Consolidated Financial Statements 1st Semester 2009 - Sonae Sierra

Consolidated Financial Statements 1st Semester 2009 - Sonae Sierra

Consolidated Financial Statements 1st Semester 2009 - Sonae Sierra

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

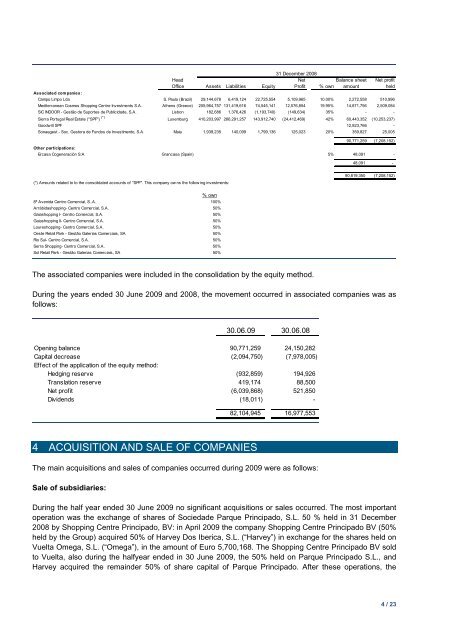

31 December 2008<br />

Head Net Balance sheet Net profit<br />

Office Assets Liabilities Equity Profit % own amount<br />

held<br />

Associated companies:<br />

Campo Limpo Lda S. Paulo (Brazil) 29,144,678 6,419,124 22,725,554 5,109,965 10.00% 2,272,558 510,996<br />

Mediterranean Cosmos Shopping Centre Investments S.A. Athens (Greece) 205,964,757 131,419,616 74,545,141 12,576,854 19.95% 14,871,756 2,509,084<br />

SIC INDOOR - Gestão de Suportes de Publicidade, S.A. Lisbon 182,686 1,376,426 (1,193,740) (149,634) 35% - -<br />

<strong>Sierra</strong> Portugal Real Estate ("SPF") (*) Luxemburg 410,203,997 266,291,257 143,912,740 (24,412,469) 42% 60,443,352 (10,253,237)<br />

Goodw ill SPF 12,823,766 -<br />

<strong>Sonae</strong>gest - Soc. Gestora de Fundos de Investimento, S.A. Maia 1,939,235 140,099 1,799,136 125,023 20% 359,827 25,005<br />

90,771,259 (7,208,152)<br />

Other participations:<br />

Ercasa Cogeneración S:A Grancasa (Spain) 5% 48,091 -<br />

48,091 -<br />

(*) Amounts related to to the consolidated accounts of "SPF". This company ow ns the follow ing investments:<br />

90,819,350 (7,208,152)<br />

% own<br />

8ª Avenida Centro Comercial, S..A. 100%<br />

Arrábidashopping- Centro Comercial, S.A. 50%<br />

Gaiashopping I- Centro Comercial, S.A. 50%<br />

Gaiashopping II- Centro Comercial, S.A. 50%<br />

Loureshopping- Centro Comercial, S.A. 50%<br />

Oeste Retail Park - Gestão Galerias Comerciais, SA 50%<br />

Rio Sul- Centro Comercial, S.A. 50%<br />

Serra Shopping- Centro Comercial, S.A. 50%<br />

Sol Retail Park - Gestão Galerias Comerciais, SA 50%<br />

The associated companies were included in the consolidation by the equity method.<br />

During the years ended 30 June <strong>2009</strong> and 2008, the movement occurred in associated companies was as<br />

follows:<br />

30.06.09 30.06.08<br />

Opening balance 90,771,259 24,150,282<br />

Capital decrease (2,094,750) (7,978,005)<br />

Effect of the application of the equity method:<br />

Hedging reserve (932,859) 194,926<br />

Translation reserve 419,174 88,500<br />

Net profit (6,039,868) 521,850<br />

Dividends (18,011) -<br />

82,104,945 16,977,553<br />

4 ACQUISITION AND SALE OF COMPANIES<br />

The main acquisitions and sales of companies occurred during <strong>2009</strong> were as follows:<br />

Sale of subsidiaries:<br />

During the half year ended 30 June <strong>2009</strong> no significant acquisitions or sales occurred. The most important<br />

operation was the exchange of shares of Sociedade Parque Principado, S.L. 50 % held in 31 December<br />

2008 by Shopping Centre Principado, BV: in April <strong>2009</strong> the company Shopping Centre Principado BV (50%<br />

held by the Group) acquired 50% of Harvey Dos Iberica, S.L. (“Harvey”) in exchange for the shares held on<br />

Vuelta Omega, S.L. (“Omega”), in the amount of Euro 5,700,168. The Shopping Centre Principado BV sold<br />

to Vuelta, also during the halfyear ended in 30 June <strong>2009</strong>, the 50% held on Parque Principado S.L., and<br />

Harvey acquired the remainder 50% of share capital of Parque Principado. After these operations, the<br />

4 / 23