1st Semester 2009 - Sonae Sierra

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

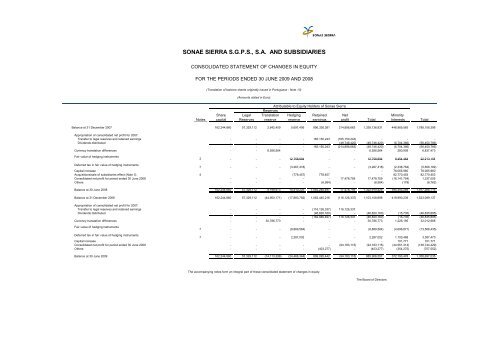

SONAE SIERRA S.G.P.S., S.A. AND SUBSIDIARIES<br />

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY<br />

FOR THE PERIODS ENDED 30 JUNE <strong>2009</strong> AND 2008<br />

(Translation of balance sheets originally issued in Portuguese - Note 13)<br />

(Amounts stated in Euro)<br />

Attributable to Equity Holders of <strong>Sonae</strong> <strong>Sierra</strong><br />

Reserves<br />

Share Legal Translation Hedging Retained Net Minority<br />

Notes capital Reserves reserve reserve earnings profit Total Interests Total<br />

Balance at 31 December 2007 162,244,860 57,329,112 2,642,409 5,697,406 896,326,381 214,896,663 1,339,136,831 448,969,565 1,788,106,396<br />

Appropriation of consolidated net profit for 2007:<br />

Transfer to legal reserves and retained earnings - - - - 165,150,243 (165,150,243) - - -<br />

Dividends distributed - - - - - (49,746,420) (49,746,420) (6,704,366) (56,450,786)<br />

- - - - 165,150,243 (214,896,663) (49,746,420) (6,704,366) (56,450,786)<br />

Currency translation differences - - 6,556,564 - - - 6,556,564 280,909 6,837,473<br />

Fair value of hedging instruments<br />

7 - - - 12,758,694 - - 12,758,694 9,454,464 22,213,158<br />

Deferred tax in fair value of hedging instruments<br />

7 - - - (3,267,418) - - (3,267,418) (2,338,764) (5,606,182)<br />

Capital increase - 78,065,960 78,065,960<br />

Acquisitions/sale of subsidiaries effect (Note 3) 4 (778,457) 778,457 - 82,770,453 82,770,453<br />

<strong>Consolidated</strong> net profit for period ended 30 June 2008 - - - - - 17,478,759 17,478,759 (16,141,754) 1,337,005<br />

Others - - - - (6,584) - (6,584) (178) (6,762)<br />

Balance at 30 June 2008 162,244,860 57,329,112 9,198,973 14,410,225 1,062,248,497 17,478,759 1,322,910,426 594,356,289 1,917,266,715<br />

Balance at 31 December 2008 162,244,860 57,329,112 (44,900,171) (17,883,782) 1,062,445,216 (116,126,337) 1,103,108,898 419,990,239 1,523,099,137<br />

Appropriation of consolidated net profit for 2007:<br />

Transfer to legal reserves and retained earnings - - - - (116,126,337) 116,126,337 - - -<br />

Dividends distributed - - - - (46,820,160) - (46,820,160) (15,735) (46,835,895)<br />

- - - - (162,946,497) 116,126,337 (46,820,160) (15,735) (46,835,895)<br />

Currency translation differences - - 30,786,773 - - - 30,786,773 1,226,195 32,012,968<br />

Fair value of hedging instruments<br />

7 - - - (8,869,564) - - (8,869,564) (4,696,871) (13,566,435)<br />

Deferred tax in fair value of hedging instruments<br />

7 - - - 2,287,002 - - 2,287,002 1,100,468 3,387,470<br />

Capital increase - 101,771 101,771<br />

<strong>Consolidated</strong> net profit for period ended 30 June <strong>2009</strong> - - - - - (94,183,115) (94,183,115) (44,561,314) (138,744,429)<br />

Others - - - - (403,277) - (403,277) (354,275) (757,552)<br />

Balance at 30 June <strong>2009</strong> 162,244,860 57,329,112 (14,113,398) (24,466,344) 899,095,442 (94,183,115) 985,906,557 372,790,478 1,358,697,035<br />

The accompanying notes form an integral part of these consolidated statement of changes in equity.<br />

The Board of Directors