Consolidated Financial Statements 1st Semester 2009 - Sonae Sierra

Consolidated Financial Statements 1st Semester 2009 - Sonae Sierra

Consolidated Financial Statements 1st Semester 2009 - Sonae Sierra

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

These standards already issued by the European Union were not adopted by the Group on the first half of<br />

<strong>2009</strong>, as its applicability is not mandatory. It is not expected to have significant prospective impacts on the<br />

financial statements of the Group, due to the adoption of those standards.<br />

The following standards and interpretations were issued by the IASB and they are not yet endorsed by the<br />

European Union:<br />

Effective<br />

Date<br />

IAS 39 – Ammendments (eligible hedged items)<br />

IFRIC 17 – Distribution of Non-cash Assets to Ow ners<br />

IFRIC 18 – Transfer of assets from customers<br />

Amendment to IFRS7 - Improving disclosures about financial instruments<br />

Improvements to IFRS (2008)<br />

01-Jul-09<br />

01-Jul-09<br />

01-Jul-09<br />

01-Jan-09<br />

Several (the first date<br />

w ill be 01-Jul-09)<br />

From these standards and interpretations already issued by the IASB but not approved by the European<br />

Union, the Group does not anticipate, with the future approval, important impacts in the accompanying<br />

consolidated financial statements.<br />

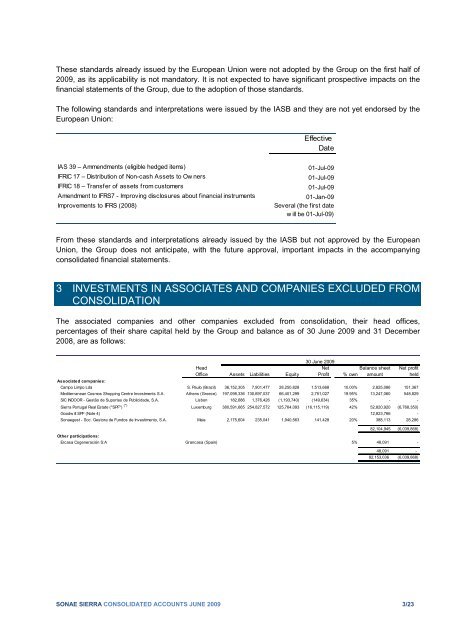

3 INVESTMENTS IN ASSOCIATES AND COMPANIES EXCLUDED FROM<br />

CONSOLIDATION<br />

The associated companies and other companies excluded from consolidation, their head offices,<br />

percentages of their share capital held by the Group and balance as of 30 June <strong>2009</strong> and 31 December<br />

2008, are as follows:<br />

Head<br />

30 June <strong>2009</strong><br />

Net Balance sheet Net profit<br />

Office Assets Liabilities Equity Profit % own amount<br />

held<br />

Associated companies:<br />

Campo Limpo Lda S. Paulo (Brazil) 36,152,305 7,901,477 28,250,828 1,513,668 10.00% 2,825,086 151,367<br />

Mediterranean Cosmos Shopping Centre Investments S.A. Athens (Greece) 197,098,336 130,697,037 66,401,299 2,751,027 19.95% 13,247,060 548,829<br />

SIC INDOOR - Gestão de Suportes de Publicidade, S.A. Lisbon 182,686 1,376,426 (1,193,740) (149,634) 35% - -<br />

<strong>Sierra</strong> Portugal Real Estate ("SPF") (*) Luxemburg 380,591,665 254,827,572 125,764,093 (16,115,119) 42% 52,820,920 (6,768,350)<br />

Goodw ill SPF (Note 4) 12,823,766 -<br />

<strong>Sonae</strong>gest - Soc. Gestora de Fundos de Investimento, S.A. Maia 2,175,604 235,041 1,940,563 141,428 20% 388,113 28,286<br />

82,104,945 (6,039,868)<br />

Other participations:<br />

Ercasa Cogeneración S:A Grancasa (Spain) 5% 48,091 -<br />

48,091 -<br />

82,153,036 (6,039,868)<br />

SONAE SIERRA CONSOLIDATED ACCOUNTS JUNE <strong>2009</strong> 3/23